The RBA Meeting Minutes, the UK CBI Industrial trends Orders, the US API Crude Oil Stock Change and the Retail Sales in New Zealand are some of the news and reports to be released today in the forex market. Low to moderate volatility should be expected today, although the Australian Dollar may witness high volatility upon the release of the RBA Meeting Minutes.

These are the mina economic events in the forex market today, time is GMT:

European Session

UK: Public Sector Net Borrowing, CBI Industrial Trends Orders

Time: 08:30, 10:00

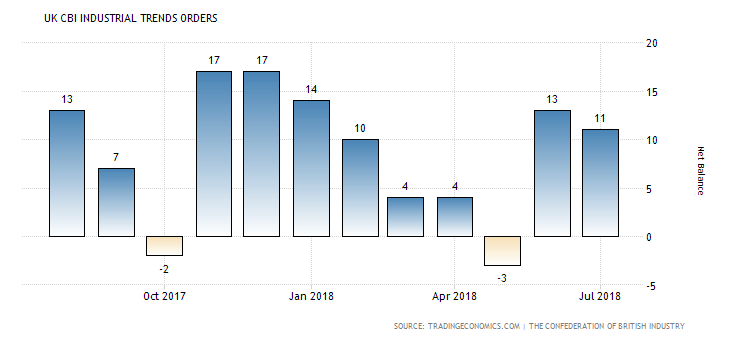

The CBI Industrial Trends Survey gives expert opinion from senior manufacturing executives, on past and expected trends in various important economic indicators such as output, exports, prices, costs, business confidence. If those opinions show a hawkish outlook in the manufacturing sector, this is considered positive for the British Pound.

“The Confederation for British Industry’s monthly industrial orders balance declined 2 points to 11 in July 2018, still beating market expectations of 9. The gauge measuring output expectations fell to 14 from 18 in the previous month, while export order books index was unchanged at 9. Also, stocks of finished products dropped (1 vs 8 in June) and domestic price expectation was steady (at 13).”, Source: Trading Economics.

The CBI Industrial Trends Orders are expected to decrease to 9.0 from 11.00 in the previous period.

The Net Borrowing figure provides information on the amount of new debt held by the U.K. governments. In general, a growth in the Net Borrowing is considered as negative for the British Pound. The Net Borrowing figure is expected to decrease to – 5.559B British Pounds from 4.530B British Pounds.

American Session

US: API Weekly Crude Oil Stock

Time: 20:30

API’s Weekly Statistical Bulletin provides U.S. and regional data relating to refinery operations and the production of crude oil, gasoline and distillates stocks showing how much oil and product is available in storage. This indicator gives an overview of US petroleum demand. If the increase in crude inventories is more than expected, then this implies a weaker than expected demand and is considered bearish for crude oil prices.

Pacific Session

Australia: RBA Meeting’s Minutes, New Zealand: Retail Sales (QoQ) (Q2), Retail Sales ex Autos (QoQ) (Q2)

Time: 01:30, 22:45

The minutes of the Reserve Bank of Australia meetings provide important insights on the policy discussion, including differences of view and record the votes of the individual members of the Committee. What is monitored by the forex market participants is the language of the RBA, if it appears to be hawkish or optimistic about the inflationary outlook for the economy, which is considered positive for the Australian Dollar as there is a higher possibility of a rate increase soon.

For the New Zealand Dollar, the retail Sales measure the total receipts of retail stores. Changes in Retail Sales are an indicator of consumer spending. A high reading is seen as positive for the New Zealand Dollar as higher consumer spending is a key driver of higher economic growth measured by the GDP Level.