The forex market economic calendar is light today, with the celebration of the 4th of July, the Independence Day in US, and lower liquidity in the market. There is economic data about the Services PMI Indexes in the Eurozone, Italy, Spain and the UK, and the release of the Retail Sales and the Trade Balance for Australia. Low to moderate volatility and price action should be expected today in the forex market.

These are the key economic events for today in the forex market to focus on:

European Session

- Spain: Markit Services PMI, Italy: Markit/ADACI Services PMI, UK: BoE FPC Minutes, Markit/CIPS UK Services PMI, BoE Saporta Speech

Time: 07:15 GMT, 07:45 GMT, 08:30 GMT, 10:55 GMT

The Services PMI is an important indicator of the economic situation in the services sector., reflecting an overview of the condition of sales and employment, with figures above the 50.0 level signaling expansion in the services sector, considered positive for the local currency.

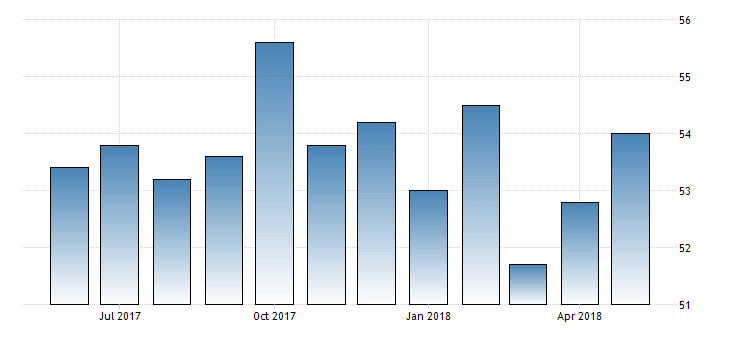

As seen from the chart “The IHS Markit/CIPS UK Services PMI moved up to a three-month high of 54 in May 2018 from the previous month’s 52.8 and way above market expectations of 53. Business activity rose the most since February following the snow-related disruption seen in the first quarter, while new business volumes increased at a relatively subdued rate and employment growth was the second-weakest since March 2017. Also, Brexit-related uncertainty continued to dampen business confidence. On the price front, average cost burdens rose strongly amid a combination of rising salary payments and greater fuel bills, while the rate of charge inflation eased for the second month running to its weakest since June 2017. “, Source: Trading Economics.

The forecast is for an unchanged Markit/CIPS UK Services PMI at 54.0, a lower Markit Services PMI for Spain at 56.2, compared to the previous reading of 56.4, and a higher Markit/ADACI Services PMI for Italy at 53.3 compared to the previous figure of 53.1. The Bank of England Financial Policy Committee Minutes will provide insights on the financial stability in the UK via mechanisms and policies and the BoE Saporta Speech will be monitored by the forex market participants for updated information and insights on current economic conditions in UK.

Pacific Session

- Australia: Retail Sales MoM, Balance of Trade

Time: 01:30 GMT

The Retail Sales show the performance of the retail sector over the short and mid-term, with higher than expected figures considered positive for the Australian Dollar, reflecting increased consumer spending, which should lead to higher economic growth measured by the GDP level. The forecast is for an increase of the monthly Retail Sales and a figure of 0.3%, lower compared to the previous figure of 0.4%.

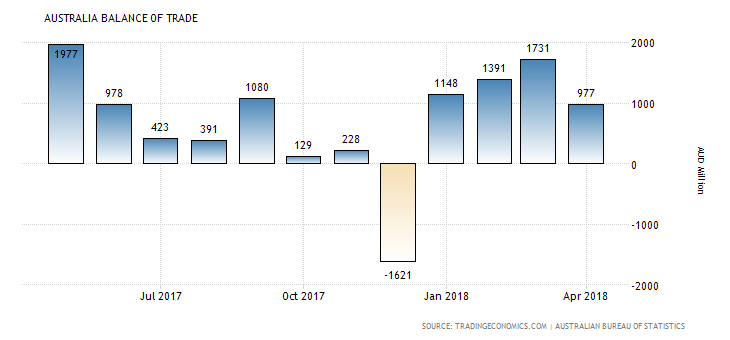

The Trade Balance is the difference in the value of its imports and exports of Australian goods. Higher than expected figures and a positive trade surplus are considered positive and supportive for the Australian Dollar, indicating capital inflows in the Australia, and increased demand for goods and services denominated in Australian Dollars, which should lead to the natural appreciation of the Australian Dollar versus other currencies.

“Australia’s trade surplus narrowed by 44 percent to AUD 0.98 billion in April of 2018 from an upwardly revised AUD 1.73 billion in the prior month and matching market expectations. It is the smallest trade surplus since a deficit in last December, mainly due to a decline in exports. In April, outbound shipments fell by 2 percent month-on-month to AUD 34.19 billion; while imports were unchanged at AUD 33.21 billion. Considering the first four months of the year, the trade surplus came in at AUD 5.25 billion, down sharply from AUD 6.84 billion surplus in the same period the prior year.”, Source: Trading Economics.

The forecast is for an increase of the trade surplus in Australia, with an expected figure of 1,200M Australian Dollars, higher than the previous figure of 977M Australian Dollars. There is significant volatility in the Balance of Trade for Australia, which is common based on factors such as seasonality.

Asian Session

- Japan: BoJ Harada Speech, Markit Services PMI

Time: 00:30 GMT, 01:30 GMT

The Services Purchasing Managers Index is indicative of business conditions in the services sector, an important indicator of the overall economic conditions in Japan as the services sector has a significant contribution in the total GDP level and the economic growth. Higher than expected readings for the Services PMI are considered positive, and levels over 50.0 indicate expansion in the sector. The forecast is for an increase with an expected figure of 51.6, higher than the previous figure of 51.0.