A very rich economic calendar today with important economic data related to the economies of Germany, Eurozone, US, Australia and Japan, which should provide moderate to high volatility in the forex market for the majority of the mentioned currency pairs. The Eurozone Business Confidence and the Inflation Rate in Germany can move the Euro in the European Session, while later on in the American Session the US Durable Goods Orders and the Consumer Confidence can move the US Dollar.

These are the main economic events in the forex market today to focus on:

European Session

- France Consumer Confidence, Spain Inflation Rate, Italy Business and Consumer Confidence, Eurozone Business Confidence, Economic Sentiment, Industrial Sentiment and Services Sentiment, Bundesbank Annual Report 2017, Spain Business Confidence

Time: 07:45 GMT, 08:00 GMT, 09:00 GMT, 10:00 GMT, 10:15 GMT

A series of economic data which can influence the Euro, with higher than expected or rising figures being positive for the Euro, as the rising figures of the Sentiment and Confidence in the Eurozone reflect increased confidence for the economy. Rising figures of Confidence reflect a positive economic outlook in terms of purchasing, business spending, and investment which can lead to higher economic growth. The forecasts are for a decline though for the readings of Business Confidence, Economic Sentiment and Industrial Sentiment in the Eurozone. The Annual Bundesbank Report for 2017 can influence the Euro providing important insights and projections on the economic conditions in Germany.

- France Unemployment Benefit Claims, Germany Inflation Rate

Time: 11:00 GMT, 13:00 GMT

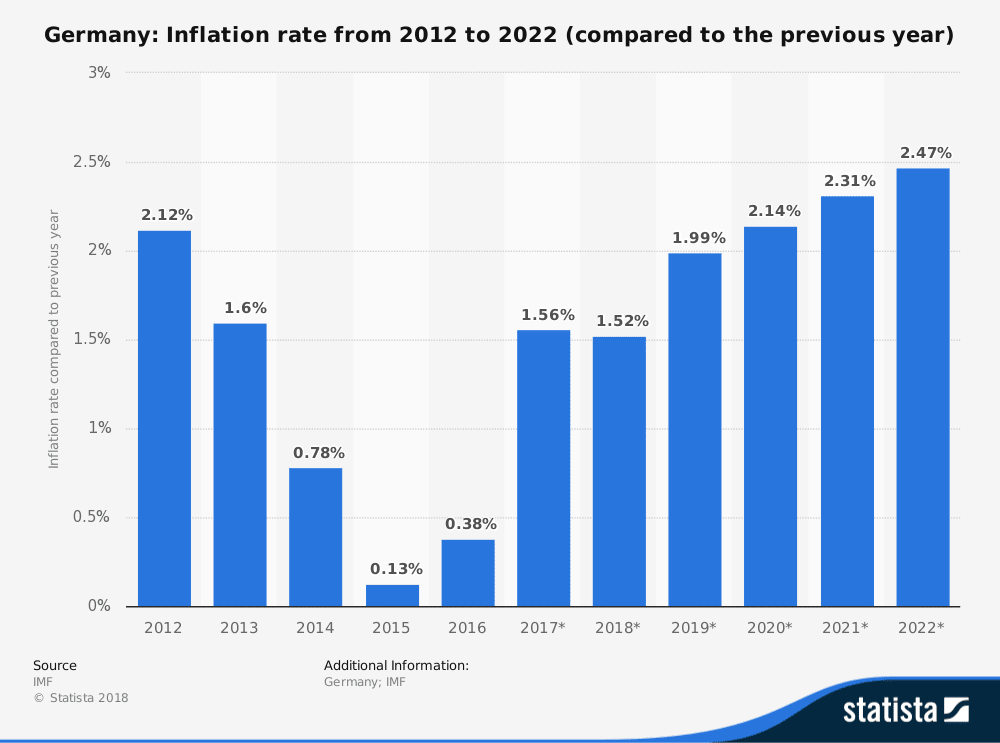

A lower than expected figure for the Unemployment Benefit Claims in France will be considered positive for the local economy and the Euro, reflecting a strong labor market. But the Inflation Rate in Germany could be a significant market mover for the Euro, as the forecast is for a small decline and a reading of 1.5% on a yearly basis, lower than the previous reading of 1.6%. This may influence negatively the Euro as the probabilities of interest rate increase by the ECB in 2018 are very low, as inflation rate in Germany and in the Eurozone remain at relative low levels. As seen from the graph the Inflation Rate in Germany is expected to rise in the following years until 2022. This may alter the monetary policy in the Eurozone as well if this future projections prove to be correct.

This statistic shows the average inflation rate in Germany from 2012 to 2016, with projections up until 2022. In 2016, the average inflation rate in Germany had amounted to about 0.38 percent compared to the previous year.

American Session

- US Durable Goods Orders, Durable Goods Orders Ex Transportation, Wholesale Inventories, S&P/ Case- Shiller Home Price Index, US Consumer Confidence Index, API Crude Oil Stock Change

Time: 13:30 GMT, 14:00 GMT, 15:00 GMT, 21:30 GMT

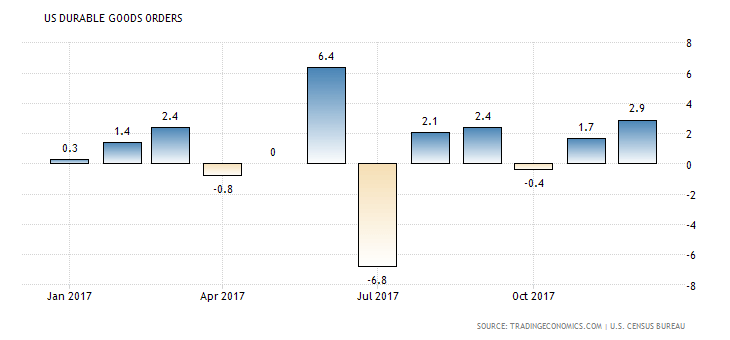

The Durable Goods Orders measure the value of orders placed for long lasting goods, reflecting the level of optimism for economic conditions, often serving as an indicator of economic changes. Higher than expected figures are positive for the economy and the US Dollar, as does a higher reading of Consumer Confidence, which leads to higher consumer spending and economic growth. As seen the trend for the US Durable Goods Orders is volatile.

The S&P/Case-Shiller Home Price tracks the change in the selling price of single-family homes in 20 metropolitan areas, with rising figures reflecting a strong housing market, being supportive for the US Dollar. The forecast is for a reading of 6.2%, a small decline compared to the previous reading of 6.4% on a yearly basis. The API Crude Oil Stock Change prove an overview of the US Petroleum Demand. An increase in crude which less than expected, in general implies greater demand and is considered positive for crude prices.

Asian Session

- Japan Retail Sales and Industrial Production

Time: 23:50 GMT

Higher figures for Retail Sales and Industrial Production will be positive for the Japanese Yen. Retail Sales lead to higher consumer spending and economic growth, while Industrial Production can be considered a leading indicator about the overall health of the Japanese economy, with an impact on employment. The forecasts are for an unchanged figure of 4.4% for the Industrial Production on a yearly basis, and a decline for the Retail Sales with a reading of 2.5% on a yearly basis, lower than the previous reading of 3.6%, which may influence negatively the Japanese Yen upon their economic release.