Economic data related to the economies of Italy, Eurozone, Germany, UK, US and Japan will weigh on the forex market participants, possibly either forming new trends or continuing some existing ones. Moderate to high volatility is expected mainly for the Euro, the British Pound, the US Dollar and the Japanese Yen.

These are the key economic events for today in the forex market to focus on:

European Session

- Italy Inflation Rate MoM Final, UK Average Earnings including Bonus, UK Unemployment Rate, UK Claimant Count Change and Employment Change, Eurozone ZEW Economic Sentiment Index, Germany ZEW Current Conditions and ZEW Economic Sentiment Index, Italy Balance of Trade

Time: 08:00 GMT, 08:30 GMT, 09:00 GMT

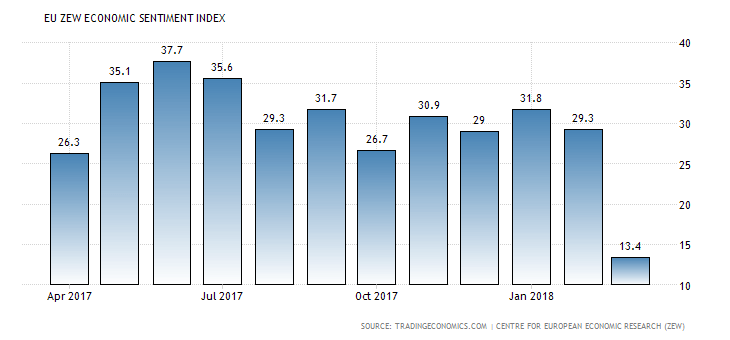

The Euro may witness significant volatility today due to the very important economic releases of the Eurozone ZEW Economic Sentiment Index, the ZEW Current Conditions and ZEW Economic Sentiment Index in Germany and the Balance of Trade in Italy. Higher than expected or increasing figures for the mentioned economic data will be supportive and positive for the Euro. The Center for European Economic Research (ZEW) releases monthly the Economic Sentiment Indicator providing important insights on the future economic expectations for the whole Eurozone. Increased figures reflect optimism for the broader economy.

As seen from the chart, The ZEW Indicator of Economic Sentiment for the Euro Area decreased to 13.4 in March of 2018 from 29.3 in February 2018, the lowest reading since October of 2016, and the second consecutive decline in 2018. The forecast is for a figure of 7.3, lower than the previous figure of 13.4. For the economy of Germany, the forecasts for the ZEW Current Conditions and ZEW Economic Sentiment Index are 88.0 and -0.8 respectively, lower than the previous figures of 90.7 and 5.1 accordingly, which may influence negatively the Euro. The Inflation Rate and Balance of Trade surplus in Italy are expected to both increase, being supportive for the Euro, which is expected to have overall a mixed economic data for the day.

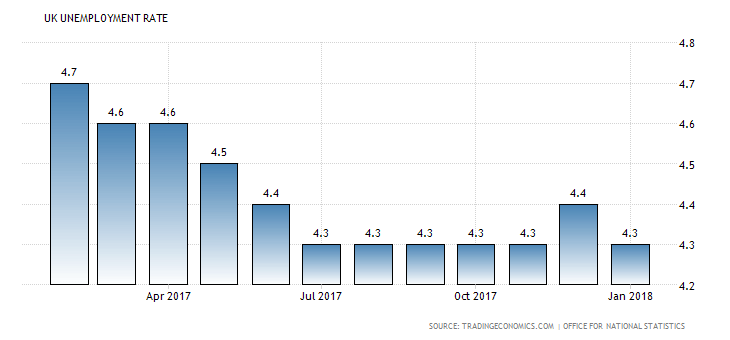

The British Pound can move significantly if there are any positive or negative economic surprises related to the Unemployment Rate and Employment Change, Claimant Count Change.

The recent trend for the Unemployment Rate in UK is a downtrend and a range of 4.7%-4.3% for the past 12-months. Declining figures for the Unemployment Rate and the Claimant Count Change are considered positive for the British Pound, reflecting a robust labor market, a lower number of people being unemployed and higher future economic expansion due to higher consumer spending. The forecast is for an unchanged figure of 4.3% for the Unemployment Rate and an increase for the Claimant Count Change having a figure of 13.3K, higher than the previous figure of 9.2K.

The Claimant Count measures the number of people who claim unemployment benefits, but actively seeking work, so a lower figure is positive for the British Pound. The Average Earnings including Bonus are expected to increase having a figure of 3.0%, higher than the previous figure of 2.8%, which can have a positive impact on consumer spending and increase inflation as well. Overall the economic data for the economy of UK is mixed.

American Session

- US Building Permits, Housing Starts, Industrial Production, Fed Williams Speech, Fed Quarles Speech, Fed Harker Speech, Fed Evans Speech, API Crude Oil Stock Change

Time: 12:30 GMT, 13;15 GMT, 14:00 GMT, 15:00 GMT, 17:40 GMT, 20:30 GMT

Increased figures for the US Building Permits, Housing Starts and Industrial Production are considered positive and supportive for the US Dollar, reflecting a strong housing market and increased business conditions for the Industrial Sector. The forecast is for an increase for the monthly Housing Starts and Building Permits and an increase for the Industrial Production but at a lower growth than before. The API Crude Oil Stock Change provides an overview of US petroleum demand. Positive or negative economic surprises have the potential to move the Oil prices.

Pacific Session

- RBA Meeting Minutes

Time: 01:30 GMT

The Meeting Minutes by the Reserve Bank of Australia have the potential to influence the Australian Dollar with the statements on current economic conditions.

Asian Session

- Japan Balance of Trade

Time: 23:50 GMT

A surplus for the Balance of trade is positive for the Japanese Yen, indicating a higher number of exports than imposts, capital inflows to Japan, and increased demand for goods and services denominated in the Japanese Yen. The forecast is for a figure of 638 Billion Yen, higher than the previous figure of 3 Billion Yen.