The focus today in the forex market for the first trading session of August 2018 is the Fed monetary policy announcement. Economic data about the manufacturing sector will be released both in the European Session and the American Session, plus data about the housing market in UK, and the weekly Crude Oil Stocks Change. Moderate to high volatility is expected for the US Dollar, due to the Fed Interest Rate Decision.

These are the key economic events which can move the forex market today:

European Session

- Russia: Markit Manufacturing PMI, UK: Nationwide Housing Prices (YoY, MoM), Markit/CIPS Manufacturing PMI, Germany: Markit Manufacturing PMI, Markit Manufacturing PMI Final, Italy: Markit/ADACI Manufacturing PMI, Eurozone: Markit Manufacturing PMI Final

Time: 06:00 GMT, 07:15 GMT, 07:45 GMT, 07:55 GMT, 08:00 GMT, 08:30 GMT

The Manufacturing Purchasing Managers Index (PMI) reflects the business conditions in the manufacturing sector. The manufacturing PMI is an important indicator of business conditions and the overall economic conditions as the manufacturing sector has a large contribution to the total GDP. Readings above the 50 level or higher than expected are considered positive. The forecasts are for lower Markit Manufacturing PMI readings for Germany, UK, and Italy, with Final readings expected higher for the Eurozone at 55.1, higher than the previous reading of 54.9 and Germany at 57.3, higher than the previous reading of 55.9. The Markit Manufacturing PMI reading for Germany is considered a barometer for the Eurozone, as Germany is the largest economy in the Eurozone.

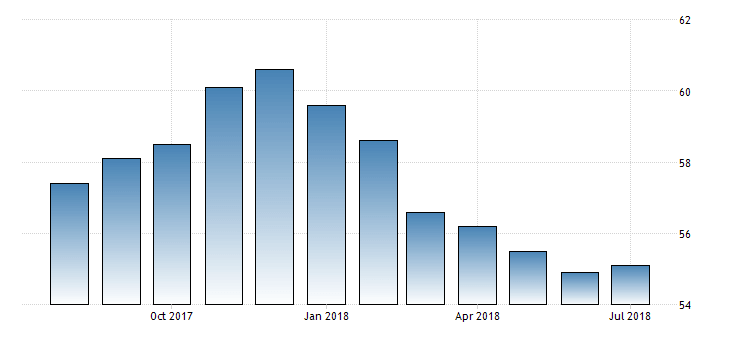

“The IHS Markit Eurozone Manufacturing PMI rose slightly to 55.1 in July 2018 from the previous month’s 19-month low of 54.9, and above market consensus of 54.6, a preliminary figure showed. New orders increased at a softer pace partly due to weakened export gains, with new export orders registering the smallest monthly rise since August 2016. In addition, the pace of job creation eased, while optimism picked up from June’s 31-month low. On the price front, input cost inflation cooled slightly, and average selling prices continued to rise.”, Source: Trading Economics.

As seen from the above chart the Euro Area Manufacturing PMI has been trending down as of January 2018, the highest value so far in 2018 indicating weak business conditions in the manufacturing sector.

For the UK economy the Nationwide Housing Prices shows the value of the houses prices in UK and current movements in the housing market. Higher than expected values are considered positive for the British Pound, reflecting a robust housing market and a leading indicator of the broader economy, plus inflationary pressures. Some mixed data is expected with an unchanged yearly reading of 2% and a decline for the monthly reading at 0.2%, compared to the previous reading of 0.5%.

American Session

- Canada: Markit Manufacturing PMI, US: ADP Employment Change, Markit Manufacturing PMI, ISM Manufacturing PMI, EIA Crude Oil Stocks Change, Fed Interest Rate Decision, Fed’s Monetary Policy Statement

Time: 12:15 GMT, 12:30 GMT, 13:30 GMT, 13:45 GMT, 14:00 GMT, 14:30 GMT, 18:00 GMT

Before the very important Fed Interest Rate Decision, several other important economic data will be released which can move the US and the Canadian Dollar. The Markit Manufacturing PMI for Canada and US will show the current business conditions in the manufacturing sector, with higher figures considered supportive for both currencies, reflecting strong economic conditions and expansion for the manufacturing activity. The same applies for the US ISM Manufacturing PMI as well. Also, for the US economy a higher reading for the ADP Employment Change is considered supportive, showing a strong labor market, measuring the change in the number of employed people in the US. In general, a rise in this indicator of the labor market has positive implications for consumer spending, which in turn can stimulate the economic growth. The forecasts are for an increase of the Markit Manufacturing PMI for Canada at 57.5, compared to the previous reading of 57.1, an unchanged US Markit Manufacturing PMI at 55.5, and a decline for the ISM Manufacturing PMI at 59.8, lower than the previous figure of 60.2.

The ADP Employment Change is expected to increase at 185K, compared to the previous reading of 177K, so mixed data overall is expected for the US economy. The weekly EIA Crude OI Stocks Change measures the change in the number of barrels of commercial crude oil held by US firms. If the increase in crude inventories is more than expected, this implies a weaker than demand and is considered negative for crude oil prices. Lower crude oil prices can have a positive impact on lower inflation.

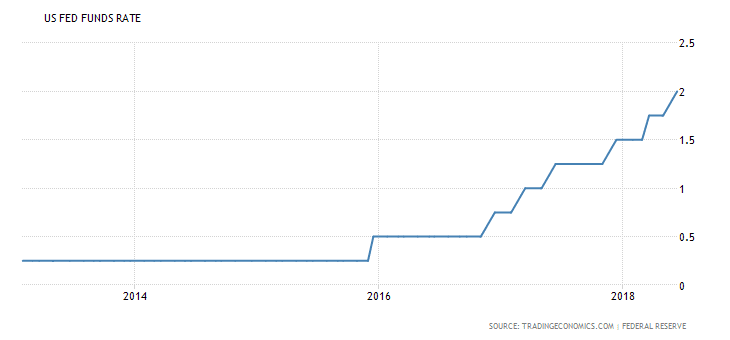

The Fed Interest Rate Decision may move the US Dollar, not based on the decision itself, as no changes are expected at the current lower-higher level of 1.75%-2.0% for the key interest rate, but mainly what could move the US Dollar is the language used in the Monetary Policy Statement. The statement may influence the volatility of USD and determine a short-term positive or negative trend, with a hawkish view considered as positive for the US Dollar, especially with any comments that future tighter monetary policy should be continued.

“The Federal Reserve raised the target range for the federal funds rate by a quarter of a percentage point to a range of between 1.75 percent and 2 percent during its June meeting, saying that the labor market has continued to strengthen, and that economic activity has been rising at a solid rate. Policymakers projected two additional hikes by the end of this year, compared to one previously estimated.”, Source: Trading Economics.

There is a divergence in the future interest rate path for the Fed, which has followed interest rate hikes during the previous periods and the ECB and recently BoJ which maintain a neutral monetary policy with no interest rate hikes expected any time soon from both central banks. This trend may continue in the rest of 2018.

Asian Session

- Japan: Monetary Base YoY, Nikkei Manufacturing PMI

Time: 00:30 GMT, 23:50

The Nikkei Manufacturing PMI provides information about the state of manufacturing sector in Japan. Higher than expected figures reflect improved business conditions for the manufacturing sector and the overall economic condition in Japan, as the manufacturing sector is a very important business sector for Japan. The Monetary Base measures the currency being in circulation, from notes and coins as well as money held in bank accounts, considered as an important indicator of inflation. A higher monetary base is considered as positive for the Japanese Yen which can lead to higher inflationary pressures in the overall economy. The forecasts are for a lower figure for the Monetary Base at 7.3%, compared to the previous figure of 7.4% and for an unchanged reading of 51.6 for the Nikkei Manufacturing PMI, which should have a neutral effect on the Yen.