After the US Public Holiday yesterday and the celebration of the 4th of July, the Independence Day, the liquidity will start returning to normal levels in the forex market and that economic calendar today has several key economic events, which can move the forex market. Some of the key economic data are the Factory Orders and Construction PMI for Germany, the Inflation Rate in Switzerland, the US ADP Employment Change, the ISM Non-Manufacturing PMI, the FOMC Minutes. Overall moderate to high volatility in the forex market should be expected today.

These are the key economic events today to focus on:

European Session

- Germany: Factory Orders MoM, Construction PMI, Bundesbank Weidmann Speech, Switzerland: Inflation Rate YoY, UK: BoE Governor Carney Speech, Eurozone: ECB Mersch Speech

Time: 06:00 GMT, 07:15 GMT, 07:30 GMT, 10:00 GMT, 11:15 GMT, 12:15 GMT

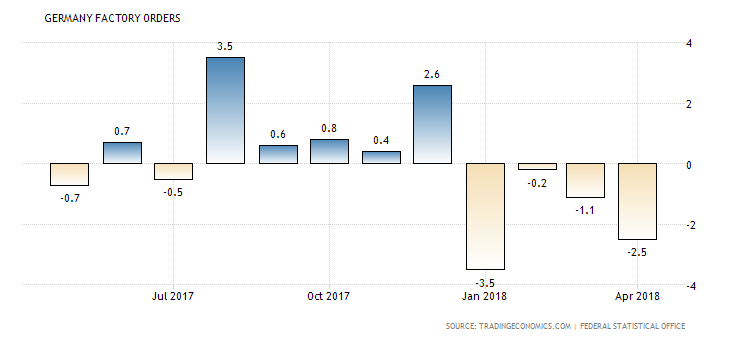

An increase in the Factory Orders may indicate an expansion in the German economy and could be an inflationary factor due to strong demand for goods. Higher than expected figures for the Factory Orders and the Construction PMI in Germany are considered positive for the Euro, reflecting also an expanding construction sector and strong economic conditions for the industrial sector. The forecast is for an increase of the monthly German Factory Orders at 1.1%, higher than the previous figure of -2.5%.

“German industrial orders declined unexpectedly by 2.5 percent month-over-month in April 2018, missing market consensus of a 0.8 percent rise and following an upwardly revised 1.1 percent drop in March. It was the fourth straight month of decrease in manufacturing orders, due to a 4.8 percent slump in domestic demand and a 0.8 percent decline in foreign orders. New orders from the Euro Area contracted by 9.9 percent while those from countries outside the bloc grew by 5.4 percent. By category, new orders dropped for both capital (-5.6 percent) and consumer goods (-2.2 percent), but rose for intermediate goods (2.5 percent). “, Source: Trading Economics.

The monthly German Factory Orders are both volatile and with not any specific trend for the past 12-months.

A higher than expected Inflation Rate for Switzerland should be considered positive for the Swiss Franc, as it may prompt the Swiss National Bank to raise interest rates to manage inflationary pressure in the broader economy. The forecast is for a marginal increase of the yearly Swiss Inflation Rate at 1.1%, higher than the previous rate of 1.0%

There are several speeches by central bank officials, which should be monitored by the forex market participants, as they can move the British Pound and the Euro with any updated statements on economic conditions and projections.

American Session

- US: ADP Employment Change, Markit Composite PMI Final, Markit Services PMI Final, ISM Non-Manufacturing PMI, ISM Non-Manufacturing Employment, EIA Crude Oil Stocks Change, FOMC Minutes

Time: 12:15 GMT, 13:45 GMT, 14:00 GMT, 15:00 GMT, 18:00 GMT

The ISM Non-Manufacturing Index shows business conditions in the US non-manufacturing sector. Higher than expected readings for the ADP Employment Change, Markit Composite PMI Final, Markit Services PMI Final, ISM Non-Manufacturing PMI, ISM Non-Manufacturing Employment are considered supportive and positive for the US Dollar, indicating a robust labor market and expanding economic and business conditions for the non-manufacturing and services sectors. An increase in the number of people employed can have positive implications for consumer spending, leading to higher economic growth.

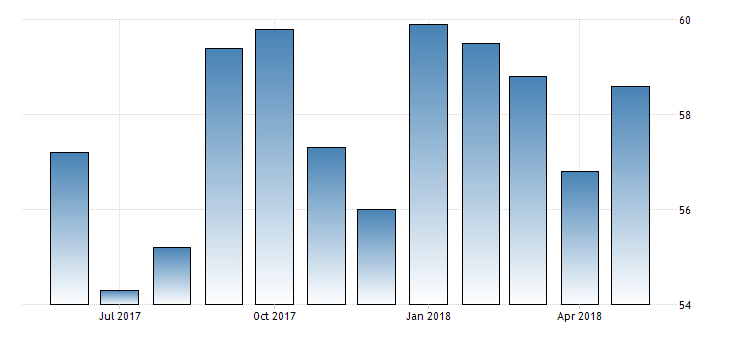

The forecasts are: “The ISM Non-Manufacturing PMI index for the United States jumped to 58.6 in May of 2018 from 56.8 in April, well above market expectations of 57.5. Faster increases were seen for business activity, new orders and employment. Firms remain optimistic about business conditions and the overall economy although there continue to be concerns about the uncertainty surrounding tariffs, trade agreements and the impact on cost of goods sold.”, Source: Trading Economics.

As seen from the below chart the US ISM Non-Manufacturing PMI after declining for three consecutive months rose during the previous month.

Later, the FOMC Minutes will also be monitored as they will provide insights on the latest economic and financial conditions and the path of future US interest rate policy. Any statements being hawkish about the economic outlook implying further future interest rate increases should be positive for the US Dollar.

The weekly EIA Crude Oil Stocks Change Report which measures the level of inventories of crude oil can influence the oil prices and the USD/CAD currency pair. If the increase in crude inventories is more than expected, then this implies a weaker than expected demand and is considered negative for crude oil prices.

Pacific Session

- Australia: AIG Performance of Construction Index

Time: 22:30 GMT

This Index measures the conditions on the short and medium term in the construction market, higher than expected readings are considered positive for the Australian Dollar.

Asian Session

- Japan: BoJ Masai Speech, Overall Household Spending YoY

Time: 01:30 GMT, 23:30 GMT

The Overall Household Spending is an indicator that measures the total expenditure by households, expressing consumer optimism, being also a measure of economic growth, as increased consumer spending is a key driver for higher economic growth. Higher than expected readings for the Overall Household Spending are considered positive for the Japanese Yen. The forecast is for a yearly figure of -1.5%, lower than the previous figure of -1.3%., which may influence negatively the Japanese Yen.