The key economic event today in the forex market is the Interest Rate Decision by the Reserve Bank of New Zealand, the second monetary policy for this week after the decision of the Reserve Bank of Australia yesterday which kept interest rates unchanged. Some other Important macroeconomics data include the home loans and consumer confidence for the economy of Australia, economic trends and machinery orders in Japan, housing market conditions in Canada and the weekly US crude oil stocks change. Moderate to high volatility should be expected for the New Zealand Dollar upon the announcement of the monetary policy decision.

These are the key economic events and releases in the forex market today, time is GMT:

American Session

- Canada: Building Permits MoM, US: Fed Barkin Speech, EIA Crude Oil Stocks Change

Time: 12:30, 12:45, 14:30

Higher than expected figures for the Building Permits are considered positive and supportive for the Canadian Dollar and economy as the Building Permits are an indicator for developments in the housing market reflecting growth in the construction sector. Furthermore, an increase in Building Permits suggests corporate and consumer optimism and the figure can also act as a leading indicator for the economy as the conditions in housing market reflect current changes in the business cycles of the broader economy. The forecast is for a figure of 1.0%, lower compared to the previous figure of 4.7%.

The Canadian Dollar can also move with the release of the weekly US EIA Crude Oil Inventories which measure the weekly change in the number of barrels of commercial crude oil held by US firms. If the increase in crude inventories is more than expected, then this implies a weaker than expected demand and is considered negative bearish for crude oil prices, and the same applies if a decline in crude oil inventories is less than expected.

Pacific Session

- Australia: Westpac Consumer Confidence, Home Loans, Investment Lending for Homes, RBA’s Governor Philip Lowe Speech, New Zealand: RBNZ Inflation Expectations (QoQ) (Q2), RBNZ Interest Rate Decision, Monetary Policy Statement, RBNZ Press Conference

Time: 00:30, 01:30, 03:00, 03:05, 21:00, 22:00

Starting first with economic data related to the economy of Australia higher than expected figures for the Westpac Consumer Confidence and the Home Loans, Investment Lending for Homes are considered positive for the Australian Dollar indicating the level of sentiment that individuals have in economic activity and expectations about near future economic conditions plus a strong housing market which correlates positively with future growth in the Australian economy. The forecast is for a decline of the monthly Home Loans at 0.2%, lower than the previous figure of 1.1%.

For the New Zealand Dollar several hours before the announcement of the monetary policy decision by the Reserve Bank of New Zealand there will released the Inflation Expectations measuring expectations of annual CPI 2 years from now. An increase in expectations is regarded as inflationary which may anticipate a rise in interest rates.

The key economic event for today is the RBNZ Interest Rate Decision, with the expectation of unchanged key interest rate at 1.75%. If the RBNZ is hawkish about the inflationary and economic outlook of the economy and rises the interest rates this should be positive for the New Zealand Dollar. The Monetary Policy Statement with comments on monetary and economic policy by the RBNZ may influence further the volatility and price action of the New Zealand Dollar.

“The Reserve Bank of New Zealand kept its official cash rate unchanged at record low of 1.75 percent on 27 June 2018, as widely expected. The central bank last moved the key rate in November of 2016. Policymakers underscored that the outlook for the economy remains intact and that CPI inflation is likely to increase in the near term due to higher fuel prices. Consumer prices in New Zealand increased 1.1 percent year-on-year in the first three months of 2018 following a 1.6 percent increase in the previous quarter, matching market expectations. It was the slowest inflation since the third quarter of 2016.”, Source: Trading Economics.

Asian Session

- Japan: Eco Watchers Survey Current, Eco Watchers Survey Outlook, Machinery Orders (YoY, MoM)

Time: 05:00, 23:50

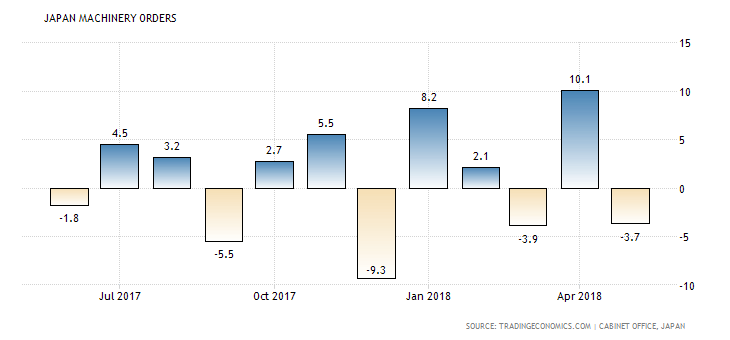

The Eco Watchers Survey Current and Outlook measure the regional short-term economic trends with high readings considered positive for the Japanese Yen reflecting increased optimism for the economic outlook. The Machinery Orders provide information about the total value of machinery orders placed at major manufacturers in Japan and are a leading indicator of business capital spending. In general increases are indicative of stronger business confidence in the economy. The forecasts are for declines for both the Eco Watchers Surveys and the yearly Machinery Orders. The yearly Machinery Orders figure is expected to decline at 9.5%, less than the previous figure of 16.5%, while the monthly Machinery Orders for Japan are expected to decline at -1.3%, which is negative but less than the previous figure of -3.7%.

“Core machinery orders in Japan, which exclude those of ships and electrical equipment, declined by 3.7 percent month-on-month in May of 2018, after a 10.1 percent jump in the previous month and compared to market expectations of a 5.5 percent contraction. It was the second fall in three months. Manufacturing orders advanced only 1.3 percent after a 22.7 percent jump in April, with food & beverages dropping 4.2 percent (vs -2.8 percent) and textiles plunging 19.0 percent (vs +40.9 percent). Meantime, non-manufacturing orders edged up 0.2 percent compared to a 0.4 percent gain. Year-on-year, core machinery orders surged 16.5 percent, gaining steam after a 9.6 percent increase in the previous month.”, Source: Trading Economics.

The monthly Japanese Machinery Orders are highly volatile as seen from the above chart and with an undefined trend. Overall the economic data for Japan should be considered negative and may influence the Japanese Yen upon its release.