The ECB Interest Rate Decision is the key economic event for today in the forex market with the European Central Bank most probably set to hold the key interest rate steady amid heightened risks of a trade war and uncertainties for the global economy, with the scenario of a trade war escalation. Other important economic data to be announced are the Consumer Confidence in Germany, the Durable Goods Orders in US, and the release of the Consumer Price Index for Japan. With this plethora of important economic news moderate to high volatility is expected today in the forex market, with the focus being on the Euro versus other currencies.

These are the key economic events in the forex market for today:

European Session

- Germany: GfK Consumer Confidence, France: Consumer Confidence, Spain: Unemployment Rate, Italy: Consumer Confidence, Business Confidence, Eurozone: ECB Interest Rate Decision, Deposit Facility Rate, Marginal Lending Rate, ECB Press Conference

Time: 06:00 GMT, 06:45 GMT, 07:00 GMT, 08:00 GMT, 11;45 GMT, 12:30 GMT

The Consumer Confidence Index measures the level of consumer confidence in economic activity with high levels of consumer confidence considered positive and supportive for the local currency stimulating economic expansion and growth with higher expected level of consumer spending. Higher than expected figures for the Consumer Confidence in Germany, France and Italy are considered positive for the Euro. In addition, positive for the Euro are considered higher readings for the Business Confidence in Italy and a lower than expected Unemployment Rate in Spain, indicating optimism for business conditions with positive effects on business spending and employment plus a robust labor market. Some mixed economic data is expected with an unchanged GfK Consumer Confidence of 10.7 for Germany, a higher Consumer Confidence at 98.0 for France compared to the previous figure of 97.0, a lower Unemployment Rate for Spain but also lower figures for the Business and Consumer Confidence in Italy.

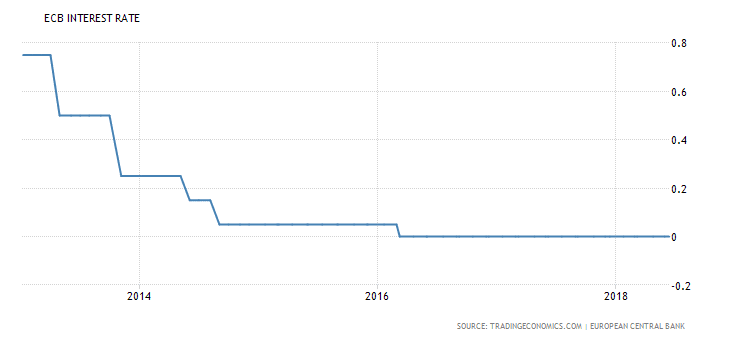

After this economic data, the focus will be on the ECB Interest Rate Decision with expectations of unchanged monetary policy. The ECB only recently made a commitment to keep unchanged rates for the next year evaluating the trade and volatility risks and financial conditions.

Some indicative statements by ECB President Mario Draghi are: “While uncertainties related to global factors, including the threat of increased protectionism, have become more prominent, the risks surrounding the euro area growth outlook remain broadly balanced,” and “Downside risks to the outlook relate mainly to the threat of increased protectionism,”.

“The ECB held its benchmark refinancing rate at 0 percent on June 14th and said the monthly pace of the net asset purchases will be reduced to €15 billion from September to December 2018, and will then end. The central bank also said it expects key interest rates to remain unchanged at least through the summer of 2019.”, Source: Trading Economics.

As no economic surprise is expected, the comments of ECB President may influence the volatility of Euro and determine a short-term trend. Any hawkish view on current economic conditions in the Euro area are considered as positive and should be supportive for the Euro.

American Session:

- US: Wholesale Inventories MoM, Durable Goods Orders Ex Transport MoM, Durable Goods Orders MoM, Kansas Fed Manufacturing Index

Time: 12:30 GMT, 15:00 GMT

The Wholesale Inventories measure the change in the number of inventories for the manufacturing sector. Higher than expected or rising readings indicate a slower economic growth and a weaker demand for manufactured products, and lower consumer spending, being negative for the US Dollar. The Durable Goods Orders reflect the change of US manufactured durable goods, where durable refers to a long-lasting period. These items can last at least 3 years or more, such as machinery or equipment. Higher readings for Durable Goods Orders are positive both for the US economy and the US Dollar, as they show strong manufacturing activity and are considered a leading indicator for the economy, as higher changes show bigger confidence and optimism for the GDP growth.

“New orders for US manufactured durable goods fell 0.6 percent month-over-month in May 2018, following a downwardly revised 1 percent drop in April while markets were expecting a bigger 1 percent decline. Transportation equipment led the decrease. Meanwhile, orders for non-defense capital goods excluding aircraft, a proxy for business spending plans, slipped 0.2 percent last month, after jumping by 2.3 percent in April.”, Source: Trading Economics.

As seen from the below chart the Durable Goods Orders are very volatile and have a non-defined trend for the past 12 months.

The forecasts are for an increase of the monthly US Durable Goods Orders at 3.0%, higher than the previous figure of -0.6%, and a decline for the Wholesale Inventories at 0.5%, lower than the previous figure of 0.6%. The Kansas Fed Manufacturing Index provides information on the regional area of Kansas, the Tenth District in US, and can signal future long-term trends with higher than expected readings considered positive for the US Dollar.

Asian Session

- Japan: Tokyo Consumer Price Index, Tokyo CPI Ex Fresh Food, Tokyo CPI Ex Food, Energy

Time: 23:30 GMT

The Tokyo Consumer Price Index tracks inflation in Tokyo comparing retail prices of a representative shopping basket of goods and services over time. Higher readings indicate inflationary pressures in Tokyo, which has a significant weight on the total CPI of Japan and are considered positive for the Japanese Yen, as the BoJ may weigh on the inflation readings and shift its monetary policy, tightening financial conditions with future interest rate hikes.