Today being an International Labour Day in many countries, liquidity is expected to be low in the forex market, mainly for the European Session. There is only economic data related to the economy of UK in the European Session, but several economic events in the American Session, related both to the US and the Canadian Dollar, while probably the most important event for today is the Reserve Bank of Australia Interest Rate Decision, which could move the Australian Dollar.

Key economic events for today to focus on:

European Session

- UK: Mortgage Lending, BoE Consumer Credit, Markit/CIPS Manufacturing PMI, Mortgage Approvals

Time: 08:30 GMT

Higher than expected figures for all the economic data related to the economy of UK are considered positive and supportive for the British Pound. Increased figures for the Mortgage lending and Approvals will indicate a robust housing market, while a higher than expected Markit/CIPS Manufacturing PMI figure will reflect industry expansion in the manufacturing sector. The forecast is for a decline for all mentioned economic data, which may influence negatively the British Pound. Especially the Markit/CIPS Manufacturing PMI Index is expected to decline having a figure of 54.8, lower than the previous figure of 55.1.

American Session

- Canada: GDP, BoC Governor Poloz Speech, US: Markit Manufacturing PMI Final, ISM Manufacturing Employment, Construction Spending, ISM Manufacturing PMI, Total Vehicle Sales, API Crude Oil Stock Change

Time: 13:45 GMT, 14:00 GMT, 18:30 GMT, 19:00 GMT, 20:30 GMT

Important economic data related to the economy of Canada, the monthly GDP Growth Rate and the US API Crude Oil Stock Change, which provide an overview of the US petroleum demand, may move the Canadian Dollar. Higher than expected GDP Growth Rate will be positive for the Canadian Dollar, as the GDP level is the major measurement of economic performance for any country.

The forecast is for a monthly GDP figure of 0.2%, higher than the previous figure of -0.1%. The USD/CAD pair can move also if there are any economic surprises related to the weekly US API Crude Oil Stock change. If the increase in crude inventories is more than expected, this implies a weaker than expected demand and is considered negative for crude oil prices. This scenario could cause a selling pressure for oil prices and the depreciation for the Canadian Dollar versus the US Dollar.

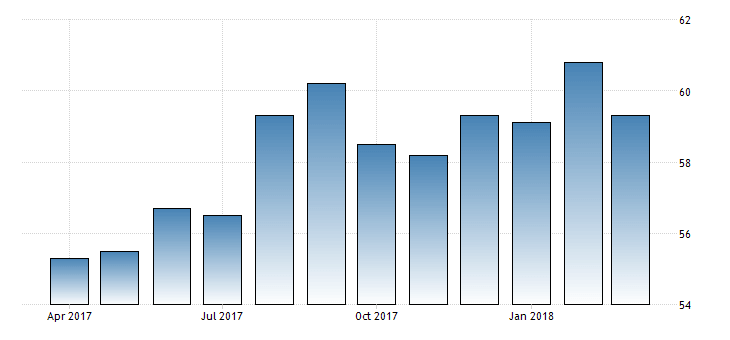

The ISM Manufacturing Survey provides important information on the inflation and labor conditions in the US, being a composite index taking into consideration several important indicators, related to business conditions. Higher than expected figures are considered positive for the US Dollar. The forecast is for a reading of 59.2, a marginal decline compared to the previous reading of 59.3.

As seen from the chart “The Institute for Supply Management’s Manufacturing PMI in the US fell to 59.3 in March 2018 from the previous month’s near 14-year high of 60.8, and missing market expectations of 60.1.” Source: Trading Economics

Overall the United States ISM Purchasing Managers Index (PMI) has been trending up for the past 12-months, and any economic surprise, positive or negative could add increased volatility and price action for the US Dollar. Increased figures for the Total Vehicle Sales, the Construction Spending and the ISM Manufacturing Employment Index are also considered positive for the US Dollar, reflecting strong consumer spending, a robust construction sector and strong employment conditions for the manufacturing sector.

Pacific Session

- Australia: RBA Interest Rate Decision

Time: 04:30 GMT

The Reserve Bank of Australia has kept the key interest rate unchanged at 1.5% for the past 12-months, and the forecast is that again there will be no change. Any surprise could move significantly the Australian Dollar, especially if there are any statements that may point to a monetary policy shift. The forex market will focus also on statements related to business and economic conditions, mainly on inflation.

Asian Session

- Japan: Nikkei Manufacturing PMI Final

Time: 00:30 GMT

The forecast is for a figure of 53.3, a marginal increase compared to the previous figure of 53.1. Increased figures are considered positive for the Japanese Yen, reflecting expansion in the manufacturing sector.