The anticipated Trump/Kim Summit in Singapore is one of the most important events to focus in today, as the statements from this Summit may set new trends in the forex market about the risk sentiment factor depending on the statements that will be announced.

There is important economic data to be released from the UK in the European Session with the Unemployment Rate and the Claimant Count Rate, the Economic Sentiment Indicator for Germany and the Eurozone, and later in the American and Pacific Sessions the Inflation Rate in US and the Business Confidence in Australia.

The US Inflation Rate one day before the FOMC Interest Rate Decision is expected to move the US Dollar, moderate to high volatility is expected for the British Pound, the Euro and the Australian Dollar.

These are the key economic events in the forex market to focus on today:

European Session

- UK: Average Earnings including Bonus, Unemployment Rate, Employment Change, Claimant Count Change, Germany: ZEW Current Conditions, ZEW Economic Sentiment Index, Eurozone: ZEW Economic Sentiment Index

Time: 08:30 GMT, 09:00 GMT

A plethora of important economic data for the economy of UK will be released today, and all this data can move the British Pound based on the outcomes. Lower than expected or declining figures for the Unemployment Rate and the Claimant Count Change, and higher than expected figures for the Employment Change and the Average Earnings including bonus are considered positive and supportive for the British Pound, reflecting a strong labor market and positive earnings growth, which can influence positively the consumer spending and the economic growth.

The forecasts are for an unchanged figure of 2.6% for the Average Earnings including bonus, an unchanged Unemployment Rate of 4.2%, a decline for the Employment Change at 124K, lower than the previous reading of 197K, and a decline for the Claimant Count Rate at 11.3K, lower than the previous reading of 31.2K. Some mixed data for the economy of UK is expected.

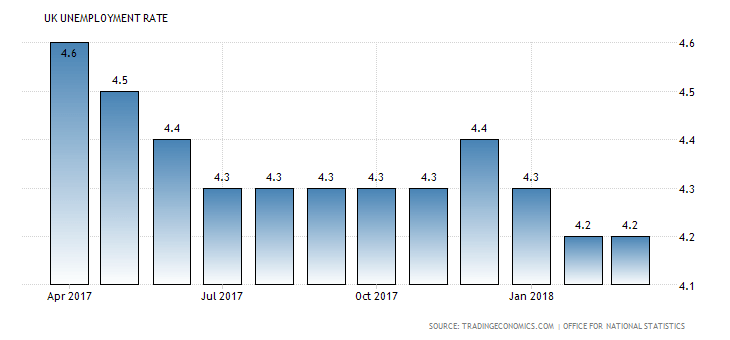

As seen from the chart “The unemployment rate in the UK stood at a 42-year low of 4.2 percent in the three months to March 2018, matching market expectations.”, Source: Trading Economics.

The Low/High UK Unemployment Rate range for the past 12-months has been 4.2%-4.6%. A sustained increase in the Employment Change and a decline in the Claimant Count Rate are key drivers for further lowering the Unemployment Rate and influencing positively the economic growth.

The ZEW Economic Sentiment Indicator measures the investor sentiment based on queries from financial analysts and the level of optimism for current and short-term future economic conditions. Higher than expected readings are both optimistic and supportive for the Euro, reflecting positive expectations for the Euro-zone economy. The forecasts are for lower readings for all the Economic Sentiment Indicators for Germany and the Eurozone, which may influence negatively the Euro.

American Session

- US: Inflation Rate (YoY, MoM), Core Inflation Rate YoY, Monthly Budget Statement, API Crude Oil Stock Change

Time: 12:30 GMT, 18:00 GMT, 20:30 GMT

The figure for the US Inflation Rate one day before the FOMC Interest Rate Decision is one the economic releases with high impact on the US Dollar today, as a higher than expected figure will be positive for the US Dollar, reflecting inflationary pressures in the economy and almost discounting at a very large degree an interest rate increase tomorrow by the Fed.

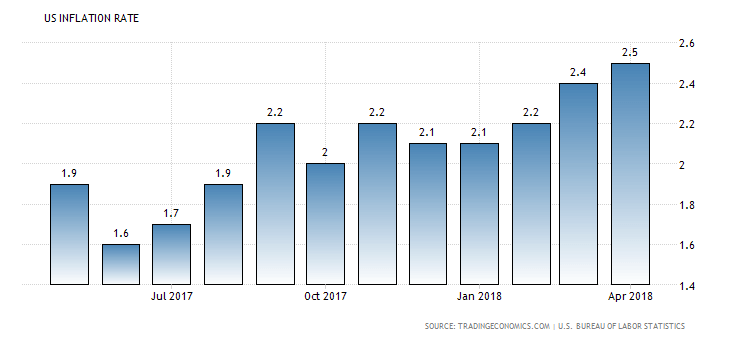

“Annual inflation rate in the United States edged up to 2.5 percent in April of 2018 from 2.4 percent in March, matching market expectations. It is the highest rate since February of 2017. Core inflation was flat at 2.1 percent.”, Source: Trading Economics.

We notice the upward trend for the US Inflation Rate as of July 2017, when it was at the rate of 1.7%. The forecast is for an increase and a figure of 2.8%, higher than the previous reading of 2.5%, while the yearly Core Inflation Rate which is considered a more conservative measurement of Inflation Rate excluding the volatile prices of food and energy is expected to increase at 2.2%, higher than the previous rate of 2.1%.

The Monthly Budget Statement summarizes the federal government’s income and expenses. In general, a budget surplus is considered positive for the US Dollar. The API Weekly Crude Oil Stock Change reports data for the US petroleum industry and the demand for Crude Oil inventory levels. Any surprises may move the Crude Oil price significantly. If the increase in crude inventories is more than expected, then this implies a weaker than expected demand and is considered negative for crude prices.

Pacific Session

- Australia: NAB Business Confidence, Home Loans MoM, Investment Lending for Homes

Time: 01:30 GMT

High readings for the NAB Business Confidence, Home Loans and Investment Lending for Homes are considered positive for the Australian Dollar, reflecting a robust housing market, and an anticipated positive economic growth as increased Business Confidence can have positive effects on capital spending and employment. The forecasts are for a decline of the Business Confidence having a reading of 9.0, lower than the previous reading of 10.0, and a negative rate of Home Loans with an expected reading of -1.9%, better than the previous negative rate of -2.2%. Overall this economic data may influence negatively the Australian Dollar.