A rich economic calendar for the forex market today includes a plethora of important economic data to be announced, which can provide volatility and price action in the forex market. Some of the key events are the German Unemployment Rate and the Inflation Rate, the Business Confidence in the Eurozone, the GDP Growth Rate in Canada for the second quarter, the Personal Income and Spending in US and the Unemployment Rate in Japan. With all this economic data to released moderate to high volatility should be expected for the Euro, the Canadian Dollar, the US Dollar and the Japanese Yen.

These are the key economic events for today in the forex market, time is GMT:

European Session

Switzerland: KOF Leading Indicator, Germany: Unemployment Change, Unemployment Rate, Inflation Rate YoY, Bundesbank Weidmann Speech, UK: Mortgage Approvals, Gfk Consumer Confidence, Eurozone: Business Confidence, Services Sentiment, Economic Sentiment, Industrial Sentiment

Time: 07:00, 07:55, 08:30, 09:00, 12:00, 23:01

The KOF Swiss Leading Indicator measures future trends of the overall economic activity. Higher than expected figures are considered positive for the Swiss Franc as they can lead to strong economic trend and growth in Switzerland. An unchanged reading of 101.1 is expected.

For the Euro important macroeconomic data about the German economy are to be released which can have an influence on its value relative to other currencies. Lower than expected readings for the German Unemployment Rate and Unemployment Change and higher than expected for the Inflation Rate are considered positive for the Euro, reflecting positive implications for consumer spending which can stimulate economic growth and the presence of inflationary pressures in the overall economy, which may weigh on the ECB to start raising the key interest rate sooner than expected as mentioned recently not until the mid-year of 2019.

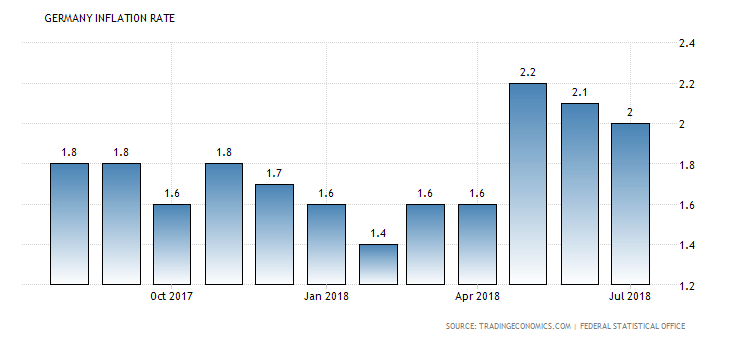

“Germany’s annual inflation rate was confirmed at 2 percent in July 2018, slightly below the previous month’s 2.1 percent. Food inflation eased while prices of services and energy rose at a faster pace.”, Source: Trading Economics.

The German Inflation Rate has increased in general in 2018 but there have been two consecutive declines during the past months and an unchanged reading of 2.0% is expected. Also, an unchanged reading of 5.2% and an increase to -8K from -6K are expected for the German Unemployment Rate and Unemployment Change respectively, which can be considered neutral readings to slightly negative readings.

For the UK a Mortgage Approvals growth represents a healthy housing market which could stimulate the overall economy and a high level of consumer confidence can have positive effects on the economic expansion and activity as well. An unchanged reading of -10K for the Gfk Consumer Confidence and a decrease for the UK Mortgage Approvals to 65.0K from 65.619K are expected.

Also, the Euro can move upon the releases of the readings for the Business Climate, Industrial Confidence, Services Sentiment and Consumer Confidence. Higher than expected readings for all these economic indicators are considered supportive and positive for the Euro indicating increased consumer confidence and business confidence which can have positive influence on production, employment, economic activity and indicating the current trend of the Eurozone economy. An unchanged reading of -1.9 is expected for the Consumer Confidence in the Eurozone, but all other economic indicators are expected to decrease which may weigh negatively on the Euro. The Business Climate Indicator to mention one of the economic indicators is expected to decrease marginally to 1.28 from 1.29. Any economic surprises for the actual versus expected readings could intensify the price action and volatility for the Euro.

American Session

Canada: GDP Growth Rate QoQ (Q2), GDP Growth Rate Annualized (Q2), GDP MoM, US: PCE Price Index (YoY, MoM), Personal Income MoM, Personal Spending MoM, Continuing Jobless Claims, Initial Jobless Claims

Time: 12:30

The GDP is a measure of the total value of all goods and services produced by Canada considered to be a broad measure of Canadian economic activity. Higher than expected readings indicate economic expansion and are positive for the Canadian Dollar.

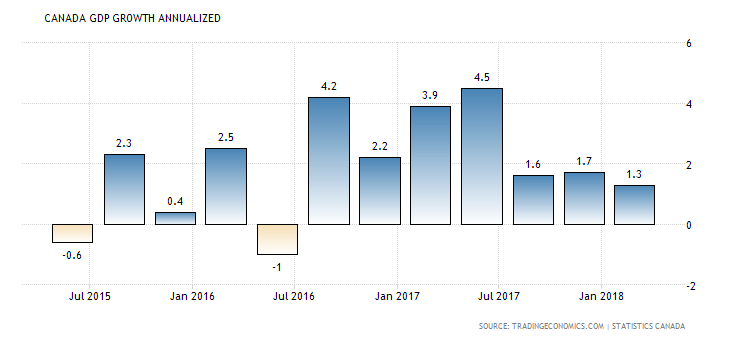

“GDP Growth Annualized in Canada decreased to 1.30 percent in the first quarter of 2018 from 1.70 percent in the fourth quarter of 2017.”, Source: Trading Economics.

After a weak Annualized GDP Growth in 2018 for the economy of Canada compared to the year 2017 an increase to 3.0% from 1.3% for the second quarter is expected and a decrease to 0.1% from 0.5% for the monthly change in GDP. A robust GDP growth can signal other than increased level of economic activity often a higher demand for the domestic currency, which may lead to the appreciation of the Canadian Dollar versus other currencies. Any economic surprises can add further volatility for the currency upon the release of the actual economic data.

For the US economy lower than expected readings for the Initial and Continuing Jobless Claims, and higher than expected readings for the Personal Consumption Expenditures Price Index, Personal Income and Spending are considered to be positive for the US Dollar. They reflect a robust labor market, a measure of inflation and the level of spending which is a key driver of economic growth. The yearly and monthly PCE Price Index is expected to remain unchanged at 2.2% and 0.1% respectively, while the monthly Personal Spending is expected to remain unchanged at 0.4% and the monthly Personal Income to decrease to 0.3% from 0.4%.

Pacific Session

Australia: Building Permits MoM, Private Capital Expenditure (Q2)

Time: 01:30

The Building Permits show the number of permits for new construction projects while the Private Capital Expenditure measure the capital expenditure level of the private sector. For bot of these readings, increased values are positive for the Australian Dollar reflecting a strong housing market and construction sector, and increased business spending.

Asian Session

Japan: Unemployment Rate, Industrial Production (YoY, MoM)

Time: 23:30, 23:50

For the Japanese economy a low Unemployment Rate indicates strength in the labor market with positive effects on the broader economy and a high industrial production strength in the manufacturing sector. Therefore, higher than expected readings for both economic indicators are positive for the Japanese Yen. An unchanged figure of 2.4% is expected for the Unemployment Rate and increases for the yearly and monthly Industrial Production to 1.0% and 0.2% respectively from -0.9% and -1.8% accordingly.