The first trading session for July 2018 and the 3rd quarter of the year is starting today with important key economic data, the Swiss Retail Sales, the Manufacturing PMI for UK, Eurozone and Germany, the Unemployment Rate in the Eurozone, the US ISM Manufacturing PMI Index and ISM Manufacturing Employment Index, and the Monetary Base for Japan. Moderate to high volatility should be expected for the Euro and the US Dollar.

These are the main economic events in the forex market for today:

European Session

- Russia: Markit Manufacturing PMI, Spain: Markit Manufacturing PMI, Switzerland: Retail Sales YoY, SVME Manufacturing PMI, Italy: Markit/ADACI Manufacturing PMI, Germany: Markit Manufacturing PMI Final, Eurozone: Markit Manufacturing PMI Final, Unemployment Rate, Italy: Unemployment Rate, UK: Markit/CIPS Manufacturing PMI

Time: 06:00 GMT, 07:15 GMT, 07:45 GMT, 07:55 GMT, 08:00 GMT, 08:30 GMT, 09:00 GMT

The Purchasing Managers Index (PMI) Manufacturing released by Markit Economics measures business conditions in the manufacturing sector, being an important indicator of business conditions and the broader economic conditions, with readings above the 50.0 level reflecting expansion and improve business conditions, considered positive for the for the local currency. Higher than expected figures for the PMI Indexes and the economies of Russia, Spain, Switzerland, Italy, German, UK and the Eurozone are considered positive for the Euro, Russian Ruble, Swiss Franc and the British Pound.

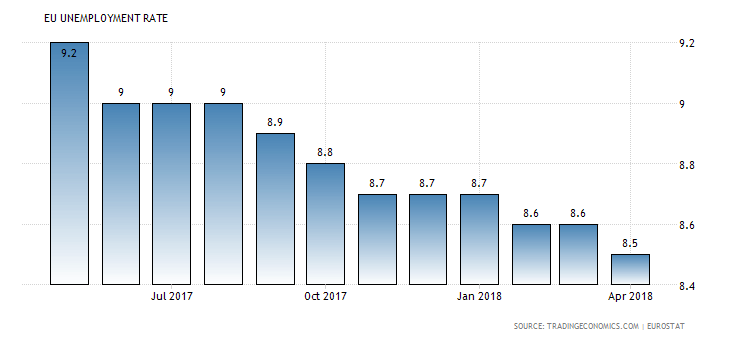

The forecasts are for higher readings of the PMI Indexes for Switzerland and Spain, unchanged for Italy, and lower for the UK, Germany and the Eurozone. The Euro is anticipating the release of the Unemployment Rate in the Eurozone, a leading indicator for the European Economy, with lower than expected readings considered positive for the Euro, reflecting a robust labor market, higher future consumer spending and economic growth measured by the GDP level. As shown in the below chart, the EU Unemployment Rate has been on a downward trend for the past 12-months, currently at the lowest level of the range between 9.2%-8.5%.

“The unemployment rate in the Euro Area decreased slightly to 8.5 percent in April 2018, following an upwardly revised 8.6 percent in March and compared with market expectations of 8.4 percent. It remains the lowest the lowest jobless rate since December 2008, well below 9.2 percent a year earlier.”, Source: Trading Economics.

The forecast is for an unchanged Unemployment Rate of 8.5%.

American Session

- US: Markit Manufacturing PMI Final, ISM Manufacturing Employment, ISM Manufacturing PMI, Construction Spending MoM

Time: 13:45 GMT, 14:00 GMT

As mentioned before higher than expected figures for the PMI Indexes are considered positive for the local currency, in this case the US Dollar, reflecting strong business conditions in the manufacturing sector, construction sector and in the employment conditions and labor market.

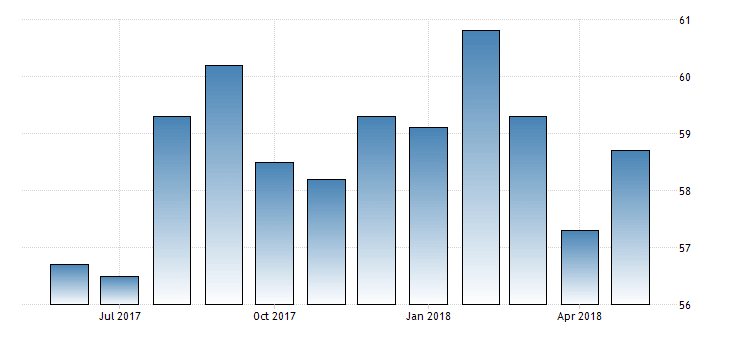

The below chart shows that the “The Institute for Supply Management’s Manufacturing PMI in the US rose to 58.7 in May 2018 from the previous month’s nine-month low of 57.3 and beating market expectations of 58.1. New orders, production and employment rose at stronger rates.”, Source: Trading Economics.

The forecast is for a lower ISM Manufacturing PMI figure of 58.0, lower than the previous figure of 58.7.

The forecast for the Markit Manufacturing PMI Final is for a lower reading, while a higher reading for the ISM Manufacturing Employment is expected and a lower reading for the monthly Construction Spending, with overall mixed US economic data expected.

Pacific Session

- New Zealand: NZIER Business Confidence

Time: 22:00 GMT

The NZIER Business shows the business outlook in New Zealand, providing important insights analysis on the economic situation in the short term, with higher readings considered supportive for the New Zealand Dollar. Increased Business Confidence can have a positive effect on business spending and in the employment conditions in New Zealand.

Asian Session

- Japan: Monetary Base YoY

Time: 23:50 GMT

The Monetary Base includes all the local currency in circulation, notes and coins as well as money held in bank accounts, considered as an important indicator of inflation, as monetary expansion is considered positive for the Japanese Yen, adding inflationary pressures in the broader economy. The forecast is for an increase of the yearly figure at 8.4%, higher than the previous figure of 8.1%.