A new trading week in the forex market for July 30-August 2018 starts today with a very rich economic calendar. During the week the Fed, the BoE and the BoJ will decide on monetary policy, while other important releases include for the US: jobs report, trade balance, personal income and spending, PCE prices and ISM PMIs, for UK: monetary indicators and PMIs, for the Eurozon: GDP growth and inflation and for Japan: unemployment and consumer confidence.

With all these economic data we should expect increased volatility and price action in the forex market this week, but also for today as key economic events include the Business Confidence in the Eurozone, the Inflation Rate in Germany, the Consumer Confidence in UK and the Unemployment Rate in Japan.

These are the key economic events in the forex market today to focus on:

European Session

- Spain: Inflation Rate Yoy Prel, Business Confidence, Switzerland: KOF Leading Indicators, Sweden: GDP Growth Rate (YoY Flash, QoQ Flash), UK: BoE Consumer Credit, Mortgage Lending, Mortgage Approvals, GfK Consumer Confidence, Eurozone: Services Sentiment, Economic Sentiment, Industrial Sentiment, Business Confidence, Germany: Inflation Rate YoY Prel

Time: 07:00 GMT, 07:30 GMT, 08:30 GMT, 09:00 GMT, 10:15 GMT, 12:00 GMT, 23:01 GMT

A plethora of economic data will be released in the European Session and in the first trading day of the week today. For the Euro higher than expected readings for the Inflation Rate in Spain and Germany, and the Sentiment Indicators plus Business Confidence are considered positive and supportive. Higher readings for the Services Sentiment and Industrial Sentiment can have a positive impact on employment, production, and stimulate economic expansion and economic activity. Recently the ECB stated that the key interest rate should remain at low levels until mid-2019, so any economic positive surprises can provide support for the Euro.

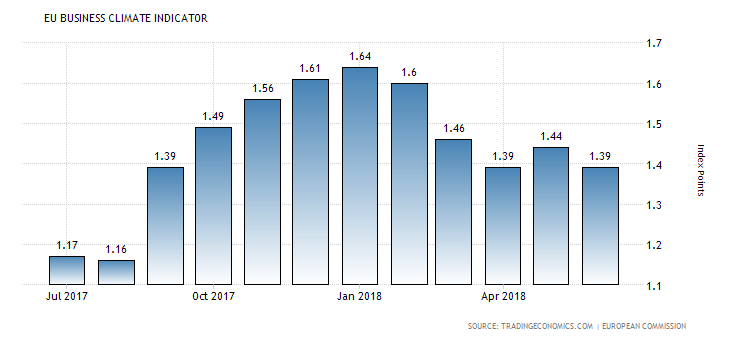

“The business climate indicator for the Euro Area fell slightly by 0.05 points to 1.39 in June 2018, in line with market expectations. Managers’ appraisals of their overall and export order books worsened markedly, while their assessments of the past production and the stocks of finished products remained virtually unchanged. By contrast, managers’ production expectations improved substantially.”, Source: Trading Economics.

The EU Business Climate Indicator has peaked in January 2018 at the figure of 1.64 and had been in a downtrend ever since.

The forecasts are for declines for all the Sentiment Indicators in the Eurozone and a decline is expected for the Business Confidence as well, at 1.35 lower than the previous figure of 1.39 which may influence negatively the Euro.

For Switzerland the KOF Swiss Leading Indicator measures future trends of the overall economic activity, with higher than expected readings reflecting an optimistic view considered positive for the Swiss Franc. A marginal decline is expected with a figure of 101.5, lower than the previous figure of 101.7.

The UK economy has for today the release of the Mortgage Approvals, a leading indicator of the UK Housing market. A mortgage growth reflects a healthy housing market that can stimulate the overall UK economy. Other important economic data for the UK include the BoE Consumer Credit, the amount of money that individuals borrowed in the previous month. Higher than expected borrowing can have a positive impact on economic growth due to increased consumer spending. Later during the day, the GfK Consumer Confidence measures the level of consumer confidence in economic activity.

A high level of consumer confidence stimulates economic expansion and is considered positive for the British Pound. If these readings are better than expected they could provide support and form a new short-term trend for the British Pound just a few days before the BoE monetary policy decision on Thursday, August 2, 2018. The forecasts are for an unchanged GfK Consumer Confidence at -9, a decline for Consumer Credit and Mortgage Approvals but an increase for Mortgage lending. Overall mixed data is expected for the UK economy.

American Session

- US: Pending Home Sales (YoY, MoM), Dallas Fed Manufacturing Index

Time: 14:00 GMT, 14:30 GMT

The Dallas Fed Manufacturing Index provides an assessment of the state factory activity. Key indicators such as output, employment, orders, prices and other indicators are monitored whether they increased, decreased or remained unchanged over the previous month. A higher than expected figure for the Dallas Fed Manufacturing Index is considered positive for the US Dollar, reflecting higher economic activity. The forecast is for a lower figure of 31.0 compared to the previous figure of 36.5.

The US Pending Home Sales are a leading indicator of trends of the housing market in the US and of the broader economy. Sustained declines or increases in the Home Sales provide early signals of a potential slowdown or expansion in the economy. The forecasts are for a decline of the yearly Pending Home Sales at -6.0%, lower than the previous figure of -2.2%, but a monthly increase of 0.1% is expected versus the previous decline of -0.5%. After the large positive economic surprise of the GDP Growth Rate on Friday, July 27, which came in at above 4.0%, any negative economic surprise today may influence negatively the US Dollar.

Asian Session

- Japan: Unemployment Rate, Industrial production (YoY Prel, MoM Prel)

Time: 23:30 GMT, 23:50 GMT

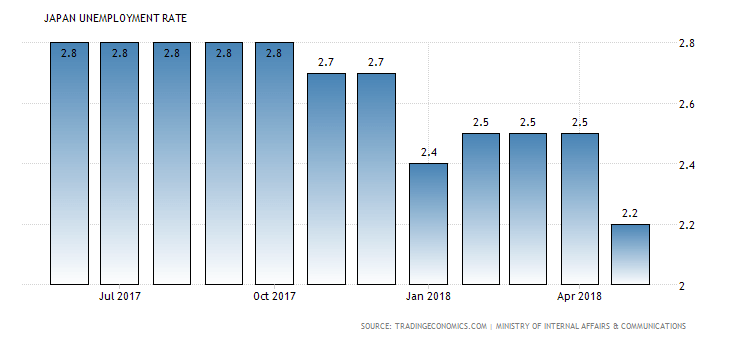

The Unemployment Rate is a measure of the percentage of unemployed in Japan. A high percentage indicates weakness in the labor market, which is considered negative for the Japanese Yen as most probably will lead to lower future economic growth measured by the GDP Growth Rate.

“The unemployment rate in Japan unexpectedly declined to 2.2 percent in May of 2018 from 2.5 percent in the previous month and below markets estimates of 2.5 percent. It is the lowest jobless rate since October 1992. Meanwhile, the jobs-to-applicants ratio edged up to 1.60 from 1.59 in April, slightly above expectations of 1.59 and reaching the highest figure since January 1974.”, Source: Trading Economics

We note that in 2018 the Unemployment Rate is lower compared to 2017, and the last figure of 2.2% is the lowest figure as of 1992.

Changes in industrial production are widely followed as a major indicator of strength in the manufacturing sector. A high reading is considered positive for the Japanese Yen reflecting increased economic activity for the industrial sector. The forecasts are for an unchanged Unemployment Rate at 2.2% and increases for the yearly and monthly Industrial Production.