The key economic events for today in the forex market are about the economies of Australia, Japan, Canada and in the European Session about France and Italy. Volatility and price action is expected to be moderate to high today.

These are the main economic events to focus on today in the forex market:

European Session

- France Industrial Productions, Italy Industrial Production, ECB Nouy Speech

Time: 09:45 GMT, 11:00 GMT, 12:30 GMT

Higher than expected or rising figures for the Industrial Production in France and Italy will be positive and supportive for the Euro, reflecting strong economic and business conditions in the Industrial Sector. The forecast is for a monthly increase of the Industrial Production in both countries. A figure of 1.5% is expected for France, higher than the previous figure of -2%, and a figure of 0.8% is expected for Italy, higher than the previous figure of -1.9%.

American Session

- Canada Housing Starts, US PPI and Core PPI, US Wholesale Inventories, API Crude Oil Stock Change

Time: 12:15 GMT, 12:30 GMT, 14:00 GMT, 20:30 GMT

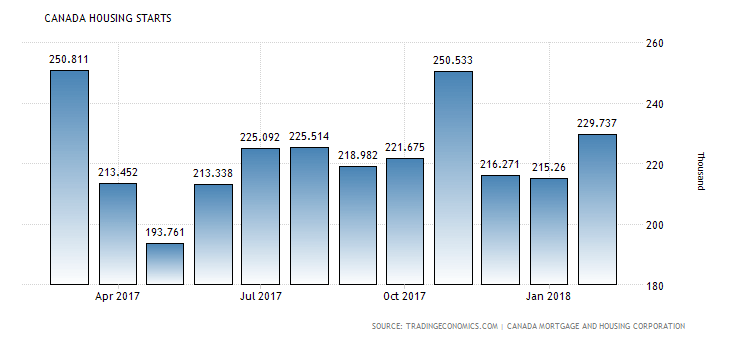

Rising figures of Canada Housing Starts are positive and supportive for the Canadian Dollar, indicating a robust housing market, growth in the Construction Sector and consumer optimism. As seen from the chart the Housing Starts in Canada are mainly in an uptrend as of May 2017. The forecast is for a figure of 224.7K, lower than the previous figure of 229.7K.

For the US Dollar higher than expected or rising figures for the Producer Price Index (PPI) and lower than expected or declining figures for the Wholesale Inventories are considered positive. The Producer Price Index (PPI) measures the change in the price of goods sold by manufacturers and can be considered as a leading indicator of consumer price inflation, while Wholesale Inventories measures the change in the total value of goods held in inventory by wholesalers, with a lower reading indicating strong demand and increased consumer spending. The American Petroleum Institute reports inventory levels of US crude oil, providing an overview of US petroleum demand. If the increase in crude inventories is more than expected, this implies a weaker than expected demand and is considered negative for crude oil prices.

Pacific Session

- Australia NAB Business Confidence

Time: 01:30 GMT

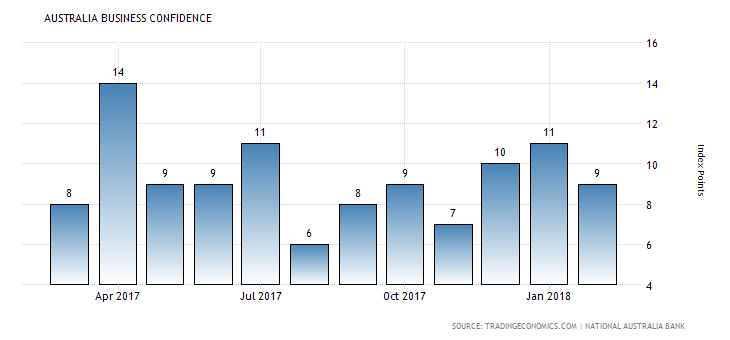

A survey of the current state of the Business Sector in Australia providing important insights on the state of the Australian economy, with rising figures considered positive for the Australian Dollar. Higher figures reflect increased Business Confidence, with positive effects on investment, and employment and a positive business outlook for the short-term.

The Business Confidence in Australia is in an uptrend as of August 2017, with the forecast being for a figure of 8.0, less than the previous figure of 9.0.

Asian Session

- Japan Machine Tool Orders, Machinery Orders

Time: 06:00 GMT, 23:50 GMT

Higher than expected or rising figures for the Machine Tool Orders and Machinery Orders are considered positive for the Japanese Yen. Machine Orders is considered as a leading indicator of business capital spending, and increases are indicative of a stronger business confidence outlook. Also, they are correlated to capital investments and can have a positive effect on the employment level. The forecast for the Machinery Orders is a monthly figure of -3.0%, lower than the previous figure of 4.5%, which may influence negatively the Japanese Yen.