The economic data today which can move the forex market is related to the economies of Australia, Russia, US and Japan. For the Eurozone there is only the yearly Construction Output and two ECB Constancio Speeches, to monitor if the recent Euro decline will continue, or pause. Moderate to high volatility is expected today in the forex market.

Key economic events for today in the forex market to focus on:

European Session

- Italy: Balance of Trade, Eurozone: Construction Output YoY, ECB Constancio Speech, Russia: GDP Growth Rate, UK: BoE Haldane Speech

Time: 08:00 GMT, 09:00 GMT, 10:30 GMT, 12:00 GMT, 13:00 GMT, 16:00 GMT

Higher than expected figures for the Construction Output in the Eurozone and the trade surplus in Italy are considered positive fundamental factors for the Euro, reflecting a robust Construction Sector with increased economic and business activity and capital inflows in Italy, plus increased demand for goods and services denominated in Euros.

The forecast is for an increase for both mentioned economic data, with a figure of 2.2% for the yearly Construction Output in the Eurozone and a reading of 3.74Billion Euros for the trade surplus in Italy, higher than the previous readings of 0.4% and 3.104Billion Euros respectively. These figures may provide some support for the Euro.

An increased figure for the yearly GDP Growth Rate in Russia is considered positive for the Russian Ruble, as the GDP Growth Rate is the ultimate measure of economic performance and growth in any economy.

American Session

- US: Philadelphia Fed Manufacturing Index, Initial and Continuing Jobless Claims, Fed Kashkari Speech, Fed Kaplan Speech, Canada: BoC Review

Time: 12:30 GMT, 14:30 GMT, 14:45 GMT, 17:30 GMT

Higher than expected readings for the Philadelphia Fed Manufacturing Index and lower than expected readings for both the Initial and Continuing Jobless Claims are considered positive and supportive for the US Dollar, reflecting improving business conditions and a strong labor market. The forecast is for a reading of 25.7 for the Philadelphia Fed Manufacturing Index, higher than the previous reading of 23.2, and some mixed data for the labor market, with an increase for the Initial Jobless Claims and a decline for the Continuing Jobless Claims.

The Bank of Canada Review can move the Canadian Dollar, if there are any significant new information on economic conditions that may point to a monetary policy tightening with future interest rate increases.

Pacific Session

- Australia: Unemployment Rate, Employment Change, Consumer Inflation Expectation, Participation Rate, New Zealand: Budget Release

Time: 01:00 GMT, 01:30 GMT, 02:00 GMT

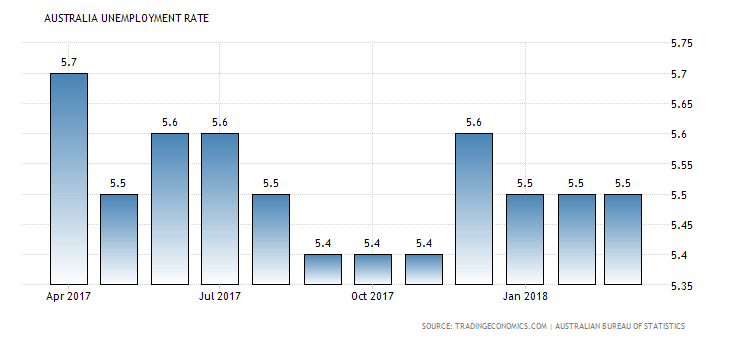

The Unemployment Rate in Australia has remained at 5.5% for the past three consecutive months and is expected to remain unchanged. A lower than expected figure for the Unemployment Rate and higher than expected for the Employment Change and the Consumer Inflation Expectation are considered positive for the Australian Dollar, reflecting a strong labor market, a key driver for economic growth.

The forecast is for an increase for the Employment Change with a figure of 15K, higher than the previous figure of 4.9K. For New Zealand the Budget release is important as any fiscal deficit can provide a stimulus in the overall economy and contribute to higher economic growth.

Asian Session

- Japan: Inflation Rate YoY, MoM, Core Inflation Rate

Time: 23:30 GMT

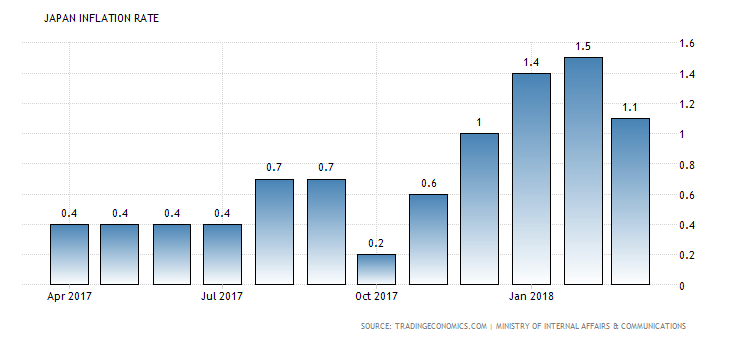

After the disappointing figures yesterday about the GDP Growth in Japan, higher than expected inflation readings may provide support for the Japanese Yen.

“The Japanese economy contracted 0.2% qoq in Q1 2018, after a downwardly revised 0.1% growth in Q4 while markets expected no growth, preliminary estimates showed. It was the first contraction since Q4 2015, as business investment fell and private consumption stalled.”, Source: Trading Economics.

Economic events drive the price action and volatility, trends for the currencies, and increased inflation readings may prompt the Bank of Japan to change its monetary policy. Form the chart we notice that indeed inflation has been rising as of October 2017, reaching the 12-months high price of 1.5% in February 2018.

The forecast is for a higher yearly Inflation Rate with a reading of 1.3%, higher than the previous reading of 1.1%, while the yearly Core Inflation Rate, a more conservative measure of the real inflationary pressures in the economy is expected to remain unchanged at 0.9%.