The economic data for today which can move the forex market is related to the Euro, the British Pound and the US Dollar, as there will important releases about the GDP Growth Rate and the Consumer Confidence in Germany, the Retail Sales in UK and the Existing Home Sales in US. Moderate to high volatility is expected today in the forex market.

The Euro and British Pound may find support after the recent decline and weakness if there any positive economic surprises with better than expected economic data. The trade war fears that returned to the forex market after the recent comments by the US President is another factor which may influence the short-term trends as risk sentiment is evident again in the forex market.

These are the main economic events for today in the forex market:

European Session

- Germany: GfK Consumer Confidence, GDP Growth Rate QoQ Final, GDP Growth Rate YoY Final, France: Business Confidence, Eurozone: Eurogroup meeting, ECB Praet Speech, UK: BoE Governor Carney Speech, Retail Sales YoY, Retail Sales ex Fuel MoM, Retail Sales ex Fuel YoY

Time: 06:00 GMT, 06:45 GMT, 08:00 GMT, 08:30 GMT, 10:30 GMT, 17:00 GMT

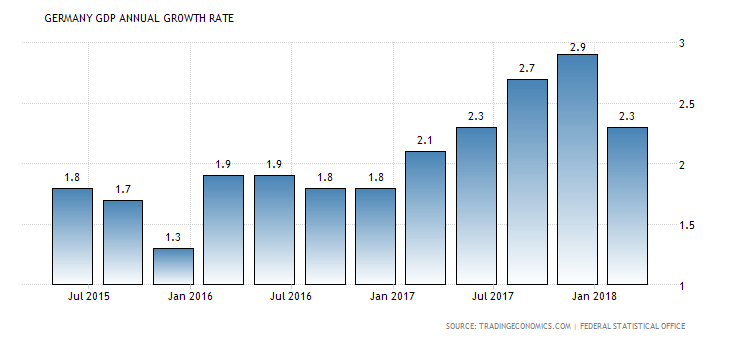

The Euro may find support after the recent weakness with any positive economic surprises, meaning higher than expected GDP Growth Rate and Consumer Confidence in Germany, and higher Business Confidence readings in France. As seen from the chart “Germany’s gross domestic product expanded by a calendar-adjusted 2.3 percent year-on-year in the first quarter of 2018, easing from a 2.9 percent growth in the previous three-month period and missing market expectations of 2.4 percent.”, Source: Trading Economics. As of January 2017, the German GDP Annual Growth Rate has been in an uptrend, except for the previous three-month period.

The forecast for the German economic data is for a figure of 2.3% for the GDP Growth Rate YoY, lower than the previous rate of 2.9%, and a figure of 0.3% for the GDP Growth Rate QoQ, lower than the previous rate of 0.6%, and an unchanged Consumer Confidence reading of 10.8.

The Business Confidence in France is expected to decline marginally at 108.0, lower than the previous reading of 109.0. A decline in Business Confidence is negative as it indicates less optimism for business conditions and may influence negatively the business spending and the level of employment.

For the economy of UK higher than expected or Increasing figures for Retail Sales is a considered positive due to the positive correlation of higher consumer spending with economic growth. After the miss yesterday of both Inflation Rate and Core Inflation Rate figures which came in below expectations in the UK, any positive economic surprise with higher than expected Retail Sales may provide some support for the British Pound. The forecast however is for a decline of the yearly Retail Sales with a figure of 0.1%, lower than the previous figure of 1.1%.

Several Speeches from Central Bank officials, both from the ECB and the Bank of England should be monitored as they may bring further volatility in the forex market with statements on economic growth and conditions.

American Session

- US: Existing Home Sales, Fed Dudley Speech, Fed Bostic Speech, Fed Harker Speech, Kansas Fed Manufacturing Index

Time: 07:00 GMT, 08:15 GMT, 14:00 GMT, 15:00 GMT, 18:00 GMT

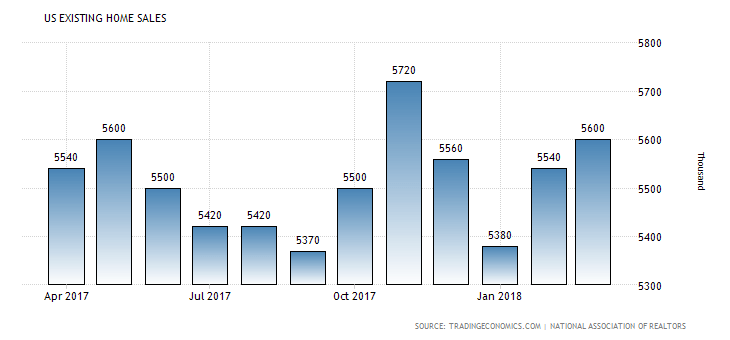

Higher than expected Existing Home Sales are considered positive for the US economy and the US Dollar, reflecting a robust housing market. The US Existing Home Sales are volatile as shown from the chart and have been increasing for the consecutive previous two-month period.

The forecast is for a figure of 5.57M, lower than the previous reading of 5.6M. The Kansas Fed Manufacturing Index provides information on current manufacturing activity in the region of Texas. Higher than expected figures indicate increased manufacturing activity and are considered positive for the US Dollar.