The new trading week for the forex market today has a light economic calendar, with important economic data to be released mainly in the European Session, the Swiss Unemployment Rate and the Balance of Trade for Germany are expected. In the American Session there is only the Consumer Credit Change, but several speeches by central bank senior officers may add volatility in the market.

The expected volatility today may be low to moderate, although the forex market will weigh on the US Nonfarm Payrolls released past Friday, July 6, which beat estimates, but the Unemployment Rate in US rose due to the higher labor force participation rate. This economic data may define a short-term trend for the US Dollar today.

These are the key economic events in the forex market today:

European Session

- Switzerland: Unemployment Rate, Germany: Balance of Trade, Eurozone: ECB Praet Speech, Eu-Ukraine Summit, ECB Draghi Speech

Time: 05:45 GMT, 06:00 GMT, 07:00 GMT, 08:00 GMT, 13:00 GMT, 15:00 GMT

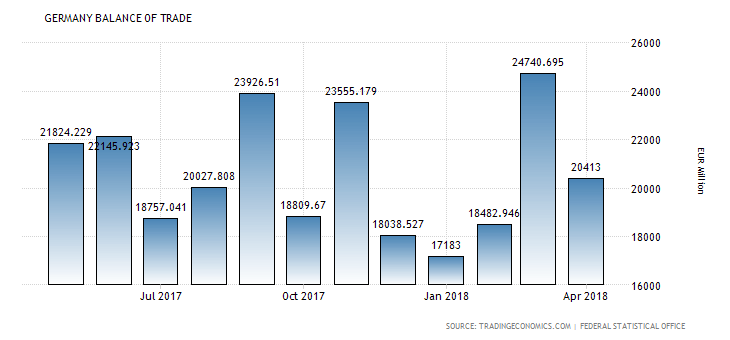

The Balance of Trade for Germany is the key economic event today which may move the Euro. “The German trade surplus increased to EUR 20.4 billion in April of 2018 from EUR 17.8 billion in the same month a year earlier, as exports rose more than imports. In the first four months of the year, the trade surplus widened to EUR 80.8 billion from EUR 77.4 billion in the same period of the previous year.”, Source: Trading Economics.

As seen from the below chart the Balance of Trade for Germany has a trade surplus for the past 12 months but with increased volatility, with significant increases and declines.

A trade surplus is considered positive for the economy of Germany and the Euro as it indicates capital inflows to Germany, as exports are higher than imports, and this increased demand for goods and services denominated in Euro may lead in economic theory to the appreciation on the Euro versus other currencies. The forecast is for an increase of the trade surplus foe Germany at 20B Euros, higher than the previous figure of 19.4B Euros.

A lower than expected Unemployment Rate in Switzerland is considered positive for the Swiss Franc with more people employed stimulation the economic growth due to higher consumer spending. The current Unemployment Rate is 2.4%.

There are also speeches by the ECB President and ECB Praet, which may influence the Euro and an EU-Ukraine Summit, where EU and Ukraine will discuss about the implementation of the association agreement and its free trade area, plus regional and foreign policy issues.

American Session

- US: FOMC Member Kashkari Speech, Consumer Credit Change

Time: 13:10 GMT, 19:00 GMT

The Consumer Credit Change measures the amount of money individuals borrowed, with higher readings considered positive for the US economy and the US Dollar as they can stimulate consumer spending and economic growth. The forecast is for an increase of the Consumer Credit Change at 11.50B US Dollars, higher than the previous figure of 9.26B US Dollars.

Asian Session

- Japan: Eco Watchers Survey (Current, Outlook)

Time: 05:00 GMT

The Eco Watchers Survey monitors current regional economic trends and provide a short-term economic outlook as well with higher figures considered positive and supportive for the Japanese Yen. The forecasts are for higher readings for both Eco Watchers Surveys, which may influence positively the Japanese Yen.