The economic calendar today has two interest rate decisions in the European Session, one related to the economy of Switzerland and one to the economy of Norway. There is also economic data related only to the economy of US, and a bulletin from the Reserve Bank of Australia. Moderate to high volatility is expected for the Swiss Franc, the Norwegian Krona and the US Dollar.

These are the main economic events for today in the forex market to focus on:

European Session

- SNB Interest Rate Decision, Norges Bank Interest Rate Decision, IEA Oil Market Report, ECB Lautenschlager Speech

Time: 08:30 GMT, 09:00 GMT, 15:45 GMT

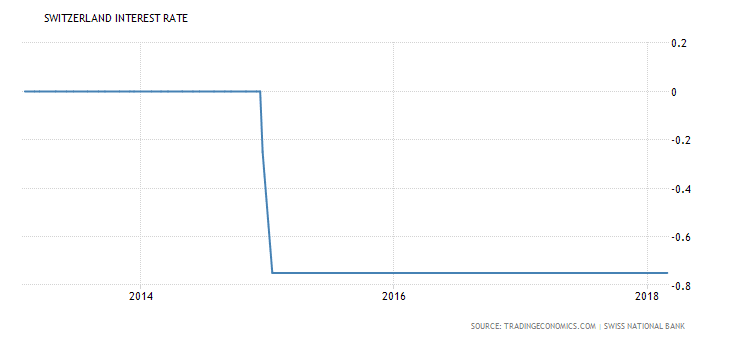

The Interest Rate Decisions have the potential to move the Swiss Franc and the Swedish Krona in the event of positive economic surprise and a potential interest rate increase from the central banks. The forecasts however are for an unchanged key interest rate of -0.75% for Switzerland and 0.5% for Norway, which may have a neutral effect upon their announcement on both currencies. As seen from the chart, the key interest rate in Switzerland is at a record low of -0.75% for a long time.

According to tradingeconomics.com “Given the supportive global environment and favourable monetary conditions, the recovery in the Swiss economy looks set to continue in the coming months. For 2018, the SNB expects GDP growth of around 2%, compared to 1% in the current year.”

In the GDP growth materializes and there are inflationary pressures in the Swiss economy, then we may see a monetary policy shift in the future. The IEA Oil Market report will provide important insights on the global supply/demand of the oil market, which can move the oil prices if not in the short-term in the long-term.

American Session

- US Import and Export Prices, NY Empire State Manufacturing Index, Philadelphia Fed Manufacturing Index, NAHB Housing Market Index, Overall Net Capital Flows, Foreign Bond Investment, Net Long-Term Tic Flows

Time: 12:30 GMT, 14:00 GMT, 20:00 GMT

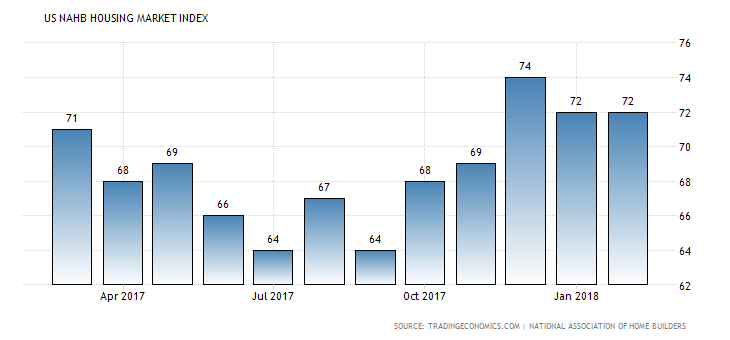

The Housing Market Index is a timely indicator of future US home sales, and can be considered a supplemental indicator for predicting housing trends, as the housing market is often viewed as an indicator of the direction of the economy as a whole.

As seen from the chart the Index has remained unchanged for the past two months at the level of 72.0, and in general as of October 2017 is in an uptrend. Higher than expected or rising figures for the NAHB Housing Market Index are positive and supportive for the US Dollar as a strong housing market is correlated high increased consumer spending and higher economic growth. The forecast is for an unchanged reading of 72.0.

Higher than expected readings for the NY Empire State Manufacturing Index and the Philadelphia Fed Manufacturing Index will be positive for the US Dollar reflecting increased manufacturing activity. The expectations are mixed, with an anticipated increase for the NY Empire State Manufacturing Index and a decrease for the Philadelphia Fed Manufacturing Index.

The reading of the Net Long-Term Tic Flows is important as it is a summary of the flow of stocks, bonds, and money market funds to and from the United States, so increased capital inflows indicate increased demand for financial assets denominated in US Dollars, which in economic theory should have a positive effect on the US Dollar, causing its appreciation against other currencies over time. The forecast is for a figure of $39.1 Billion, higher than the previous reading of $27.3 Billion.

Pacific Session

- RBA Bulletin

Time: 00:30 GMT

The Reserve Bank of Australia Bulleting is important and can move the Australian Dollar as it will provide fundamental information on current economic conditions, and the language used may imply a more optimistic or pessimistic view of the economy, economic growth or the inflation rate. The interpretation of these statements by the forex market may weigh on the value of the Australian Dollar.