A rich economic calendar with very important economic data today is expected to add volatility in the forex market, as what drives the price is mainly the expectations and the actual releases of economic events. Early in the European Session there are the releases of the Swiss Industrial Production, the UK Inflation Rate and the Core Inflation Rate, the Industrial Productions and the Employment Production in the Eurozone.

Later in the American Session, the anticipated FOMC Interest Rate Decision is probably the most important economic event for today, expected to move the US Dollar. Overall moderate to high volatility is expected today for the Euro, the British Pound, and the US Dollar.

These are the key economic events in the forex market today to focus on:

European Session

- Switzerland: Industrial Production YoY, France: IEA Oil Market Report, UK: Inflation Rate (YoY, MoM), Core Inflation Rate YoY, Eurozone: Industrial Production (YoY, MoM), Employment Change (YoY, QoQ)

Time: 07:15 GMT, 08:00 GMT, 08:30 GMT, 09:00 GMT

The Industrial Production reading shows the industrial production growth, with higher than expected or rising figures considered positive and supportive for the Swiss Franc, indicating a strong Industrial Sector. The IEA Oil Market Report is a monthly report providing important information on supply, demand, stocks, prices and refinery activity, and a forecast for oil demand growth. It can move the oil prices, adding volatility to the USD/CAD currency pair, in addition to the weekly US Crude Oil Stocks Change Report to be released later during the day.

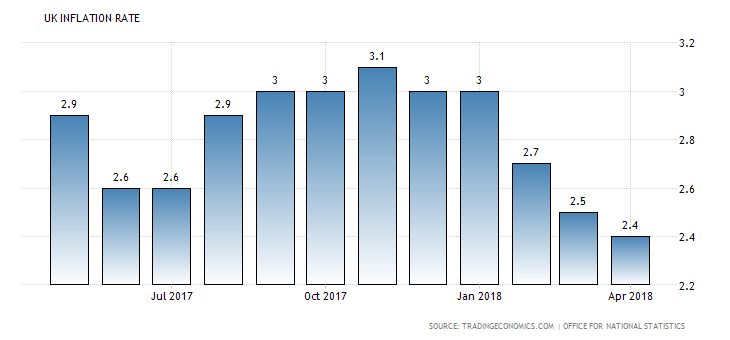

Important economic data for the economy of UK is released, with the yearly Inflation Rate expected to increase at the rate of 2.5%, higher than the previous rate of 2.4%, and the monthly Inflation Rate to remain unchanged at the rate of 0.4%. The chart below shows the trend for the yearly Inflation Rate in UK.

‘Annual inflation in the UK edged down to 2.4 percent in April of 2018 from 2.5 percent in March, below market expectations of 2.5 percent. It is the lowest rate since March of 2017, mainly due to a slowdown in cost of transport, food and clothing and footwear.’, Source: Trading Economics.

We notice a downtrend for the yearly Inflation Rate in UK as of January 2018, and a peak price of 3.0%. A higher than expected reading for the Inflation Rate in UK should be considered positive and supportive for the British Pound, indicating inflationary pressures in the broader economy, with increased odds of a future interest rate hike by the Bank of England. The yearly Core Inflation Rate, which excludes the volatile prices of food and energy is expected to remain unchanged at 2.1%.

For the Eurozone, higher than expected readings for the Industrial production and the Employment Change are considered positive for the Euro, reflecting a strong industrial sector growth, and a robust labor market, which can have positive implications for consumer spending and stimulate economic growth. The forecasts for the Eurozone are for a decline of the monthly Industrial Production with a figure of -0.5% expected, lower than the previous figure of 0.5%, a decline of the yearly Industrial Production with a figure of 2.8% expected, lower than the previous figure of 3.0% and an unchanged quarterly Employment Change at 0.3%. Mixed to negative data is expected overall for the Euro, which may be influenced negatively.

American Session

- US: Fed Interest Rate Decision, PPI and Core PPI (MoM), EIA Crude Oil Stocks Change, FOMC Economic Projections, Fed Press Release

Time: 12:30 GMT, 14:30 GMT, 18:00 GMT, 18:30 GMT

The Producer Price Index measures the average changes in prices in primary markets of the US by the market side of producers, with changes in the PPI being widely followed as an indicator of commodity inflation. Higher readings are considered to have inflationary effects and are positive for the US Dollar. The forecast is for an increase of the monthly PPI at 0.3%, higher than the previous reading of 0.1% and an unchanged reading of 0.2% for the monthly US Core PPI.

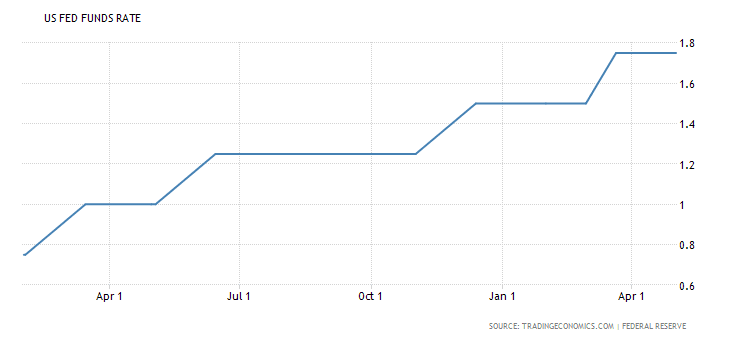

The main anticipated event for the day is the Fed Interest Rate Decision, which can move the US Dollar significantly both due to the outcome and mainly for the economic projections and statements made by the Fed, implying further tighter monetary policy in the future. The Monetary Policy Statement by the Fed if hawkish will be considered positive for the US Dollar. As seen from the below chart, the US federal funds rate has been in an uptrend for the past 12-months, and a further increase of 25 basis points is expected, increasing the Central Bank Rate from the low-high range of 1.5%-1.75% to the new range of 1.75%-2.0%.

The EIA Crude Oil Stocks Change can move the oil prices and the USD/CAD currency pair with any positive or negative economic surprise. If a decline in inventories is less than expected, this implies a weaker demand and is considered negative for oil prices.

Pacific Session

- Australia: Westpac Consumer Confidence Index, RBA Governor Lowe Speech

Time: 00:30 GMT, 02:00 GMT

The Westpac Consumer Confidence measures the level of sentiment that individuals have in economic activity, and expectations about short-term and medium-term economic conditions. High readings are considered positive for the Australian Dollar, reflecting increased optimism for the economy. A marginal increase is anticipated, having a reading of 102.0, higher than the previous reading of 101.8.