The economic news and reports today are focused on the Purchasing Managers Index (PMI) announcements measuring the business conditions for various sectors in France, Germany, the Eurozone, and the US. The forex market participants will evaluate the relative performance of the overall economic conditions for the mentioned countries and as a result new short-term trends may appear. The Euro especially will be anticipating the ECB Interest Rate Decision on Thursday, July 26, with any economic surprises in the meantime probably adding further volatility to its price versus other currencies.

Most Important Events in Calendar for today:

European Session

- Germany: Markit PMI Composite, Markit Services PMI, Markit Manufacturing PMI, Eurozone: Markit PMI Composite, Markit Services PMI, Markit Manufacturing PMI

Time: 07:30 GMT, 08:00 GMT

The PMI is made up of several different surveys that include several elements such as New orders, Factory orders, Employment levels and Inventories signaling improvement, no change or deterioration of current economic conditions. The PMI is an extremely important indicator about economic growth and can be considered as a leading indicator for GDP growth or decline. Higher than expected figures for the PMI are considered positive and supportive for the local currencies, reflecting an expansion in economic activity and most probably higher future economic growth.

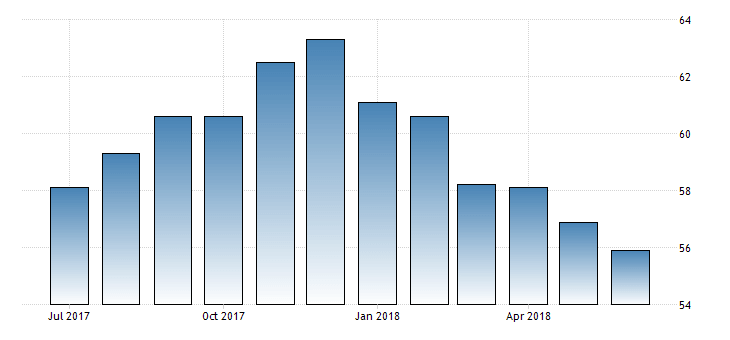

“The IHS Markit/BME Germany Manufacturing PMI was confirmed at 55.9 in June 2018, below the previous month’s final figure of 56.9. The reading pointed to the weakest pace of expansion in the manufacturing sector since December 2016 as new order growth eased further to the weakest since March 2016, and export sales also rose the least for over two years on fewer orders from the US and China. In addition, business confidence was at its lowest for over three years in June amid a cooling market, tariffs and supply constraints. Still, the pace of job creation picked up from a 15-month low seen in May to the highest since February as firms looked to boost production capacity. On the price front, factory gate charges rose at the slowest rate for eight months despite manufacturers facing an acceleration in input cost inflation.”, Source: Trading Economics.

From the above chart we notice an evident downtrend for the Germany Manufacturing PMI, having formed so far in 2018 a peak in January and declining for all the next month’s ever since, indicative of weaker economic conditions in the Manufacturing Sector and probably lower economic growth.

The forecasts for the PMI figures in Germany are for an unchanged Markit PMI Composite at 54.8, a decline for the Markit Services PMI at 54.3, lower than the previous figure of 54.5 and a decline for the Markit Manufacturing at 55.5, lower than the previous figure of 55.9. For the Eurozone declines are expected for all the PMI figures, which may influence negatively the Euro.

American Session

- US: Housing Price Index MoM, Markit PMI Composite, Markit Services PMI, Markit Manufacturing PMI, API Weekly Crude Oil Stock

Time: 13:00 GMT, 13:45 GMT, 20:30 GMT

The same financial analysis related to the PMI figures applies to the US economy, with increasing or higher than expected figures considered positive and supportive for the US Dollar, indicating expansion in the economic conditions for various sectors and leading to higher future economic growth.

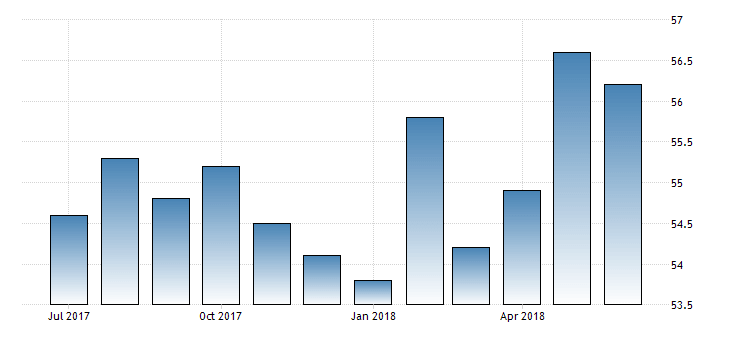

“The IHS Markit US Composite PMI stood at 56.2 in June 2018, slightly above a preliminary figure of 56.0 and compared to May’s final 56.6. The overall private sector expansion was the second-fastest since April 2015, supported by strong increases in both services activity (PMI at 56.5 vs 56.8 in May) and manufacturing output (PMI at 55.4 vs 56.4).”, Source: Trading Economics.

As seen from the chart the US Composite PMI is in an uptrend in 2018, with the lowest value reported in January. It has the opposite trend compared to the German Composite PMI, a clear divergence in the comparison of the relative economic performance of mentioned countries. The forecasts for the PMI figures in US are for an unchanged Markit Manufacturing PMI at 55.4, a decline for the Markit PMI Composite at 56.0, lower than the previous figure of 56.2 and an unchanged Markit Services PMI at 56.5.

The Housing Price Index provides an indicator of current housing market conditions, with higher readings considered positive for the US Dollar, indicating a robust housing market which is an itself a leading indicator of the overall economy and inflationary pressures in the economy as well. The forecast is for a higher reading of 0.4% compared to the previous reading of 0.1%.

The API Weekly Crude Oil Report is an overview of US petroleum demand. If the increase in crude inventories is more than expected, then this implies a weaker than expected demand and is considered a negative factor for crude oil prices.

Pacific Session

- New Zealand: Trade Balance (YoY, MoM)

Time: 22: 45 GMT

The Trade Balance is a measure of balance amount between imports and exports. A positive value shows a trade surplus, capital inflows in the country, increased demand for goods and services denominated in local currency, which in economic theory may lead to the natural appreciation of the New Zealand Dollar versus other currencies. The forecasts are for a lower monthly trade surplus of 200M New Zealand Dollars compared to the previous figure of 294M New Zealand Dollars, a decline for both imports and exports and a wider yearly trade deficit of -3.681B New Zealand Dollars, compared to the previous figure of -3.600B New Zealand Dollars. A positive trade balance shows high competitiveness of country’s economy, so these expected figures may weigh negatively on the New Zealand Dollar upon their release.