Some speculation news that the ECB plans to discuss its plans for the asset purchasing program in June made a large bounce for the Euro, and this is an important fundamental factor which may set a new trend for the Euro in the short-term. Sometimes news that are not included in the economic calendar cause sudden moves in the currency market.

Today the economic calendar has important economic data related to the Eurozone and its GDP Growth Rate, the Australian Trade Balance, the Unemployment Rate in Switzerland, labor market data for the US, and the Leading Economic Index for Japan. Moderate to high volatility should be expected in the forex market, mainly for the Euro.

These are the key economic events for today which may move the forex market:

European Session

- Switzerland: Unemployment Rate, Germany: Factory Orders MoM, France: Balance of Trade, Italy: Retail Sales MoM, Eurozone: GDP Growth Rate (YoY 3rd Est, QoQ 3rd Est), Russia: Foreign Exchange Reserves, UK: BoE Ramsden Speech

Time: 05:45 GMT, 06:00 GMT, 06:45 GMT, 08:00 GMT, 09:00 GMT, 13:00 GMT, 15:00 GMT

The European Session main event is the release of the Eurozone GDP Growth Rate, with the forecast being for a decline both for the yearly and the quarterly GDP Growth Rate.

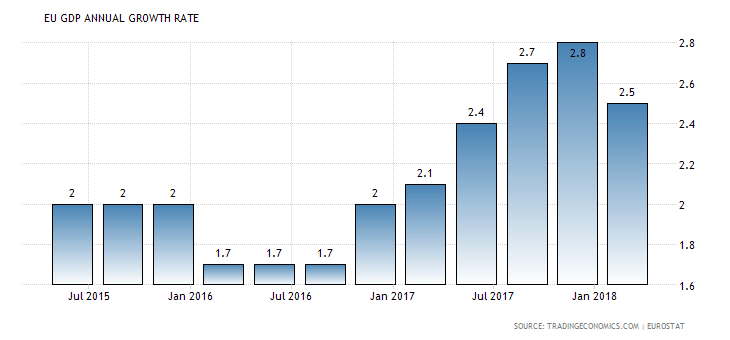

As seen from the chart “The Eurozone’s gross domestic product grew by 2.5 percent year-on-year in the first quarter of 2018, unrevised from the preliminary estimate and below 2.8 percent in the previous period.”, Source: Trading Economics.

The figures expected for the annual and quarterly Euro Area GDP Growth Rate are 2.5% and 0.4% accordingly, lower than the previous figures of 2.8% and 0.7% respectively. Higher figures for the GDP Growth Rate reflect the expansion of the economy, so these lower figures may influence negatively the Euro, which showed strength based on the rumors about the ECB changing its asset purchase program in June.

The Unemployment Rate in Switzerland is expected to decline at 2.5%, lower than the previous rate of 2.7%, which is considered positive for the Swiss Franc, while the Balance of Trade for France is expected to remain unchanged at -5.3B Euros, the monthly Retail Sales in Italy to increase at 0.2%, higher than the previous figure of

-0.2%, and the monthly factory orders in Germany to increase at 0.8%, higher than the previous reading of -0.9%. These latest economic data are positive for the Euro reflecting an expansion in the German economy and an indicator of consumer spending in Italy.

American Session

- Canada: BoC Financial System Review, Boc Governor Poloz Speech

Time: 14:30 GMT, 15:15 GMT

Any statements that provide updated and mainly new information on current economic conditions may influence the Canadian Dollar.

Pacific Session

- Australia: Imports, Exports, Trade Balance

Time: 01:30 GMT

The trade balance is the difference in the value of its imports and exports of Australian goods. A trade surplus is considered positive for the Australian Dollar, and mainly rising figures or better than expected figures, reflecting capital inflows and increased demand for goods and services denominated in Australian Dollars. The forecast is for a narrowing trade surplus of 1B Australian Dollars, lower than the previous surplus of 1.53B Australian Dollars.

Asian Session

- Japan: Coincident Index Prel, Leading Economic Index Prel, Current Account, GDP Growth Rate (QoQ Final Q1, Annualized Final Q1)

Time: 05:00 GMT, 23:50 GMT

The Leading Economic Index an economic indicator that consists of several indexes such as account inventory ratios, machinery orders, and other leading economic indicators, reflecting the performance of the Japanese Economy over the near future. Higher than expected values are considered positive for the Japanese Yen, and same applies for the Coincident Index. The forecasts are for an increase of the Leading Economic Index and a decline for the Coincident Index.

A trade surplus for the Current Account and higher than expected figures for the GDP Growth Rate are considered positive for the Japanese Yen, reflecting higher economic growth and capital inflows in Japan. The forecasts are for a narrower trade surplus for the Current Account, and a decline for the GDP Growth Rate, both quarterly and on an annualized basis. Figures of -0.1% for the quarterly and -0.4% for the annualized final GDP Growth Rate are expected respectively, compared to the previous figures of 0.1% and 0.6% accordingly.

As seen from the chart the Japan GDP Growth Rate Annualized has been trending lower as of the early months of 2017.