The Inflation Rate in Germany, the Industrial Production in the Eurozone, the Inflation Rate and Core Inflation Rate in US, and the Consumer Inflation Expectation for Australia, the Housing Price Index for Canada and the Business PMI Index for New Zealand are among the key economic data to be released today which can move the forex market. Moderate to high volatility should be expected today, mainly for the Euro and the US Dollar. There is also a NATO Summit and a Eurogroup Meeting.

These are the key economic events in the forex market today to focus on:

European Session

- Germany: Inflation Rate YoY Final, Sweden: Inflation Rate MoM, CPIF YoY, France: IEA Oil Market Report, Italy: Inflation Rate YoY, Eurozone: Industrial Production (YoY, MoM), ECB Monetary Policy Meeting Accounts

Time: 06:00 GMT, 07:30 GMT, 08:00 GMT, 09:00 GMT, 11:30 GMT

The yearly Inflation Rate in Germany is expected to remain unchanged at 2.1%. Germany is the largest economic country in the Euro area, so the German Inflation Rate has a lot of weight in the total Inflation Rate in the Eurozone and any increased readings indicating inflationary pressures are considered positive for the Euro, as they may weigh on the ECB to change its monetary policy increasing the key interest rate.

“The German consumer price inflation is expected to ease to 2.1 percent year-on-year in June 2018 from a 15-month high of 2.2 percent in the previous month and in line with market expectations. Services inflation is likely to slow from the previous month while prices of goods are set to rise at a faster pace boosted by energy. “, Source: Trading Economics.

As seen from the chart the German Inflation Rate has increased significantly for the past two consecutive months, over the rate of 2.0%.

Other economic data which may support the Euro are higher than expected figures for the Inflation Rate in Italy, and the Industrial Production in the Eurozone. The forecasts are for increases for the monthly and yearly Industrial Production in the Eurozone at 1.2% and 2.1% accordingly, higher than the previous figures of -0.9% and 1.7% respectively. The ECB Monetary Policy Meeting Accounts provide an overview of financial market, economic and monetary developments and will be monitored about the assessment of the economy in the Eurozone.

For Sweden A higher than expected reading for the monthly Inflation Rate and yearly Consumer Price Index with a Fixed Interest Rate (CPIF) is considered positive for the Swedish Krona, as the central bank in Sweden will monitor them to decide on any potential future monetary policy changes. The forecast is for an increase of the yearly CPIF at 2.3% compared to the previous reading of 2.1%.

The IEA Oil Market Report shows important information on supply, demand, stocks, prices and refinery activity and could move the oil prices both short-term and in the long-term.

American Session

- Canada: New Housing Price Index (MoM, YoY), US: Inflation Rate (YoY, MoM), Core Inflation Rate (YoY, MoM), Initial Jobless Claims, Continuing Jobless Claims, Fed Harker Speech, Fed Kashkari Speech

Time: 12:30 GMT, 16:15 GMT

Higher than expected readings for the New Housing Price Index in Canada should be supportive and positive for the Canadian Dollar, as the growth rate of the housing market affects the broader economy. The forecasts are for a yearly New Housing Price Index at 1.0%, lower than the previous reading of 1.6%, and an increase for the monthly New Housing Price Index at 0.2% compared to the previous reading of 0.0%.

The key economic event for the day is the release of the yearly US Inflation Rate expected to increase at 2.9% compared to the previous reading of 2.8%. The yearly Core Inflation Rate, a more conservative measurement of the Inflation Rate excluding the volatile prices of food and energy is expected to increase at 2.3%, compared to its previous reading of 2.2%. Higher readings for the Inflation Rate in US may signal further future interest rate increases by the Fed, which should be supportive for the US Dollar.

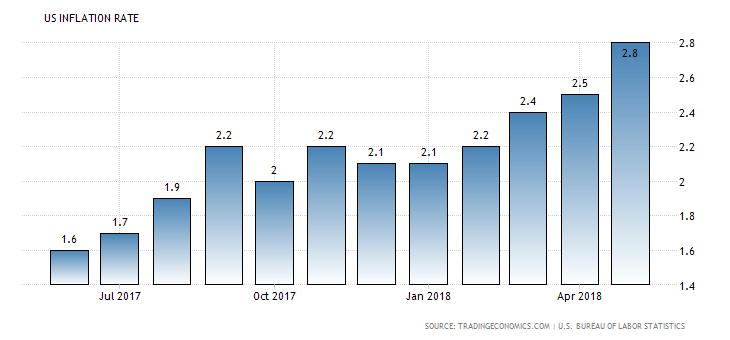

“The inflation rate in the US increased to 2.8 percent in May of 2018 from 2.5 percent in April, beating market forecasts of 2.7 percent. It is the highest inflation rate since February of 2012. On a monthly basis, consumer prices edged up 0.2 percent, the same as in April and in line with expectations. Gasoline and shelter made the largest upward contributions.”, Source: Trading Economics.

As seen from the below chart the US Inflation Rate has been in an uptrend so far in 2018.

Lower than expected readings for the US weekly Initial Jobless Claims and Continuing Jobless Claims are considered positive for the US Dollar reflecting a strong labor market, with fewer people filing for unemployment benefits. The forecasts are for lower readings for both Jobless Claims.

Pacific Session

- Australia: Consumer Inflation Expectation, New Zealand: Business NZ PMI

Time: 01:00 GMT, 22:30 GMT

The Consumer Inflation Expectation in Australia shows the consumer expectations of future inflation during the next 12 months, with higher expectations considered positive for the Australian Dollar implying increased odds future rate hikes by the RBA. The Business NZ PMI indicates business conditions in New Zealand, an important indicator of the overall economic condition. A result above 50 signals improved economic and business conditions and is considered positive for the New Zealand Dollar.