In the forex market economic calendar today, there are Important economic data for the economies of UK, Germany, France, Italy, Canada, and Japan, which can provide moderate to high volatility and price action. The British Pound most probably will experience high volatility as there will be the announcement of the first monthly estimate of GDP, the Balance of Trade and information on the state of manufacturing, industrial and construction sectors.

These are the key economic events in the forex market today to focus on:

European Session

- France: Industrial Production MoM, Italy: Industrial Production MoM, UK: Industrial Production (YoY, MoM), Balance of Trade, Manufacturing Production (YoY, MoM), Monthly GDP, Construction Output YoY, Eurozone: ZEW Economic Sentiment Index, Germany: ZEW Economic Sentiment Index, ZEW Current Conditions

Time: 06:45 GMT, 08:00 GMT, 08:30 GMT, 09:00 GMT

Important economic data for the economy of UK and the developments about Brexit will influence the British Pound today. A trade surplus, higher than expected readings for the Industrial Production, Manufacturing Production, Construction Output and monthly GDP are considered positive and supportive for the British Pound.

“The UK’s trade deficit widened by GBP 2.1 billion to GBP 5.28 billion in April 2018 from an upwardly revised GBP 3.22 billion in the previous month and above market expectations of a GBP 2.5 billion gap. It was the largest trade deficit since September 2016, due to a sharp drop in exports.”, Source: Trading Economics.

As seen from the above chart the UK Balance of Trade is very volatile and has a trade deficit for the past 12 months. The forecasts are for higher positive yearly Industrial Production and Manufacturing Production figures but for a negative reading, yet higher compared to the previous reading Construction Output.

For the Euro higher than expected readings for the ZEW Surveys are considered positive, indicating an optimistic view about the broader economy, the current and short-term future economic conditions. Also, higher than expected figures for the Industrial Production in Italy and France are also considered positive for the Euro. Some mixed economic data is expected overall which may add volatility for the Euro. All ZEW Economic Sentiment readings are expected to decline which may influence negatively the Euro.

American Session

- Canada: Housing Starts YoY, Building Permits MoM, US: JOLTs Job Openings, API Crude Oil Stock Change

Time: 12:15 GMT, 12:30 GMT, 14:00 GMT, 20:30 GMT

The Housing Starts and the Building Permits figures show the strength of the Canadian housing market and the Construction sector, considered a significant indicator of the broader economy, both due to business cycles but also contributing to the economic growth as well with increased consumer spending on various goods and services associated with the housing market. Higher than expected figures are considered positive for the Canadian Dollar. The forecasts are for a higher figure of the yearly Canadian housing Starts at 210K, compared to the previous reading of 196K, and for a higher reading of monthly Canadian Building Permits at 1.4%, compared to the previous reading of -4.6%

Higher than expected readings for the US JOLTs Openings are considered positive for the US Dollar, showing a higher number of job vacancies reflecting a strong labor market. The API Weekly Crude Oil Stock report is an overview of the US petroleum demand. Economic surprises either positive or negative can move the oil prices and the USD/CAD currency pair. The forecast is for a higher figure for the JOLTs Job Openings at 6.88M, compared to the previous figure of 6.698M.

Pacific Session

- Australia: NAB Business Confidence

Time: 01:30 GMT

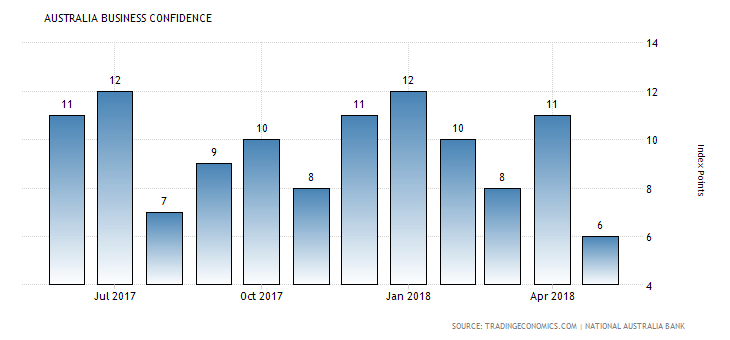

The National Australia Bank Business Confidence is a survey of the current business conditions in Australia, higher figures are considered positive for the Australian Dollar as they can lead to higher economic growth. The forecast is for an increase of the figure at 8, higher than the previous figure of 6.

“The NAB business confidence index in Australia declined to 6 in May of 2018 from an upwardly revised 11 in the previous month and missing market consensus of 9. It is the lowest reading since December 2016, as the gauge measuring business conditions dropped markedly by 6 points to 15 from April’s record high of 21. By component, both profitability (down 9 points to 13) and sales (down 6 points to 22) reversed their gains made in a month earlier. Also, employment index decreased by 5 points to 8. Conditions eased in all industries except for transport/utilities and retail, but overall conditions remain at or above average levels.”, Source: trading Economics.

As seen from the below chart the Business Confidence in Australia is positive in 2018, yet it is volatile, with the highest reading so far in 2018 in January.

Asian Session

- Japan: Machinery Orders (MoM, YoY)

Time: 23:50 GMT

The Machinery Orders are considered a leading indicator of business capital spending, with increases being indicative of stronger business confidence and higher consumers spending, positive and supportive for higher economic growth. Higher figures are considered positive for the Japanese Yen. Some mixed economic data is expected, with an increase for the yearly Machinery Orders at 8.6%, lower than the previous reading of 9.6% and a decline for the monthly Machinery Orders at -5.5%, lower than the previous figure of 10.1%. This slowdown in the Machinery Orders may have a negative influence on the Yen.