The trade war tensions which influence the risk sentiment in the forex market are influencing the short-term trends for major currencies such as the US Dollar, nevertheless today there are important economic events which can move the forex market. In the economic calendar today, there is one Interest Rate Decision by the Reserve Bank of New Zealand and the releases of Consumer and Business Confidence for Italy and France, the ECB Non-Monetary Policy Meeting, the US Durable Goods Orders and Home Sales, the EIA Crude Oil Stocks Change, the Retail Sales in Japan and several speeches by senior central bank officials. This plethora of economic news may add increased volatility and price action in the forex market today.

These are the main economic events in the forex market today to focus on:

European Session

- France: Consumer Confidence, Unemployment Benefit Claims, Italy: Consumer Confidence, Business Confidence, UK: BoE Carney Speech, BoE Financial Stability Report, Switzerland: SNB Quarterly Bulletin

Time: 06:45 GMT, 08:00 GMT, 08:30 GMT, 10:00 GMT, 13:00 GMT

Higher than expected figures for the Consumer and Business Confidence in France and Italy should be supportive for the Euro, indicating the current business conditions, labor market conditions and prospects for job and income growth, reflecting the performance of the overall economy in a short-term view and future positive economic growth. The forecast is for an unchanged Consumer Confidence in France having a reading of 100.0, and lower readings for the Business and Consumer Confidence in Italy with readings of 106.9 and 113.2 respectively, lower than the previous readings of 107.7 and 113.7 accordingly. The ECB Non-Monetary Policy Meeting will provide important information on economic relations, market infrastructure and payments, corporate governance and other issues.

The Bank of England Financial Stability Report will be monitored providing insights on the financial sector and the outlook for its stability, and possible risks for the economy. If the BoE appears to be optimistic about the financial outlook this is considered positive for the British Pound. The statements made by the BoE’s Governor Carney Speech can also move the British Pound.

The Swiss National Bank Quarterly Bulletin should be monitored by the forex market participants including the Monetary Policy Report and insights on the business sector and the broader economy, with the potential to influence the Swiss Franc.

American Session

- US: Wholesale Inventories MoM, Durable Goods Orders MoM, Durable Goods Orders Ex Transport MoM, Pending Home Sales (YoY, MoM), EIA Crude Oil Stocks Change, EIA Gasoline Stocks Change, Fed Quarles Speech, Fed Rosengren Speech, Canada: BoC Gov Poloz Speech

Time: 12:30 GMT, 14:00 GMT, 14:30 GMT, 15:00 GMT, 16:15 GMT, 19:15 GMT

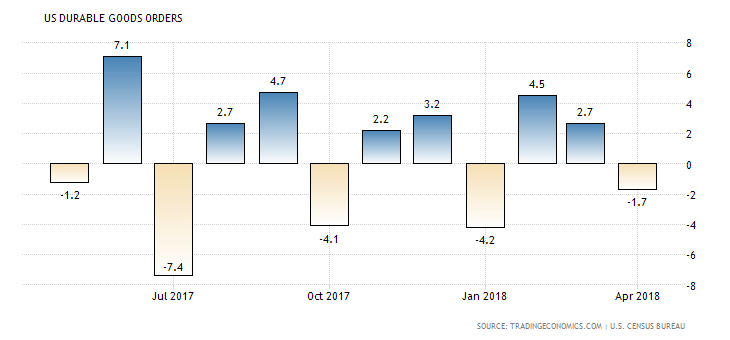

The US Durable Goods orders measure the value of orders received by manufacturers for durable goods, which means goods planned to last for three years or more, being sensitive to economic changes and business cycles, reflecting optimism for current and future economic conditions. Higher than expected readings for the Durable Goods Orders and lower than expected readings for the Wholesale Inventories are considered positive for the US economy and US Dollar.

As seen from the chart the US Durable Goods Orders are volatile, and there is not any clear trend for the past 12 months, with significant increases and declines.

The forecasts are for declines for the monthly Durable Goods Orders and Durable Goods Orders Ex Transport with figures expected at -1.0% and 0.5% accordingly, higher and lower than the previous figures or -1.9% and 0.9% respectively.

A higher reading for the US Pending Home Sales is also considered positive for the US Dollar, being a leading indicator of trends of the housing market in the US and having a high correlation with the broader state of the US economy. The forecast is for an increase in the monthly Pending Home Sales with a figure of 0.5% expected, higher than the previous figure of -1.3%.

The weekly EIA Crude Oil Stocks Change, and the Speeches by the Fed officials and the BoC Governor can move the oil prices and the USD/CAD currency pair. If the increase in crude inventories is more than expected, this implies a weaker than expected demand and is negative for crude oil prices.

Pacific Session

- New Zealand: RBNZ Interest Rate Decision, RBNZ Rate Statement

Time: 21:00 GMT

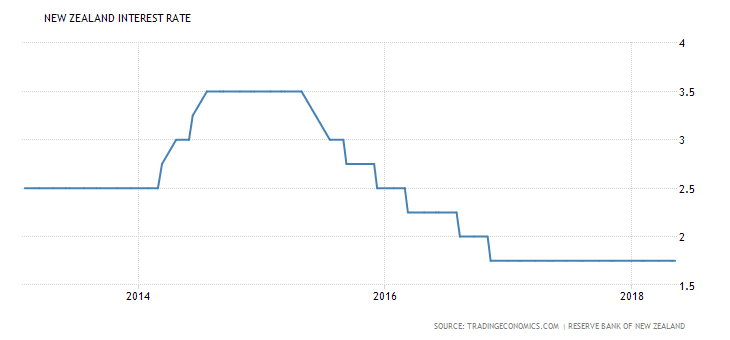

An increase for the key interest rate by the Reserve Bank of New Zealand currently at 1.75% and hawkish comments on the economic outlook are considered positive for the New Zealand Dollar.

As seen from the above chart “The Reserve Bank of New Zealand kept its official cash rate unchanged at record low of 1.75 percent on 10 May 2018, as widely expected. The central bank last moved the key rate in November of 2016. Policymakers underscored that consumer price inflation remains below the 2 percent mid-point of the central bank target due, in part, to recent low food and import price inflation, and subdued wage pressures. They also mentioned that the direction of the next move is equally balanced, up or down.”, Source: Trading Economics. The forecast is for an unchanged key interest rate at 1.75%, and any economic surprise may add volatility to the New Zealand Dollar.

Asian Session

- Japan: Retail Trade (YoY, MoM)

Time: 23:50 GMT

A higher than expected figure for the Retail Trade in Japan is considered positive for the Japanese economy and the Yen, reflecting increased consumers spending, a key indicator for the economy which leads to higher economic growth measured by the GDP levels. The forecasts are for declines for both the yearly and monthly Retail trade figures, with expected reading of 1.2% and -0.9% accordingly, lower than the previous figures of 1.6% and 1.4% respectively, which may influence negatively the Japanese Yen.