The Forex week for May 21-25, 2018 is starting today with a very thin economic calendar and not any major economic events during the European, Pacific and Asian Session. There are only a few Speeches from Fed Officials and the release of the Chicago Fed National Activity Index, which may move the US Dollar. Moderate to high volatility is expected mainly for the US Dollar. With the absence of any important economic events the forex market should witness a range bound trading session for today, with former trends most probably not being able to reverse, rather a continuation is most likely.

There is also the important release of the Financial Stability Review by the ECB, which provides an overview of the possible sources of risk related to the financial stability in the euro area, and an OPEC meeting, which can influence the oil prices and the USD/CAD currency pair, if any updated decision is announced about the level of supply.

Main economic events for today to focus on:

American Session

- US: Chicago Fed National Activity Index, FOMC Member Bostic speech, FOMC Member Harker Speech, FOMC Member Kashkari Speech

Time: 12:30 GMT, 16:15 GMT, 18:05 GMT, 21:30 GMT

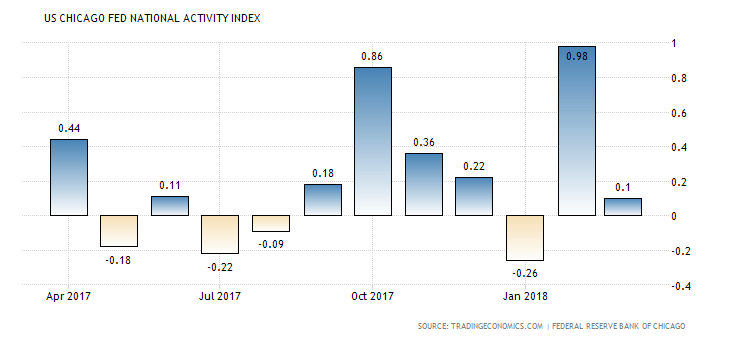

The Chicago Fed National Activity Index released by the Chicago Federal Reserve Bank tracks economic activity in the 7th district, economic growth and potential inflationary pressures. A higher than expected reading should be taken as positive for the US Dollar, with the forecast being for an increase and a figure of 0.25, higher than the previous figure of 0.10.

Higher than expected or rising figures are considered positive for the US Dollar, reflecting mainly higher economic growth.

“The Chicago Fed National Activity Index slumped to 0.1 in March of 2018 from an upwardly revised 0.98 in the previous month which was the highest reading since October of 1999.”, Source: Trading Economics.

The Index is volatile as seen from the chart with an undefined trend, and significant changes which reflect economic conditions related to growth and employment.