The last trading session today for July 2018 has a very rich economic calendar, with several important economic events to be released, starting with an Interest Rate Decision by the BoJ, and later with the Unemployment Rate in Germany, for the Eurozone the GDP Growth Rate for the second quarter, the Inflation Rate and the Unemployment Rate , the GDP Growth Rate in Canada, the US Consumer Confidence Index and the Unemployment Rate in New Zealand. All this economic data today should result in moderate to high volatility in the forex market.

These are the key economic events for today which can move the forex market:

European Session

- Germany: Retail Sales (YoY,MoM), Unemployment Rate Harmonised, Unemployment Rate, Unemployment Change, France: Inflation Rate YoY Prel, Spain: GDP Growth Rate (YoY Flash,QoQ Flash), Italy: Unemployment Rate, Inflation Rate (YoY Prel, MoM Prel), GDP Growth Rate (YoY Adv, QoQ Adv), Eurozone: Core Inflation Rate YoY Flash, Inflation Rate YoY Flash, Unemployment Rate, GDP Growth Rate (YoY Flash,QoQ Flash)

Time: 06:00 GMT, 06;45 GMT, 07:00 GMT, 07:55 GMT, 08:00 GMT, 09:00 GMT, 10:00 GMT

A plethora of important economic events will be released today related to the Euro. The ECB at its recent Interest Rate Decision mentioned that the key interest rate will remain at current low levels until mid-2019. Nevertheless, the current economic conditions and the future ones may shift the monetary policy sooner than expected. Higher than expected figures for the Retail Sales in Germany, the Inflation Rate in France, Italy and in the Eurozone, plus GDP Growth Rate in the Eurozone are considered positive and supportive for the Euro. Also, lower than expected figures for the Unemployment Rate in Germany and Italy, and in the Eurozone are considered positive fundamental factors for the Euro. Any economic surprises may intensify the volatility in the forex market for the Euro versus other currencies.

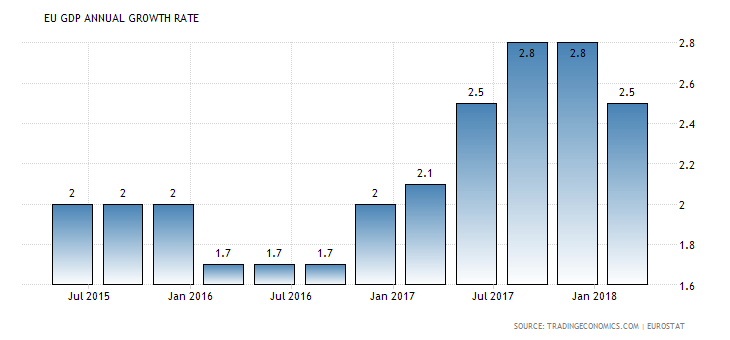

“The Eurozone economy expanded 2.5 percent year-on-year in the first quarter of 2018, unrevised from the second estimate and below 2.8 percent in the previous period.”, Source: Trading Economics.

After the peak of EU GDP Annual Growth Rate in January 2018 at the rate of 2.8% a decline followed, and the forecast is for a further decline at 2.2%, lower than the previous figure of 2.5%. The quarterly GDP Growth Rate is expected to remain unchanged at 0.4%.

The German Retail Sales are expected to increase both on a yearly and monthly basis at 1.5% and 1.1% accordingly, higher than the previous figures of -1.6% and -2.1% respectively. The Unemployment Rate is expected to remain unchanged at the rate of 5.2% in Germany but decline marginally at the rate of 8.3% in the Eurozone, lower than the previous figure of 8.4%, and the yearly Inflation Rate in the Eurozone is expected to remain unchanged at the target level of 2.0%, while the yearly Core Inflation Rate in the Eurozone is expected to increase marginally at the rat of 1.0%, higher than the previous figure of 0.9%.

Overall mixed data is expected for the Eurozone and the countries in the Eurozone, such as Italy. The yearly Inflation Rate in Italy is expected to increase at the rate of 1.4%, higher than the previous figure of 1.3%, but the yearly GDP Growth Rate is expected to decline at 1.2%, lower than the previous figure of 1.4%. This mixed data as mentioned before most probably will add significant volatility for the Euro and the forex market participants will have a lot of economic information to evaluate.

American Session

- Canada: GDP MoM, US: Employment Cost Index QoQ, PCE Price Index (YoY, MoM), Personal Income MoM, Personal Spending MoM, S&P/Case-Shiller Home Price (YoY, MoM), Chicago PMI, CB Consumer Confidence, API Crude Oil Stock Change

Time: 12:30 GMT, 13:00 GMT, 13:45 GMT, 14:00 GMT, 20:30 GMT

A lot of important economic events will be released in the American Session, including the monthly GDP Growth Rate in Canada. The GDP is considered as a broad measure of economic activity and health, with higher than expected figures considered positive for the local economy. The forecast is for an increase of the monthly GDP Growth Rate at 0.4%, higher than the previous figure of 0.1%.

The US Personal Consumption Expenditures Index measures price changes in goods and services and is monitored by the Fed as its preferred measure of inflation. Higher than expected figures for the PCE Price Index, Personal Spending and Personal Income, the S&P/Case-Shiller Home Price Index, the Chicago PMI and the CB Consumer Confidence are considered positive for the US Dollar, reflecting the health of the US housing market, the level of consumer spending, business conditions in the broader area of Chicago, and the level of consumer confidence.

Some mixed economic data is expected for the US economy, with a decline for the Chicago PMI at 62.0, lower than the previous figure of 64.1, an unchanged reading for the yearly PCE Price Index at 2.3% and a decline for the CB Consumer Confidence at 126, lower than the previous reading of 126.4.

Pacific Session

- Australia: HIA New Home Sales MoM, Building Permits MoM, AiG Performance of Manufacturing Index, New Zealand: Unemployment Rate, Employment Change

Time: 01:30 GMT, 22:30 GMT, 22:45 GMT

For the economy of Australia increased or higher than expected readings for the AiG Performance of Manufacturing Index will indicate strong business conditions in the Australian manufacturing sector, and for the Home Sales and Building Permits a strong construction sector and robust housing market conditions. High readings are considered positive for the Australian Dollar, while lower than expected readings for the Unemployment Rate in New Zealand and higher readings for the Employment Change are considered positive for the New Zealand Dollar, with positive implications for consumer spending which can stimulate economic growth. The forecast is for an unchanged Unemployment Rate of 4.4% for the economy of New Zealand and a lower Employment Change of 0.4% versus the previous figure of 0.6%.

Asian Session

- Japan: BoJ Monetary Policy Statement, BoJ Interest Rate Decision, BoJ Press Conference

Time: 02:00 GMT

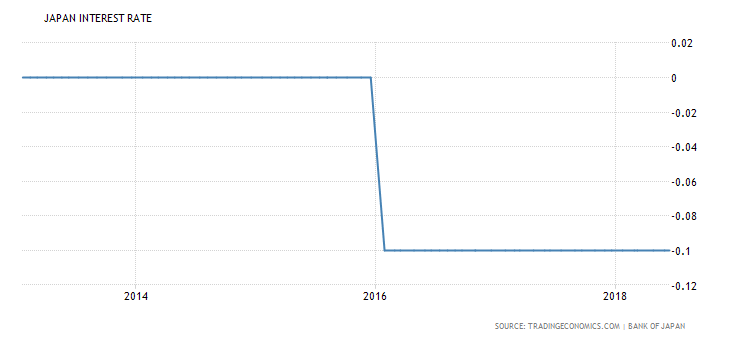

“The Bank of Japan left its key short-term interest rate unchanged at -0.1 percent at its June 2018 meeting, as widely expected. Policymakers also kept its 10-year government bond yield target around zero percent but lowered their assessment on inflation to be in a range of 0.5 to 1 percent for 2018 fiscal year. Previously in April, the central bank said inflation was moving around 1 percent.”, Source: Trading Economics.

In general, if the BoJ appears to be hawkish about the inflationary outlook of the economy and rises the interest rates this is considered positive for the Japanese Yen. The forecast is for an unchanged key interest rate of -0.1% and statements on economic conditions may influence the Yen, especially if the statements provide any clue to future changes in monetary policy.