The SNB Interest Rate Decision, the Retail Sales in UK, the US Existing Home Sales and Philadelphia Fed Manufacturing Index, the Consumer Confidence in the Eurozone and the Inflation Rate in Japan are all part of a rich economic calendar today in the forex market. Moderate to high volatility should be anticipated mostly for the Swiss Franc and the Japanese Yen, the British Pound with any Brexit news, and the US Dollar.

These are the key economic events today in the forex market to focus on, time is GMT:

European Session

Switzerland: Balance of Trade, SNB Interest Rate Decision, Norway: Norges Bank Interest Rate Decision, Norges Bank Monetary Policy Report, UK: Retail Sales (YoY, MoM), Retail Sales ex Fuel (YoY, MoM), Eurozone: Consumer Confidence Flash, EU leaders’ summit, Germany: Bundesbank Weidmann Speech

Time: 06:00, 07:30, 08:00, 08:30, 14:00, 15:15

There are two Interest Rate Decisions in the European Session today, one form the Swiss National Bank and later from the Norges Bank. It is interesting that the SNB is expected to keep the key interest rate unchanged at -0.75%, while the Norges Bank is expected to make an increase to its key interest rate to 0.75% from 0.50%. In general, an interest rate increase by a central bank has positive effects for its currency, leading to its appreciation versus other currencies either in the short-term or even in the long-term depending the expectations for the shift in monetary policy and the projections for the economic outlook.

For the economy of Switzerland, a trade surplus for the Balance of Trade is also considered positive for the Swiss Franc, reflecting capital inflows in Switzerland and an increased demand for goods and services denominated in the local currency which should support the natural appreciation of Swiss Franc over time.

The UK economy saw the Annual inflation going up to 2.7% in August from 2.5% in July, above expectations of 2.4%, the highest inflation rate since February. An increase in the Retail Sales figure is positive for the British Pound as Retail Sales are an indicator of consumer spending, a key driver of economic growth measured by the GDP figures. Both the yearly Retail Sales and Retail Sales ex Fuel are expected to decrease to 2.3% and 2.5% respectively, from 3.5% and 3.7% accordingly, while may influence negatively the British Pound. The monthly readings are also expected to show a decrease.

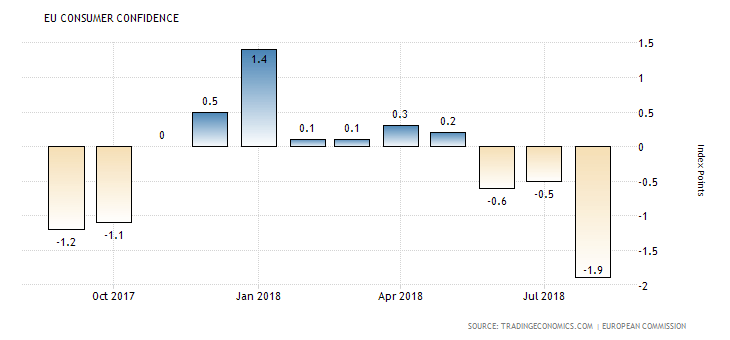

The Eurozone Consumer Confidence measures the level of consumer sentiment in the Euro considering surveys on personal finance, the job market, the likelihood of saving and expectations on the economy. High levels of consumer confidence are positive for the economy, and the Euro indicating consumers are more likely to increase consumption stimulating growth and potentially adding inflationary pressures in the broader economy.

“The consumer confidence indicator in the Euro Area decreased markedly by 1.4 points to -1.9 in August 2018 from -0.5 in the previous month and in line with the preliminary estimate. It was the weakest reading since May 2017, mainly due to a deterioration in consumers’ assessment of the future unemployment, while consumers’ views on their future financial situation, the future general economic situation, and their savings expectations remained broadly stable. Considering the European Union as a whole, the consumer sentiment indicator dropped by 1.1 points to -1.8 in August, also the lowest in one year.”, Source: Trading Economics.

As seen the Euro area Consumer Confidence has been negative and in a weak trend for the past three consecutive months, reaching its high-value in January of 2018. A further decrease to -2 from -1.9 is expected, a negative factor for the Euro.

American Session

US: Philadelphia Fed Manufacturing Index, Existing Home Sales, Existing Home Sales MoM, Canada: BoC Review

Time: 12:30, 14:00, 14:30

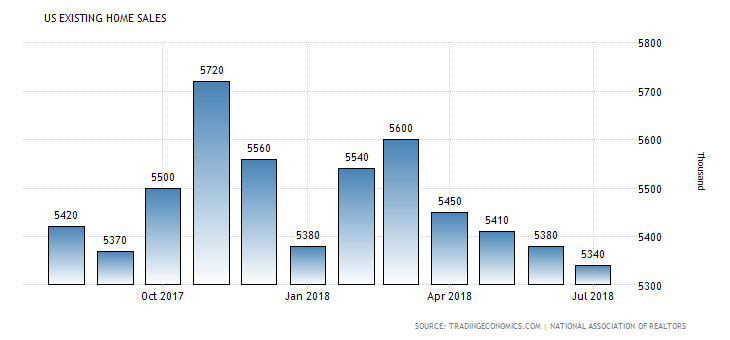

The Existing Home Sales provide important information about the housing market conditions. The housing market is considered as a very important economic indicator to the US economy often warning about changes in economic cycles. Higher than expected figures are considered to be positive for the US economy indicating a robust housing market. An increase to 0.3% from -0.7% is expected for the monthly Existing Home Sales.

“Sales of previously owned houses in the US declined 0.7 percent month-over-month to a seasonally adjusted annual rate of 5.34 million in July of 2018. It compares with market expectations of a 0.6 percent rise to 5.4 million. It is the fourth straight fall and the lowest rate since February of 2016. The median house price fell to $269,600 from $273,800 in June and the months’ worth of supply was flat at 4.3. In addition, the number of houses available in the market declined to 1.92 million from 1.93 million in June. Year-on-year, existing home sales fell 1.5 percent.”, Source: Trading Economics.

The US Existing Home Sales have been following a downward trend as of April 2018, and a marginal increase to 5.35M from 5.34M is expected.

The Philadelphia Fed Survey is an indicator of manufacturing sector trends, measuring the relative level of general business conditions in Philadelphia. A reading above zero on the index indicates improving conditions, with an increase to 17.0 from 11.9 expected.

Pacific Session

Australia: RBA Bulletin

Time: 01:30

The Bulletin contains articles and speeches that discuss economic and financial developments as well as the Bank’s operations and is monitored by the forex market participants for any updated economic and financial developments that may affect the local currency.

Asian Session

Japan: Inflation Rate YoY, Core Inflation Rate YoY

Time: 23:30

The Inflation Rate measures price movements obtained by comparison of the retail prices of a representative shopping basket of goods and services. Higher than expected readings indicate the presence of inflationary pressures in the economy which may weigh on the Bank of Japan to tighten its monetary policy increasing the key interest rate, which should be positive for the Japanese Yen. An increase for the yearly Inflation Rate and the yearly Core Inflation Rate is expected to 1.1% and 0.9% respectively, from 0.9% and 0.8% accordingly, reflecting still very low inflationary pressures in the Japanese economy.