One day before the two important interest rate decisions by the ECB and the BoE the news feed today is relatively calm, with economic reports from the US such as the Producer Price Index and the Fed’s Beige Book report, the Industrial Production in the Eurozone and the Westpac Consumer Confidence in Australia. The Brexit, NAFTA and trade war news are external factors which have the potential to provide increased volatility in the forex market.

These are the key economic events in the forex market today, time is GMT:

European Session

Eurozone: Industrial Production (YoY, MoM)

Time: 12:00

The Industrial Production shows the volume of production of Industries such as factories and manufacturing being a very important indicator for forecasting GDP changes and economic cycles. Higher than expected figures are positive for the Euro indicating a robust industrial sector and potential inflationary pressures in the economy which may anticipate interest rates to rise in the future.

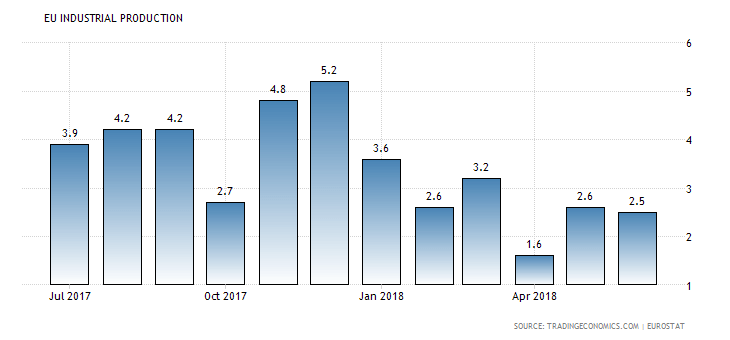

“Industrial production in the Euro Area rose by 2.5 percent year-on-year in June 2018, following an upwardly revised 2.6 percent gain in the prior month while markets had expected it to advance 2.6 percent. Output grew less for intermediate goods and non-durable consumer goods and contracted further for energy. On a monthly basis, industrial activity shrank 0.7 percent, after an upwardly revised 1.4 percent rise in May and worse than market expectations of a 0.4 percent fall.”, Source: Trading Economics.

From the above chart we can see that year-on-year, industrial output has advanced at a softer pace in 2018 compared to 2017. The forecasts are for a decrease for the yearly Industrial Production to 1.0% from 2.5% and an increase for the monthly Industrial Production to -0.5% from -0.7%. Any economic surprise may add increased volatility for the Euro versus other currencies.

American Session

US: Fed Bullard Speech, Producer Price Index ex Food and Energy (YoY, MoM), Producer Price Index (YoY, MoM), EIA Crude Oil Stocks Change, Fed Brainard Speech, Fed Beige Book

Time: 09:30, 12:30, 14:30, 16:45, 18:00

The Producer Price Index (PPI) measures the change in the price of goods sold by manufacturers and is a leading indicator of consumer price inflation. Higher than expected readings indicate inflationary pressures in the economy which may weigh on the Fed to tighten further its monetary policy increasing the key interest rate. The Core PPI is a more conservative measure of inflation excluding the volatile prices of food and energy.

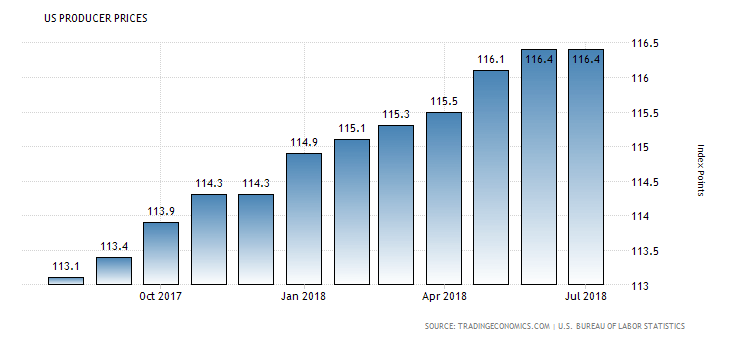

“Producer prices for final demand in the US were unchanged in July 2018, following a 0.3 percent gain in June and missing market expectations of a 0.2 percent advance. Prices for goods inched up 0.1 percent in July, the same as in June, despite a 0.5 percent fall in energy prices and a 0.1 percent decrease in food costs. Meanwhile, prices for services edged down 0.1 percent, the first decline since last December, due to a sharp drop in prices for trade services (-0.8 percent). The core index, which excludes food and energy, advanced 0.1 percent in July, also below market consensus of 0.2 percent. On a yearly basis, producer prices grew 3.3 percent and the core index rose 2.7 percent.”, Source: Trading Economics.

As seen from the chart the US Producer prices Index has been in an uptrend for the past 12-months. The forecasts are for a decrease for the yearly PPI to 3.2% from 3.3%, an increase for the monthly PPI to 0.2% from 0.0%, while the Core yearly PPI is expected to remain unchanged at 2.7% and the Core monthly PPI to increase to 0.2% from 0.1%.

The Beige Book report on the current US economic situation is an important economic event as economists and market experts give their opinion on the overall US economic growth. An optimistic view of those authorities is considered as positive for the US Dollar. The Energy Information Administration’s (EIA) Crude Oil Inventories report measures the weekly change in the number of barrels of commercial crude oil held by US firms. If the increase in crude oil inventories is more than expected, then this implies a weaker than expected demand and is considered negative for crude oil prices.

Pacific Session

Australia: Westpac Consumer Confidence Index

Time: 00:30

The Westpac Consumer Confidence measures the level of sentiment that individuals have in economic activity reflecting expectations about the one-year and five-year economic conditions and views about economic outlook. A rise in the indicator is positive for the Australian Dollar, as higher Consumer Confidence can stimulate Consumer Spending and economic growth. A decrease to 101.0 from 103.6 is expected which may influence negatively the Australian Dollar.

Asian Session

Japan: Machinery Orders (YoY, MoM)

Time: 23:50

The Machinery Orders are the total value of machinery orders placed at major manufacturers in Japan and are considered the best leading indicator of business capital spending. As increases are indicative of stronger business confidence with positive effects of other economic indicators such as employment higher than expected figures are positive for the Japanese Yen, reflecting a robust manufacturing sector, which is very important to the Japanese economy. An increase to 5.7% and 4.7% is expected for the monthly and yearly Machinery Orders respectively from -8.8% and 0.3% accordingly.