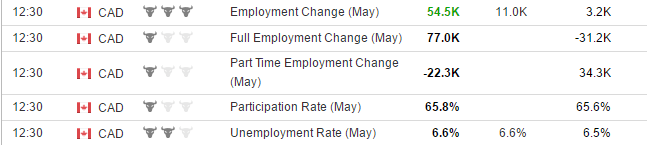

The main economic data on Friday 9th June 2017 was the Canadian Unemployment Rate and several UK related economic readings which showed weakness for the British economy.

Canadian Dollar

The Unemployment Rate for May 2017 moved up to 6.6% from previous reading of 6.5%, but the change in Full Time Employment was strong creating 77,000 new jobs, while the Part Time change was poor.

The Unemployment Rate for May 2017 moved up to 6.6% from previous reading of 6.5%, but the change in Full Time Employment was strong creating 77,000 new jobs, while the Part Time change was poor.

The Participation Rate also moved higher to 65.8% from the previous reading of 65.6%. Generally positive economic readings, especially the creating of new full time jobs, which show strength for the Canadian economy.

As oil prices fell the Canadian Dollar appreciated against the US Dollar and USD/CAD moved lower from 1.3541 to 1.3420.

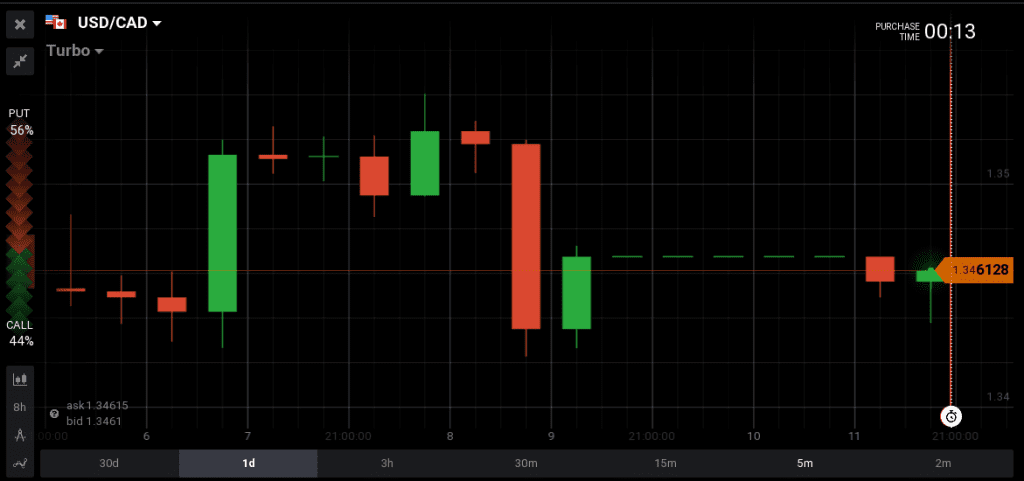

Japanese Yen

A better than expected Tertiary Industry Index at 1.2% vs the estimate of 0.5% for the month of April 2017 showed increased services domestic activity, which means increased consumer demand for various services to cover domestic needs, and as it was increased it reflects stronger economic activity and positive news for the Yen.

A better than expected Tertiary Industry Index at 1.2% vs the estimate of 0.5% for the month of April 2017 showed increased services domestic activity, which means increased consumer demand for various services to cover domestic needs, and as it was increased it reflects stronger economic activity and positive news for the Yen.

The market however ignored this reading, and USD/JPY moved higher from 109.73 to 110.81. USD/JPY trended up for 3 consecutive days, and this could be explained as positioning of trades ahead of the Fed monetary policy decision later this week.

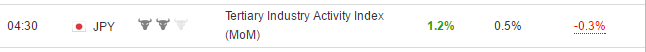

Euro

Only some German related economic readings, showing a narrower than expected German Trade Balance surplus of 18.1 billion vs the estimate of 23.0 billion, and again a narrower than expected German Current Account surplus of 15.1 billion vs the estimate of 24.5 billion.

Only some German related economic readings, showing a narrower than expected German Trade Balance surplus of 18.1 billion vs the estimate of 23.0 billion, and again a narrower than expected German Current Account surplus of 15.1 billion vs the estimate of 24.5 billion.

German had increased exports and imports for the month of April 2017 and being the largest economy in the Eurozone its economic data often move the price of the Euro. These economic data readings were not negative and in theory the Euro should have been appreciating against the US Dollar, something which did not happen though.

EUR/USD moved lower from 1.1240 to 1.1165, again having a down trend present for 3 consecutive days.

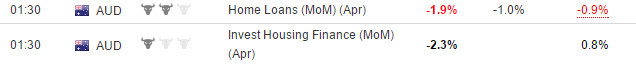

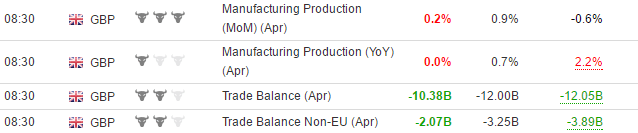

Australian Dollar

Some low importance economic readings such as lower than expected Home Loans and Investment Lending for the month of April put some low selling pressure for the Australian Dollar and AUD/USD moved lower from 0.7550 to 0.7516.

Some low importance economic readings such as lower than expected Home Loans and Investment Lending for the month of April put some low selling pressure for the Australian Dollar and AUD/USD moved lower from 0.7550 to 0.7516.

These two economic readings although of low importance were negative for the Australian Dollar reflecting potentially lower future growth for the economy.

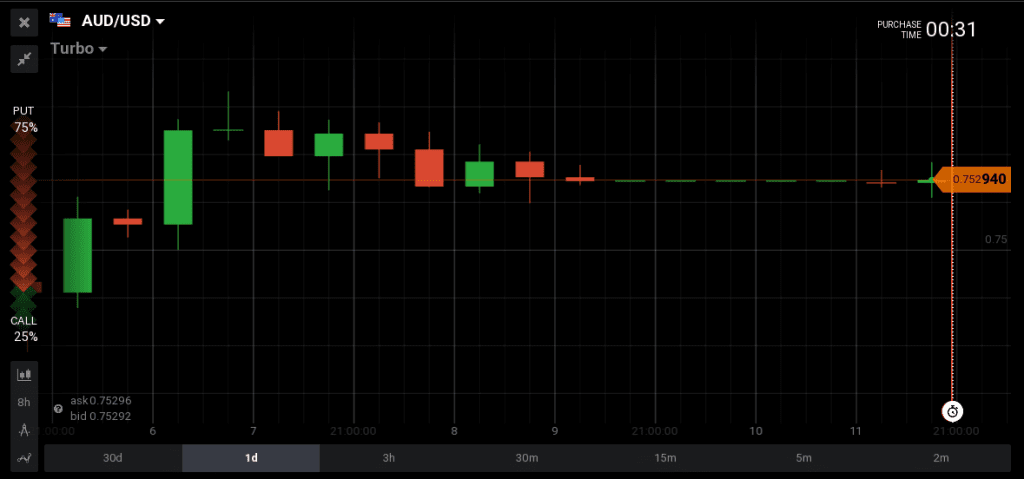

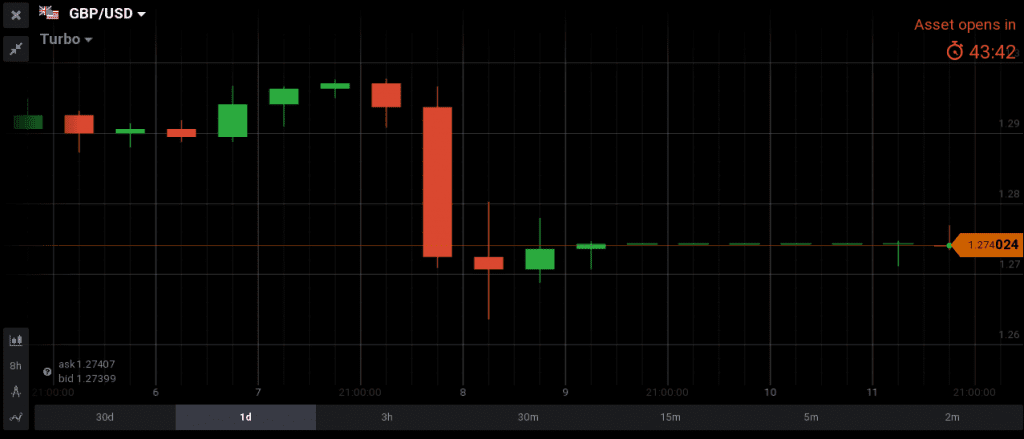

British Pound

One day after the outcome of the British Elections which showed that the present political party forming the Government lost the majority in the parliament, some economic readings such as Industrial Production, Manufacturing Production and Construction Output, showed weakness for the British economy.

One day after the outcome of the British Elections which showed that the present political party forming the Government lost the majority in the parliament, some economic readings such as Industrial Production, Manufacturing Production and Construction Output, showed weakness for the British economy.

Only the Total Trade Balance showed a narrower than expected deficit, which could partly be interpreted as positive sign for the British Pound. But the political result of the elections showed that the recent government will not have the majority to negotiate various Brexit related aspects, something the forex market now will put under a lot of consideration.

It is not surprising that the British Pound depreciated significantly against the US Dollar as GBP/USD moved lower from 1.2964 to 1.2632.

US Dollar

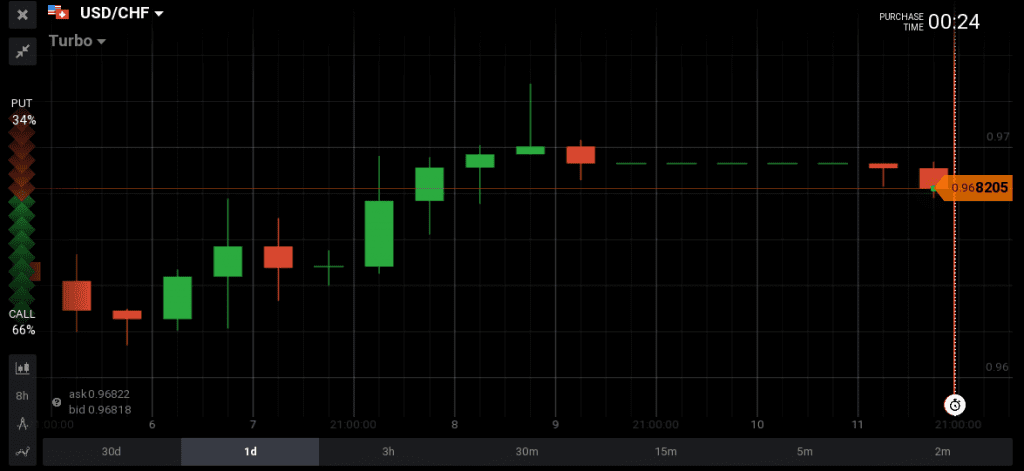

With no important economic data, the US Dollar appreciated also against the Swiss Franc, maybe due to the fall of gold prices as well. USD/CHF moved higher from 0.9659 to 09729.

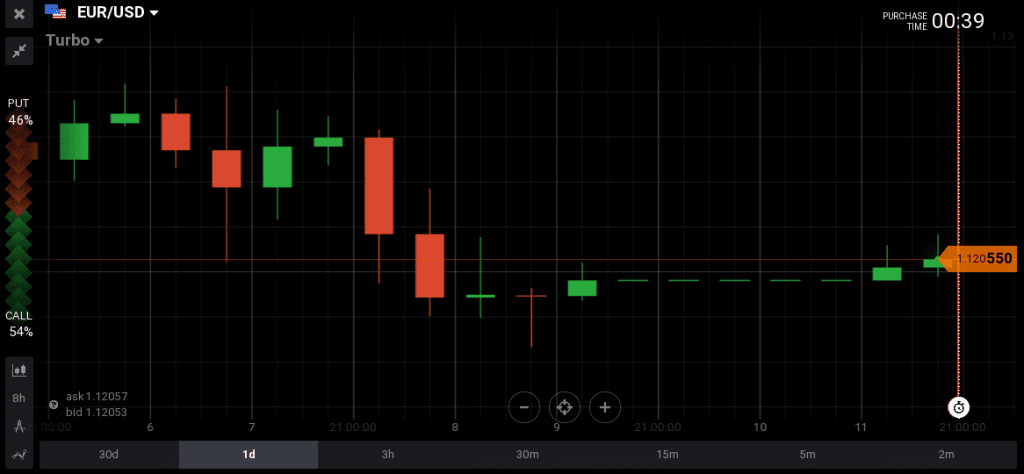

Key economic calendar news for Monday 12th June 2017

There aren’t any important economic readings for today, and the chances to have some trends continuing is high. But later on this week we have 4 interest rate decisions from the US, UK, Switzerland and Japan. It will be a busy week as there are also important US and UK related economic readings. The forex market anticipates an interest rate hike from the Fed on Wednesday June 14th 2017, while keeping all the other interest rates decisions unchanged. This by itself can form a new trend for the US Dollar, and in economic theory this trend should be an appreciation of the US Dollar against its major counterparts, due to the interest rate difference, which acts as positively for the US Dollar.