The trading week in the forex market for July 16-20, 2018 has economic data for the US economy, with the releases of the retail trade, industrial production, building permits and housing starts. Elsewhere other important releases include Japan: inflation and foreign trade; UK: inflation, wages and unemployment and Australia: employment.

Trade wars can influence the forex market and the risk sentiment perception. For today high volatility is expected for the US Dollar with the release of the Retail Sales and the New Zealand Dollar with the release of the Consumer Price Index. For the Euro the announcement of the Trade Balance in the Eurozone may add volatility and price action versus other currencies. There are also an EU-China Summit and an US-Russia Summit with an important Trump-Putin meeting.

These are the key economic events which may move the forex market today:

European Session

- Eurozone: Trade Balance, Italy: Trade Balance

Time: 08:00 GMT, 09:00 GMT

The Trade Balance is the difference between exports and imports of goods and service for a specific country, with positive values indicating a trade surplus, capital inflows in the country and increased demand for goods and services denominated in the local currency. This should lead to the appreciation of the local currency, i.e. the Euro over time. The forecast is for an increase of the trade surplus for the Eurozone at 19.7B Euros, higher than the previous figure of 18.1B Euros.

American Session

- US: NY Empire State Manufacturing Index, Retail Sales MoM, Retail Sales Ex Autos MoM, Retail Sales Control Group, Business Inventories MoM, Canada: Existing Home Sales MoM

Time: 12:30 GMT, 13:00 GMT, 14:00 GMT

Changes in Retail Sales are widely followed as an important indicator of consumer spending, with higher than expected or increasing figures considered positive and supportive for the local economy, i.e. the US economy and the US Dollar, as consumer spending is one of the key factor that influence the level of economic growth.

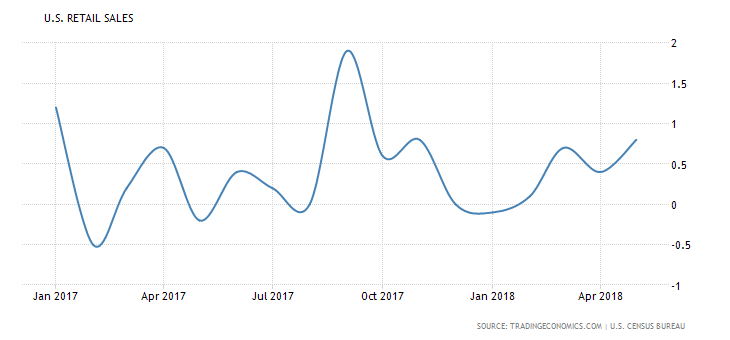

“US retail trade rose by 0.8 percent month-over-month in May 2018, following an upwardly revised 0.4 percent advance in April and easily beating market expectations of a 0.4 percent gain. It was the steepest increase in retail trade since November, mainly boosted by higher sales at gasoline stations and motor vehicle & parts dealers.”, Source: Trading Economics.

As seen from the above chart the US Retail Sales are highly volatile and in general are in an uptrend for 2018. The forecast is for a monthly figure of 0.6% lower than the previous figure of 0.8%. A decline is expected also for the Figures of Retail Sales Control Group representing the total industry sales, and the Retail Sales excluding Autos, which may influence negatively the US Dollar.

For Canada a higher than expected figure for the Existing Home Sales is considered positive for the Canadian Dollar, reflecting a robust housing market, increased consumer spending and optimism for the broader economic outlook. The forecast is for a monthly reading of 1.5%, higher than the previous reading of -0.1%.

Pacific Session

- New Zealand: Consumer Price Index 2Q (QoQ, YoY)

Time: 22:45 GMT

The CPI is a key indicator to measure inflation and changes in purchasing trends, with increased figures considered positive for the New Zealand Dollar, reflecting inflationary pressures in the broader economy, which probably will weigh on the decision of the central bank in New Zealand to change its monetary policy and raise the key interest level is these inflationary pressures are sustainable over time.

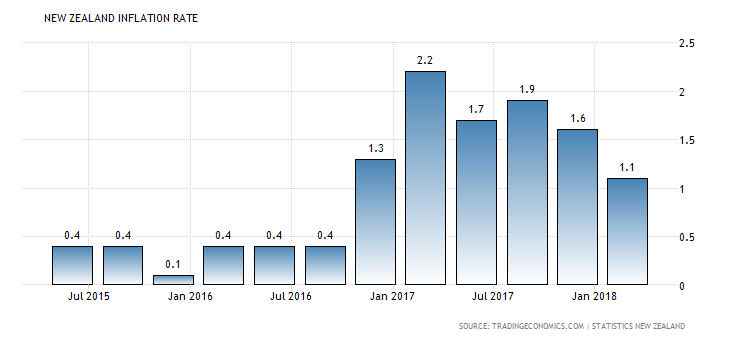

“Consumer prices in New Zealand increased 1.1 percent year-on-year in the first three months of 2018 following a 1.6 percent increase in the previous quarter, matching market expectations. It was the slowest inflation since the third quarter of 2016.”, Source: Trading Economics.

As seen from the above chart the CPI in New Zealand in 2018 is in a downtrend, showing a lack of inflationary pressures in the economy. The forecasts are for an unchanged quarterly figure of 0.5% for the second quarter, and an increase for the yearly figure at 1.6%, for the same second quarter, higher than the previous reading of 1.1%, which could influence positively the New Zealand Dollar upon their releases.