Two Monetary Policy Meetings from the Reserve Bank of Australia and the Bank of Japan, several speeches by senior central bank officials, the yearly Construction Output in the Eurozone, Economic Forecasts about the Swiss economy and economic data about the housing market in US and Australia are some of the economic events today in the forex market. Moderate to high volatility is expected for the Australian Dollar and the Japanese Yen, but the Euro, Swiss Franc and the US Dollar may also move if there are any positive or negative economic surprises to the actual economic data released.

These are the key economic events in the forex market today to focus on:

European Session

- Switzerland: SECO Economic Forecasts, Eurozone: ECB President Draghi Speech, ECB Praet Speech, Construction Output YoY, ECB Nouy Speech

Time: 05:45 GMT, 08:00 GMT, 08:30 GMT, 09:00 GMT, 11:00 GMT, 13:00 GMT

The Economic Forecasts for the Swiss Economy are considered as a measure of market activity because they reflect the pace at which the Swiss economy is growing or decreasing, the state of its economic growth. In general, a high reading or a better than expected number is considered as positive for the Swiss Franc. The speeches by the ECB President Draghi and other senior ECB central bank officials may have an influence on the Euro based on the comments and may form a short-term trend. A higher than expected figure for the yearly Construction Output in the Eurozone should be positive for the Euro indicating the output and the strength of the construction industry.

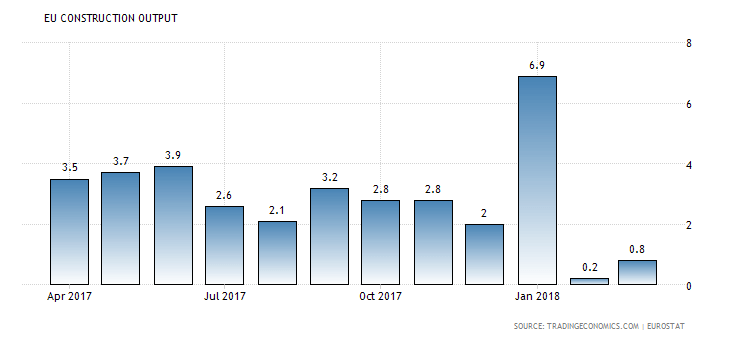

“Construction output in the Euro Area increased by 0.8 percent year-on-year in March 2018, following an upwardly revised 0.4 percent gain in the previous month, but missing market expectations of 2.2 percent growth.”, Source: Trading Economics.

We notice that except from January 2018, the Construction Output in the Eurozone for 2018 has been weak compared to the previous year 2017.

American Session

- US: Fed Bullard Speech, Building Permits MoM, Housing Starts MoM, API Crude Oil Stock Change

Time: 11:00 GMT, 12:30 GMT, 20:30 GMT

The Housing Starts and the Building Permits are both important indicators that track how many new single-family homes or buildings were constructed, and the state of the US housing market. Higher than expected figures for both Housing Starts and the Building Permits are considered positive for the US Dollar, reflecting strength in the housing market, which affects the US economy in many aspects, creating jobs, investing and providing a source of revenue for individuals and businesses, and contributing significantly to the economic output. As seen from the chart “Housing starts in the US slumped 3.7 percent month-over-month to an annualized rate of 1,287 thousand in April of 2018, following an upwardly revised 3.6 percent rise in March. It is the lowest rate in four months, mainly due to a sharp fall in the multi-family segment.”, Source: Trading Economics.

The US Housing Starts are volatile, but are in an uptrend in 2018, compared to the previous year 2017. The forecasts are for an increase of the monthly US Housing Starts with a figure of 1.317M expected, higher than the previous figure of 1.287M, but the Building Permits are expected to decline at 1.35M, lower than the previous figure of 1.364M. The weekly API Crude Oil Stock Change provides an important overview of US petroleum demand. If the increase in crude inventories is more than expected, then this implies a weaker than expected demand and is considered negative bearish for crude oil prices.

Pacific Session

- Australia: House Price Index (QoQ, YoY), RBA Meetings Minutes

Time: 01:30 GMT

The House Price Index shows changes in housing prices of major cities in Australia and can be considered as a key indicator for inflationary pressures. Higher than expected or rising figures are considered positive for the Australian Dollar, reflecting a robust housing market. The forecasts are for lower values for the House Price Index both on a yearly and quarterly basis. The minutes of the Reserve Bank of Australia show important information on policy discussion, including differences of view, and forex market participants will weigh on them for any statements pointing at changes in monetary policy.

Asian Session

- Japan: BoJ Monetary Policy Meeting Minutes

Time: 23:50 GMT

The Bank of Japan Monetary Policy Meeting Minutes review economic developments in Japan and indicate the outlook for the economy. If the BoJ appears to be optimistic on current economic conditions this is considered supportive and positive for the Japanese Yen and changes in this report may affect the JPY volatility.