The Reserve Bank of Australia Interest Rate Decision is the key economic event for today in the forex market. Elsewhere there will be releases about important economic data for the economies of Japan, Germany, Canada and US. Moderate to high volatility should be expected today, especially for the Australian Dollar upon the announcement of Interest Rate Decision.

These are the main economic events which can move the forex market today, time is GMT:

European Session

- Germany: Balance of Trade, Industrial Production (YoY, MoM), France: Balance of Trade

Time: 06:00, 06:45

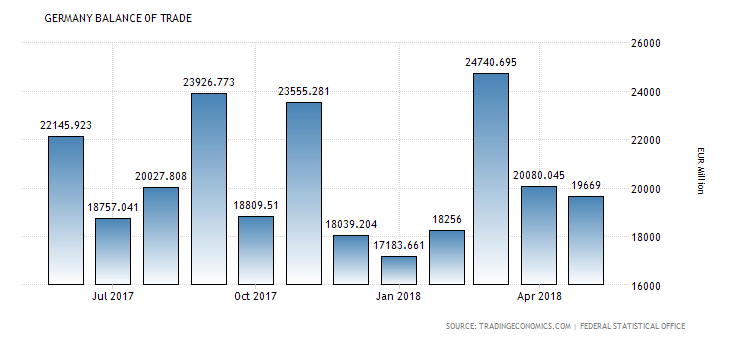

The Industrial Production measures outputs of the German factories and mines with changes in industrial production considered as a major indicator of strength in the manufacturing sector. The Balance of Trade is a balance between exports and imports of total goods and services, with a positive value reflecting a trade surplus. A trade surplus and higher figures for the Industrial Production are considered positive for the German economy and the Euro. A trade surplus indicates capital inflows in Germany and increased demand for goods and services denominated in Euros which may result in the appreciation of the Euro over time.

High figures of Industrial Production show a robust manufacturing sector and increased economic activity. The forecasts are for a decline for a decline for the monthly and yearly Industrial Production in Germany at -0.5% and 3.0% respectively, compared to the previous readings of 2.6% and 3.1% correspondingly. The forecast for the German Balance of Trade is for a decline at 20.1B Euros, compared to the previous figure of 20.3B Euros. The Balance of Trade for France is expected to show a trade deficit of -5.60B Euros, narrower than the previous deficit of -6.01B Euros.

“The German trade surplus fell to EUR 19.7 billion in May 2018 from EUR 21.8 billion in the same month a year earlier, as exports declined while imports rose.”, Source: Trading Economics.

We see that there is significant volatility for the German Balance of Trade, but the main feature is that is has a trade surplus in the past 12 months.

American Session

- Canada: Ivey PMI, US: IBD/TIPP Economic Optimism, JOLTs Job Openings, API Crude Oil Stock Change

Time: 14:00, 20:30

The Ivey PMI measures business conditions in Canada, being an important indicator of both business conditions and the overall economic condition in Canada. A higher than expected reading is considered positive for the Canadian Dollar with an expected reading of 64.2, higher than the previous reading of 63.1.

For the economy of US, JOLTS Job Openings is a survey to measure job vacancies. The Economic Optimism Index measures the sentiment of consumers related to economic conditions and evaluating the economic outlook for the next six months. In general, it can be said that If consumers are optimistic they will purchase more goods and services which will stimulate the economy. A reading above 50 indicates optimism for the economic outlook. The forecasts are for an increase for the JOLTs Job Openings at 6.642M, higher than the previous reading of 6.638M and an increase for the IBD/TIPP Economic Optimism at 57.2, higher than the previous reading of 56.4.

The American Petroleum Institute reports inventory levels of US crude oil, gasoline and distillates stocks, being an overview of US petroleum demand. If the increase in crude inventories is more than expected, then this implies a weaker than expected demand and is considered negative for crude oil prices.

Pacific Session

- Australia: RBA Interest Rate Decision, RBA Rate Statement

Time: 04:30

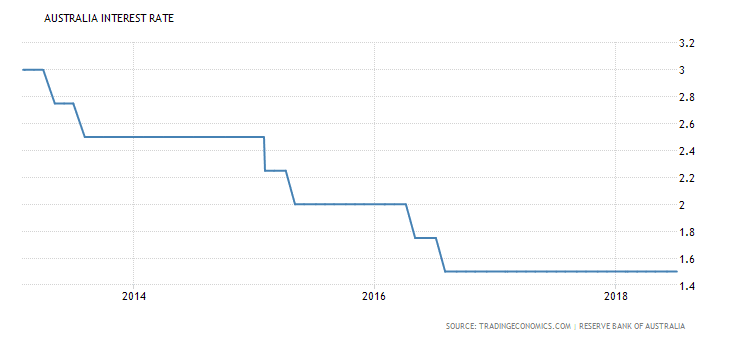

If the RBA appears to be optimistic or hawkish about the inflationary outlook of the economy and rises the interest rates it is considered positive, or bullish, for the Australian Dollar, and the statements made can move the Australian Dollar more rather than the actual Interest Rate Decision itself. The forecast is for an unchanged key interest rate at 1.5%. Naturally any positive or even negative economic surprise should add increased price action and volatility for the currency.

“The Reserve Bank of Australia left the cash rate unchanged at a record low of 1.5 percent at its July meeting, as widely expected, citing sluggishness in inflation and wages, high household debt and the risk to global growth from trade policy in the US.”, Source: Trading Economics.

Asian Session

- Japan: Coincident Index Prel, Leading Economic Index Prel, Labor Cash Earnings, Real Cash Earnings, Trade Balance

Time: 00:00, 05:00, 23:50

Labor Cash Earnings show the average income, before taxes, per regular employee, with higher income having a positive impact on personal spending and consumption stimulating economic growth and at the same time an increasing trend in earnings is considered to be inflationary for the Japanese economy. The Leading Economic Index is an economic indicator that shows the performance of the Japanese Economy over the short and mid-term future. The Coincident Index measures the current economic conditions, with a rise in the index indicating an expansion of economic activity. A trade surplus is positive for the Japanese Yen indicating capital inflows in Japan and increased demand for goods and services denominated in Japanese Yen.

Overall higher readings for all the above-mentioned economic indicators are considered positive for the Japanese Yen. The forecasts are for lower yearly Labor Cash Earnings at 1.7%, lower Leading Economic index at 105.4 and lower Coincident Index at 116.2 but also for a higher trade surplus of 822.0 B Yen. The previous figures were 2.1%, 106.9, 116.8 and -3003.8B Yen respectively.