A new week for the forex market starts today with a focus on trade wars, the outcome and statements of the G7 meeting in Canada, with tensions between the US and the rest of the allies especially on tariffs and trade issues, and with high interest on the meeting of the US President with North Korean leader Kim Jong, which may influence significant the risk sentiment in the forex market and set new trends. But later during this week there are three monetary policy decisions, as the Fed, the ECB and the BoJ will announce their latest decision on their key interest rates, which can add both volatility and form new trends in the forex market. Today the economic calendar is relatively light, with important economic data related to the economy of UK in the European Session. Moderate to high volatility is expected for the British Pound.

These are the key economic events in the forex market today:

European Session

- Italy: Industrial Production MoM, UK: Balance of Trade, Industrial Production (YoY, MoM), Construction Output YoY, Manufacturing Production (YoY, MoM)

Time: 08:00 GMT, 08:30 GMT

The changes in Industrial Production, Construction Output and Manufacturing Production measure the output and are an indicator of the state in the mentioned sectors, with higher values considered positive for the British Pound and the Euro, reflecting expansion in the current business and economic conditions. The forecast is for a decline for the monthly Italian Industrial Production with a figure of -0.6% expected, lower than the previous figure of 1.2%.

For the British Pound some mixed economic data is expected, with a decline in the yearly Industrial Production and a figure of 2.7%, lower than the previous figure of 2.9%, an increase in the yearly Manufacturing Production with a figure of 3.1%, higher than the previous reading of 2.9% and a negative growth rate for the yearly Construction Output, with a figure of -1.8%, higher than the previous figure of -4.9%, but still indicating weak conditions and contraction for the Construction Sector.

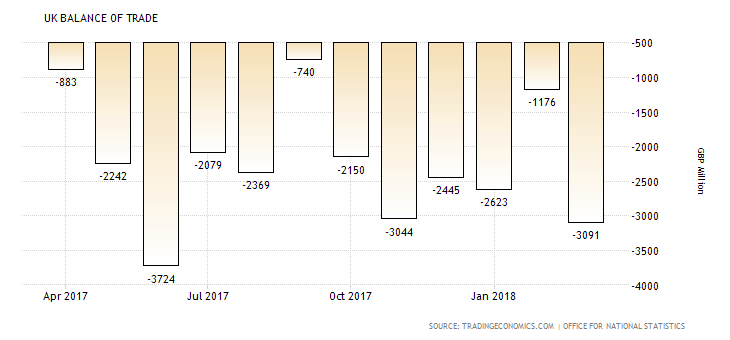

The Balance of Trade for the economy in UK has the potential to move significantly the British Pound. As seen from the chart “The UK’s trade deficit widened by GBP 1.9 billion to GBP 3.091 billion in March 2018 from an upwardly revised GBP 1.176 billion in the previous month and above market expectations of a GBP 2 billion gap. It was the largest trade deficit since last June, as imports rose 5.8 percent to a record high of GBP 56.0 billion while exports increased at a slower 2.2 percent to GBP 52.9 billion.”, Source: Trade Economics.

For the past 12-months the Balance of Trade in UK has a trade deficit, which has widened significantly in the latest period of reference, in March 2018. The Balance of Trade measures the balance between exports and imports of goods, and capital inflows or outflows in the country. A trade surplus is considered positive for any country, reflecting higher exports than imports, capital inflows in the country, and increased demand for goods and services denominated in any specific currency, which in economic theory this increased demand should lead to the natural appreciation of the currency over time.

Any economic surprise in the Balance of Trade figure may add further volatility for the British Pound.

Asian Session

- Japan: Machine Tool Orders YoY

Time: 06:00 GMT

The Machine Tool Orders in Japan reflect trends, economic conditions, business capital spending and business confidence for the Manufacturing Sector in Japan. Higher than expected or rising number of Machine Tool Orders are considered positive for the Japanese Yen, as they can have a positive influence on the employment and the broader economic growth due to higher consumer spending.