The Interest Rate Decision by the Bank of Canada and the expected interest rate hike is the main economic event for today in the forex market. There are not any economic data releases during the European Session, only important speeches by the ECB President and BoE Governor and an EU-Japan Summit. The weekly release of the US EIA Crude Oil Stocks Change, the monthly US PPI and Core PPI, and the Consumer Confidence in Australia are other key economic events to monitor. Moderate to high volatility is expected today mainly for the Canadian Dollar.

Key economic events which can move the forex market today:

European Session

- Eurozone: ECB Draghi Speech, ECB Praet Speech, ECB Non-Monetary Policy Meeting, EU-Japan Summit, UK: BoE Governor Carney Speech

Time: 07:00 GMT, 07:30 GMT, 08:00 GMT, 15:30 GMT

The ECB Non-monetary Policy Meeting focuses on external economic relations, market infrastructure, supervision of banks, corporate governance and other issues which may indirectly influence the euro. The speeches by the ECB President and the BoE Governor can also move the Euro and the British Pound in the event of new updated information on monetary policy, current economic conditions and in the case of British Pound developments on the Brexit.

American Session

- US: Producer Price Index (YoY, MoM), Core PPI MoM, Wholesale Inventories, EIA Crude Oil Stocks Change, Fed Bostic Speech, Fed Williams Speech, Canada: BoC Interest Rate Decision, BoC Statement, BoC Monetary Policy Report

Time: 12:30 GMT, 14:00 GMT, 14:30 GMT, 15:15 GMT, 16:30 GMT, 20:30 GMT

The Bank of Canada Interest Rate Decision is probably the most important economic event today in the forex market and can add significant volatility and price action for the Canadian Dollar.

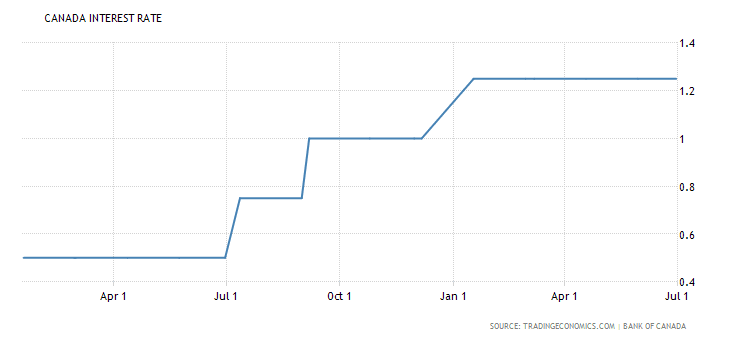

“The Bank of Canada left its key overnight rate at 1.25 percent on May 30th, 2018, in line with market expectations. Policymakers said core measures of inflation remain near 2 percent and recent data support the Bank’s outlook for growth at around 2 percent in the first half of 2018. The Bank Rate is correspondingly 1.5 percent and the deposit rate is 1 percent. “, Source: Trading Economics.

As seen from the chart, the Bank of Canada has been increasing its key interest rate for the past 12 months, and the forecast is for an increase of 25 basis points, from 1.25% to 1.50% for the key interest rate. This interest rate hike most probably will be supportive and positive for the Canadian Dollar.

Later the wording of the BOC statement is also important as it contains the Bank’s collective outlook on the economy as well as hints about future monetary policy changes and comments about the outlook on the economy and inflation rate may add further support to the Canadian Dollar. The forex market will weigh on the BoC statements that may support further interest rate hikes in the future.

The US Producer Price measures the average changes in prices by producers in primary markets and changes in the PPI are considered an indicator of inflationary pressures. Higher than expected figures for the PPI Index and lower than expected for the Wholesale Inventories are considered positive for the US Dollar, as high levels of inventory suggest an economic slowing in the US economy. The forecasts are for an increase of the yearly US PPI Index at 3.2%, compared to the previous figure of 3.1%, and an increased figure of 0.5% for the Wholesale Inventories, compared to the previous figure of 0.1%.

Τhe weekly EIA Crude Oil Stocks Change can move the oil prices and the USD/CAD currency pair further to the earlier BoC Monetary Policy Decision. If the increase in crude inventories is more than expected, it implies a weaker than expected demand and is considered negative for crude oil prices.

Pacific Session

- Australia: Westpac Consumer Confidence Index, Home Loans MoM, Investment Lending for Homes

Time: 00:30 GMT, 01:30 GMT

Higher than expected figures for the Consumer Confidence Index and the Home Loans, Investment Lending for Homes, are considered positive and supportive for the Australian Dollar. A high Consumer Confidence reflects the level of sentiment that individuals have in economic activity, which may stimulate consumer spending and lead to higher future economic growth. A strong housing market is highly correlated with the state of the broader economy.

“The Westpac Melbourne Institute Consumer Sentiment Index for Australia increased by 0.3 percent from the previous month to 102.2 in June of 2018, following a 0.6 percent fall in the previous month. The measure of family finances compared to a year ago increased by 4.5 percent from a month earlier; and those of family finances over the next 12 months went up 2.8 percent. In addition, the gauge of whether it was a good time to buy major household items rose by 1 percent. Meantime, expectations for the economic outlook over the next five years dropped by 3.1 percent; and those for the economic outlook over the next 12 months declined by 2.8 percent.”, Source: Trading Economics.

As seen the Consumer Confidence in 2018 has peaked in January, but in general is higher than the previous seven months of 2017, from July-December 2017.

The forecast is for a declining reading for the monthly Home Loans at -1.9%, lower than the previous reading of -1.4%.

Asian Session

- Japan: Tertiary Industry Index MoM

Time: 04:30 GMT, 23:50 GMT

This Economic Index measures the monthly change in output produced by Japan’s service sector, a key indicator of domestic activity. Generally, a high reading is positive for the Japanese Yen. The forecast is for a figure of -0.4%, lower than the previous figure of 1.0%.