The last monetary policy decision this week by the Bank of England is the key economic event for today, with an expected interest rate hike and the inflation report on the UK economy being fundamental factors to move the British Pound. Elsewhere there will be the releases of the Australian Balance of Trade, the Retail Sales, Consumer Confidence and Manufacturing PMI for Switzerland, plus the monthly Factory Orders in US. Moderate to high volatility and most probably a short-term trend is expected mostly for the British Pound, the Swiss Franc and the US Dollar.

These are the key economic events in the forex market for today:

European Session

- Switzerland: Consumer Confidence, Retail Sales YoY, SVME Manufacturing PMI, Spain: Unemployment Change, UK: Construction PMI, BoE Interest Rate Decision, BoE Quantitative Easing, BoE Inflation Report, BoE Governor Carney Speech

Time: 05:45 GMT, 07:00 GMT, 07:15 GMT, 07:30 GMT, 08:30 GMT, 11:00 GMT, 11:30 GMT

Early in the European Session economic data about the Swiss economy will be released, the Consumer Confidence, the yearly Retail Sales and the SVME Manufacturing PMI Index. Higher than expected figures for all this data are considered positive and supportive for the Swiss Franc. They measure business conditions in the manufacturing sector with values above 50 signaling expansion in the economic activity, and an indicator of Swiss consumer demand. Increased Retail Sales and Consumer Confidence are associated with higher economic growth due to higher level of consumer spending. The forecasts are for an unchanged reading of Swiss Consumer Confidence at 2.0, unchanged yearly Retail Sales of 0% which are still better than the previous figure of -0.1% and a decline for the SVME Manufacturing Index at 60.7, compared to the previous figure of 61.6. Overall the economic data is considered mainly neutral to negative for the Swiss Franc and economy.

For the economy of Spain and the Euro the Unemployment Change shows the number of unemployed workers added during the previous month, a leading indicator for the Spanish economy. If the number is negative, it indicates an expansion within the labor market considered a positive fundamental factor. The forecast is for a figure of -87.6K, lower than the previous reading of -90K.

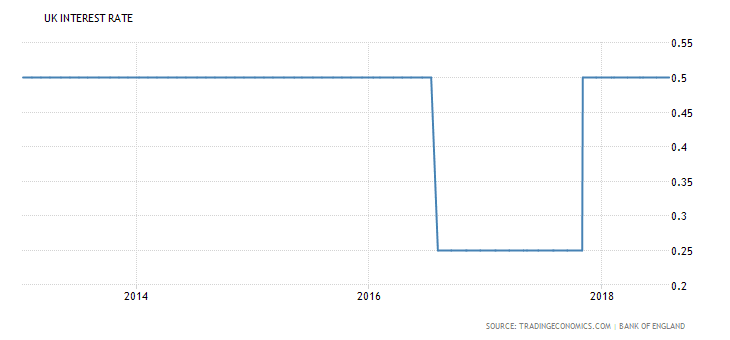

All the attention of the forex market participants will most probably be on the economic releases related to the economy of UK. An interest rate increase of 25 basis points by the Bank of England is widely expected forming the key interest rate at 0.75%, compared to the previous rate of 0.5%. The Construction PMI is expected to decline at 52.8, lower than the previous figure of 53.1., reflecting weaker business conditions in the UK construction sector.

Not only the actual interest rate decision but also the Inflation Report and the Monetary Policy Statement by the BoE about the economic conditions and outlook will be monitored and can move the British Pound. A hawkish view about the inflation and the overall economy pointing to a further tightening monetary policy depending on the economic conditions should be supportive for the British Pound, while any dovish view and a feeling that there should be no more interest rate hikes any time soon, may only provide temporary support and strengthen the British Pound versus other currencies.

“The Bank of England left its key Bank Rate on hold at 0.5 percent on June 21st, 2018, in line with market expectations. However, 3 out of 9 policymakers including BoE Chief Economist, voted for a rate hike compared with only 2 votes in the previous meeting. The Committee voted unanimously to maintain the stock of UK government bond purchases, financed by the issuance of central bank reserves, at GBP 435 billion. But, the MPC now intends not to reduce the stock of purchased assets until the rate reaches around 1.5%, compared to the previous guidance of around 2%.”, Source: Trading Economics.

American Session

- US: Factory Orders MoM

Time: 14:00 GMT

The Factory Orders measure he total orders of durable and non-durable goods providing insights into inflation and growth in the manufacturing sector. Higher than expected or increasing readings show strength in the manufacturing sector and are considered positive for the US Dollar. An increase is expected with a reading of 0.7%, higher than the previous reading of 0.4%.

Pacific Session

- Australia: Balance of Trade

Time: 01:30 GMT

A trade surplus i.e. higher exports than exports is considered positive for the Australian Dollar, indicating capital inflows and increased demand for goods and services denominated in local currency, which in economic theory should lead to the appreciation of the Australian Dollar versus other currencies.

“Australia’s trade surplus widened by 75 percent to AUD 0.83 billion in May of 2018 from a downwardly revised AUD 0.47 billion in the prior month but below market expectations of an AUD 1.2 billion surplus. Both exports and imports hit record highs.”, Source: Trading Economics.

In 2018 so far, there is a trade surplus for the Balance of Trade in Australia showing significant volatility though. The forecast is for a higher monthly trade surplus of 900M Australian Dollars, compared to the previous figure of 827M Australian Dollars.

Asian Session

- Japan: BoJ Monetary Policy Meeting Minutes

Time: 23:50 GMT

These meetings review economic developments related to the economy of Japan and indicate a sign of fiscal policy. Any changes in this report may affect the volatility of the Japanese Yen. If the BoJ minutes indicate a hawkish outlook, that is considered as positive for the Yen.