There are many important economic events today which can move the forex market with early in the European Session expecting the releases of the Inflation Rate in UK, the Consumer Confidence in the Eurozone, the Unemployment Rate in France and the Markit Manufacturing PMI Flash figure in Germany, and later in the American Session the US Home Sales and mainly the FOMC minutes.

Overall moderate to high volatility is expected today due to the plethora of important economic data, mainly for the Euro, the British Pound and the US Dollar. Improving trading relations between China and the US is another economic factor worth mentioning, as it may change the investors sentiment towards risk and present some short-term trends in the forex market.

These are the main economic events to focus on today in the forex market:

European Session

- France: Unemployment Rate, Markit Manufacturing PMI Flash, Markit Services PMI Flash, Germany: Markit Manufacturing PMI Flash, Markit Services PMI Flash, Eurozone: Markit Manufacturing PMI Flash, Markit Services PMI Flash, European Council Meeting, ECB Angeloni Speech, Consumer Confidence Flash, European Council Meeting, Sweden: Financial Stability Report 2018, UK: Core Inflation Rate YoY, Inflation Rate YoY, Inflation Rate MoM

Time: 05:30 GMT, 07:00 GMT, 07:30 GMT, 08:00 GMT, 08:30 GMT, 10:00 GMT, 14:00 GMT

There are numerous important economic events in the European Session today, with a focus on the release of the Inflation Rate in the UK and the Consumer Confidence Index in the Eurozone, both of which having the potential to move significantly the British Pound and the Euro. Yesterday BOE Governor Mark Carney testified in Parliament mentioning that there are rather soft economic conditions and expressed optimism about an increase in retail spending.

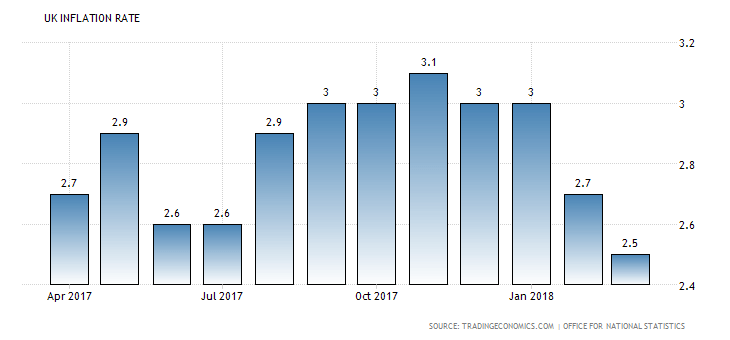

Higher than expected or rising figures of Inflation Rate are considered positive for the British Pound increasing the odds of a tighter monetary policy. As seen from the chart the Inflation Rate in UK has been trending lower as of November 2017 reaching the high level of 3.1% with last value being at 2.5%, the lowest rate in the past 12-months.

The forecast is for an unchanged yearly rate of 2.5%, an increase for the monthly rate at 0.5%, higher than the previous rate of 0.1% and a decline for the yearly Core Inflation at 2.2%, lower than the previous rate of 2.3%.

The Euro has important expected economic data which can either provide support or continue its recent decline depending on the outcomes. Lower Unemployment Rate in France is expected which should be positive for the Euro, but marginal lower readings for the Markit Services PMIs in France and the Eurozone, and marginal lower Markit Manufacturing PMIs in France, Germany and the Eurozone are considered negative for the Euro.

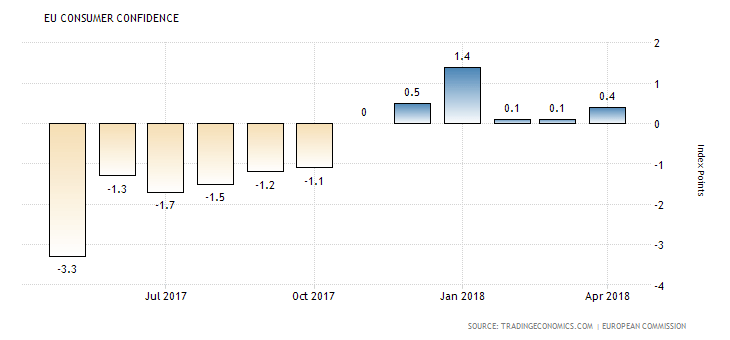

Later The forex market will place attention on the release of the Consumer Confidence in the Eurozone, which is expected to remain unchanged at 0.4. The Consumer Confidence index tracks the consumers’ insights regarding business conditions, employment situation, income and overall economy.

“The consumer confidence index in the Euro Area increased to 0.4 in April of 2018 from 0.1 in March, matching the preliminary estimate. It is the highest reading in three months reflecting households’ historically optimistic expectations regarding future unemployment, improved savings expectations and slightly brighter views on their future financial situation. In contrast, future general economic situation was assessed more negative.”, Source: Trading Economics.

The Consumer Confidence in the Euro area has been very volatile in the past 12-monthsbut has turned positive as of December 2017. Higher readings indicate optimism about current economic conditions and may lead to higher economic growth measured by the GDP level is this optimism will support higher consumer spending levels.

American Session

- US: Markit Manufacturing PMI Flash, Markit Services PMI Flash, Markit Composite PMI Flash, New Home Sales, EIA Crude Oil Stocks Change, and EIA Gasoline Stocks Change, FOMC Minutes, Fed Kashkari Speech

Time: 13:45 GMT, 14:00 GMT, 14:30 GMT, 18:00 GMT, 18:15 GMT

The US Dollar can move today on the outcome of the Markit PMIs readings, which indicate the well-being of both manufacturing and non-manufacturing sectors, with higher readings being positive, and above the 50.o level indicating expansion for the services, manufacturing and composite sectors. Also, higher readings for the New Home Sales are considered positive for the US Dollar reflecting a robust housing market, a leading indicator of the overall economy. Some mixed data is expected with a lower reading for the New Home Sales but marginal higher figures for the Markit Service PMI and the Markit Composite PMI and an unchanged figure for the Markit Manufacturing PMI at 56.5.

The main event though which can move the US Dollar is the release of the FOMC minutes. Any statements that point to future interest rate increases and commentary on the current economic conditions and economic growth projections can add increased volatility for the US Dollar.

The weekly EIA Crude Oil Stocks Change can move the oil prices and the USD/CAD pair if there are any economic surprises. If the increase in crude is less than expected, this implies greater demand and is considered positive for crude oil prices.

Pacific Session

- Australia: Construction Work Done, RBA Governor Lowe Speech

Time: 01:30 GMT, 08:00 GMT

Increased figures for the Construction Work Done on quarterly basis are considered positive for the Australian Dollar, reflecting a strong construction output and increase economic activity. The forecast is for a figure of 2%, higher than the previous figure of -19.4%.

Asian Session

- Japan: Nikkei Manufacturing PMI Flash

Time: 00:30 GMT

Higher than expected or rising figures for the Nikkei Manufacturing PMI are considered positive and supportive for the Japanese Yen, reflecting expansion and increased economic conditions in the manufacturing sector, a key sector for the Japanese economy. The forecast is for a reading of 53.0, marginal lower than the previous figure of 53.3, which may influence negatively the Japanese Yen.