The economic news and reports today in the forex market are focused on the inflation rate in UK and in the Eurozone, the housing market in US and the Fed Beige Book report, and the trade balance in Japan. There is also an Ecofin meeting and the release of the weekly US crude oil inventories. After the economic news yesterday about the unemployment rate and employment change in UK, the British Pound today is expected to have increased volatility and price action, something that also applies for the Euro, and maybe for the US Dollar due to the Fed Beige Book report.

Most Important Events in Economic Calendar today:

European Session

- UK: Inflation Rate (YoY, Mom), Core Inflation Rate YoY, Eurozone: Core Inflation Rate YoY Final, Inflation Rate YoY Final, Inflation Rate MoM

Time: 08:30 GMT, 09:00 GMT

A higher than expected figure for the inflation rate in UK improves the odds of a rate hike at the Bank of England’s next rate decision in August, indicating inflationary pressures in the economy considered positive and supportive for the British Pound.

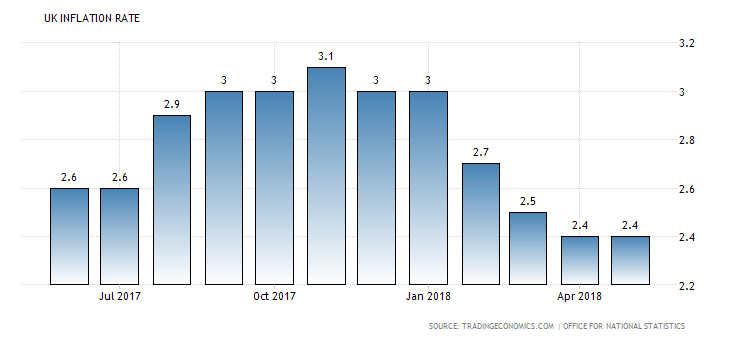

“Consumer price inflation in the UK stood at an annual rate of 2.4 percent in May 2018, unchanged from the previous month’s one-year low and slightly below market expectations of 2.5 percent. Transport inflation jumped on higher fuels and lubricants costs, while prices rose at a softer pace for recreation & culture, housing & utilities, restaurants & hotels, and food & non-alcoholic beverages.”, Source: Trading Economics.

As seen from the chart the Consumer price inflation in the UK announced was at an annual rate of 2.4 percent in May 2018, unchanged from the previous month’s one-year low and slightly below market expectations of 2.5 percent, while the core inflation was unchanged at 2.1 percent. As of January 2018, the inflation rate in UK has been declining and has been stabilized at the rate of 2.4% for the past two consecutive months. The forecasts are for an increase of the yearly inflation rate in UK at 2.6%, higher than the previous rate of 2.4%, and for an increase of the most conservative and representative measure of inflation, the yearly core inflation rate at 2.1%, higher than the previous rate of 2.1%. The core inflation rate excludes the volatile prices of food and energy providing a more accurate calculation of the inflationary pressures in the economy.

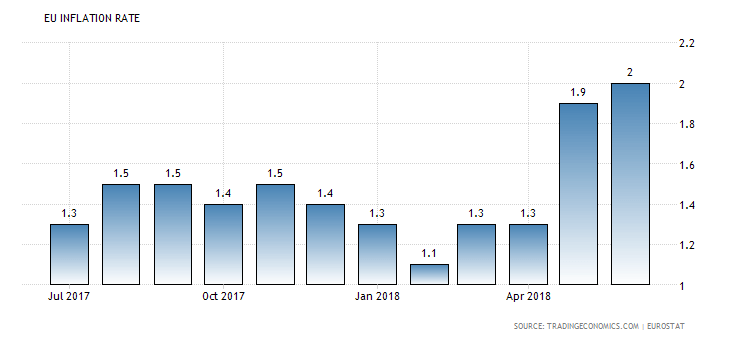

The yearly inflation rate in the Eurozone is expected to remain unchanged at the rate of 2%, the yearly core inflation rate is also expected to remain unchanged at the rate of 1%, while the monthly inflation rate is expected to decline at 0.1%, lower than the previous rate of 0.5%.

“The inflation rate in the Euro Area is expected to edge up to 2 percent year-on-year in June 2018 from the previous month’s 1.9 percent, and in line with market expectations. It is the highest rate since February 2017, mainly boosted by higher prices of energy and food.”, Source: Trading Economics.

In contrast with the path of the inflation rate in UK, the inflation rate in the Eurozone has been increasing in 2018, currently at 2%, the highest inflation rate since April of 2017 due to rising oil prices. Any surprise either positive or negative in the actual reading of the inflation rate in the Euro area may add further volatility for the Euro versus other currencies.

American Session

- US: Housing Starts Change, Housing Starts MoM, Building Permits Change, Building Permits MoM, Fed Powell Speech, Fed Beige Book, EIA Crude Oil Stocks Change

Time: 12:30 GMT, 14:00 GMT, 14:30 GMT, 18:00 GMT

The Housing Starts and the Building Permits are an indicator of the housing market and corporate investments in the construction sector. Higher than expected readings are considered positive and supportive for the US Dollar, reflecting a robust housing market, which is also a leading indicator of the broader economy performance. The forecasts are for mixed economic data, with a decline for the Housing starts at 1.32M, lower than the previous figure of 1.35M, and an increase for the Building Permits at 1.330M, higher than the previous figure of 1.301M.

The Beige Book reports on the current US economic situation, providing insights and information of the overall US economic growth. An optimistic outlook is considered positive for the US Dollar, and the forex market participants will focus on the statements and language used in the report to predict future changes in monetary policy and in the performance of the US economy.

The weekly EIA Crude Oil Inventories measure the level of inventories of barrels of commercial crude oil held by US firms, with an increase in crude inventories more than expected implying a weaker than expected demand, considered negative for crude prices. Any economic surprise could add increased volatility for the USD/CAD currency pair.

A speech by the Chairman of the Federal Reserve is always a very important key economic event, which can move the US Dollar based on updated opinions on the economic conditions and outlook.

Asian Session

- Japan: Trade Balance

Time: 23:50 GMT

The Trade Balance is a measure of balance amount between imports and exports, and positive value shows a trade surplus which is considered positive for the Japanese Yen indicating capital inflows in Japan and increased demand for goods and services denominated in Japanese Yen, which in economic theory may lead to the appreciation of the Yen versus other currencies over time. The forecast is for a decline of the trade surplus at 534.2B Yen, lower than the previous trade surplus of 580.5B Yen.