The forex market economic calendar today has important events and releases that can affect the forex market, the most important ones being the Unemployment Rate in Australia, the Retail Sales in UK, the Trade Balance in the Eurozone and economic data about the labor market and housing in US. As liquidity will return to the forex market after the public holiday yesterday moderate to high volatility is expected today mainly for the Australian Dollar.

These are the key economic events which can move the forex market today, time is GMT:

European Session

Norway: Norges Bank Interest Rate Decision, UK: Retail Sales (YoY, MoM), Retail Sales ex Fuel (YoY, MoM), Eurozone: Balance of Trade

Time: 08:00, 08:30, 09:00

The first important economic event during the European Session is the Norges Bank Interest Rate Decision with the expectation being of keeping unchanged the key interest rate at 0.5%. Any positive economic surprise should be positive for the Norwegian Krone and may lead to its strengthening versus other currencies upon the release of the interest rate decision. The Norges Bank kept its monetary policy unchanged with interest rates at 0.5% record lows for the past 12 months and Inflation is expected to remain at low levels, which does not put any severe pressure on the Norges Bank to shift its monetary policy for now.

The retail Sales in UK show the performance of the retail sector in the short term with changes considered as an indicator of consumer spending. Higher figures are considered supportive and positive for the British Pound, as consumer spending is a key economic indicator and driver for the economic growth. The forecasts are for higher monthly and yearly Retail Sales at 3% and 0.2% respectively, higher than the previous figures of 2.9% and -0.5% accordingly.

The Trade Balance in the Euro area is expected to show an increase for the trade surplus at Euros 18B, higher than the previous figure of Euros 16.5B. A trade surplus is considered positive for the Euro as it reflects capital inflows in the Eurozone and increased demand for goods and services denominated in Euros which in economic theory may result in the natural appreciation of the currency versus other currencies over time. The Euro has been lately depreciating versus major currencies such as the US Dollar amid the geopolitical turmoil in Turkey and a weak Euro is beneficial for the trade surplus in the Eurozone making exports less expensive in relative terms now. However, value of the Euro is determined largely by investor preferences for assets denominated in Euros and mostly the supply and demand determine the value of the Euro.

“The Euro Area trade surplus narrowed to EUR 16.5 billion in May 2018 from EUR 19.3 billion in the same month of the previous year. The latest figure came in well below market expectations of a EUR 20.9 billion surplus due to a 0.8 percent drop in exports, while imports rose 0.7 percent.”, Source: Trading Economics.

After a relative low level of trade surplus in January 2018 the Trade Balance in the Eurozone has widened significantly over the past months.

American Session

US: Philadelphia Fed Manufacturing Index, Housing Starts MoM, Building Permits MoM

Time: 12:30

The Philadelphia Fed Manufacturing Index measures the business conditions in Philadelphia. A level above zero on the index indicates improving conditions and a higher than expected reading should be considered as positive for the US Dollar. The forecast is for a decline of the Index at 22, lower than the previous figure of 25.7.

The Building Permits show the number of permits for new construction projects, while the Housing Starts tracks how many new single-family homes or buildings were constructed indicating the state of the US housing market, which is considered a leading indicator of the broader US economy. Higher than expected figures for the Building Permits and the Housing Starts are considered positive for the US Dollar. The forecasts are for increases for both the monthly Building Permits and the Housing Starts at 1.4% and 7.4% respectively higher than the previous readings of -0.7% and -12.3% correspondingly.

Pacific Session

Australia: Employment Change, Unemployment Rate, Consumer Inflation Expectation, Participation Rate, RBA’s Governor Philip Lowe Speech

Time: 01:00, 01:30, 23:30

For the Economy of Australia and the Australian Dollar higher than expected figures for the Employment Change, Consumer Inflation Expectation, Participation Rate and lower than expected for the Unemployment Rate are considered positive reflecting a strong labor market, consumer expectations of higher future inflation during the next 12 months which may weigh on a probability of a rate hike by the RBA, and a larger percentage of the total number of people of labor force age that is in the labor force either working or looking for a job, which can affect positively the economic growth measured by the GDP level.

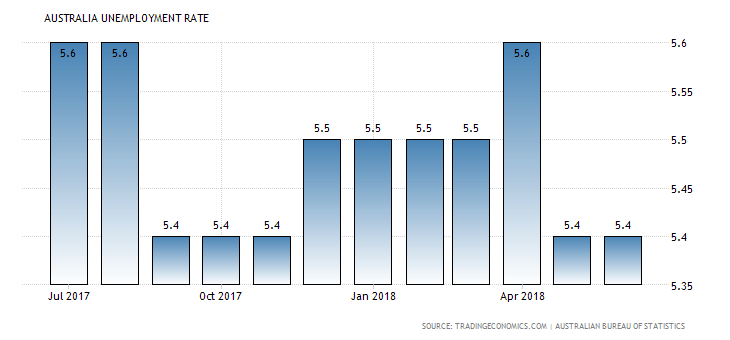

The forecasts are for unchanged figures of Unemployment Rate at 5.4% and of Participation Rate at 65.7% and a lower figure for the Employment Change at 15.0K versus the previous figure of 50.9K. Higher readings for the Employment Change have positive implications for consumer spending which may stimulate economic growth. Overall the economic data expected for the economy of Australia are considered neutral to slightly negative due to the lower expected figure of Employment Change.

“Australia’s seasonally adjusted unemployment rate stood at 5.4 percent in June of 2018, the same as in the prior month and in line with market consensus. The jobless rate remained at the lowest level since last November, as the economy added 50,900 jobs while the number of unemployed declined by 1,100.”, Source: Trading Economics.

We note that for the past two consecutive months the Unemployment Rate in Australia has been 5.4% and this may be the third consecutive month with the same reading, a trend that follows the late months of 2017 after the increase of the Unemployment Rate in the first half of 2018.