The last trading session for April 2018 today has plenty of important economic data, which can move the Euro, the US Dollar, the Swiss Franc and the Australian Dollar. Later during the week there are two important economic events related to the US Dollar, the Fed monetary policy announcement and US jobs data for the month of April, which can set a new trend for the UD Dollar, or continue its current trend, an appreciation against major other currencies.

These are the main economic events for today in the forex market to focus on:

European Session

- Germany: Retail Sales, Inflation Rate, Switzerland: KOF Leading Indicators, Italy: Inflation Rate

Time: 06:00 GMT, 07:00 GMT, 09:00 GMT, 12:00 GMT

Two very important economic events for the economy of Germany, the Retail Sales and the Inflation Rate have the potential to move the Euro, which has depreciated past week against the US Dollar. Higher than expected or rising figures for bot the Retail Sales and the Inflation Rate will be positive and supportive for the Euro, reflecting increased consumer spending, which can lead to higher economic growth, and inflationary pressures in the economy. The forecast is for a monthly increase for the Retail Sales in Germany with a figure of 0.8%, higher than the previous reading of -0.7% but for an increase of the yearly Retail Sales aa 1.0%, lower than the previous figure of 1.3%. This slowdown in the yearly figure needs to be monitored as lower Retail Sales if sustained will probably lead to lower economic growth.

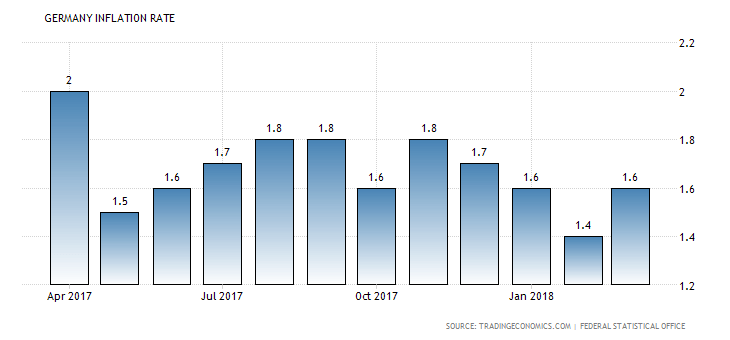

The Inflation Rate in Germany is expected to decline monthly with a figure of -0.1%, lower than the previous figure of 0.4%, and remain unchanged at 1.6% on a yearly basis.

As seen from the chart the Inflation Rate in Germany for the past 12-months has been in the range 1.4%-2.0%, showing little inflationary pressures for now, as it is in the low level of the 12-months range.

For Italy the same comments can be made, there are no severe inflationary pressures in the local economy, and the forecast is for a decline for the monthly Inflation at 0.2%, lower than the previous figure of 0.3%, and a decline for the yearly Inflation Rate at 0.7%, lower than the previous figure of 0.8%.

In general, there are no severe inflationary pressures in the Eurozone so far in 2018. The KOF Leading Indicators Index for Switzerland, which is used to predict the performance of the economy over the following six months is expected to decline at 105.5, lower than the previous figure of 106.0. Increased figures are considered positive for the Swiss economy and the Swiss Franc.

American Session

- US: PCE Price Index, Personal Income and Spending, Chicago PMI, Pending Homes Sales, Dallas Fed Manufacturing Index

Time: 12:30 GMT, 13:45 GMT, 14:00 GMT, 14:30 GMT

Higher than expected or rising figures for the US Personal Income, Personal Spending and Personal Consumption Expenditures (PCE) price Index will be positive for the US Dollar, indicating a robust consumer spending and increased prices paid by consumers for goods and services, a higher inflation trend.

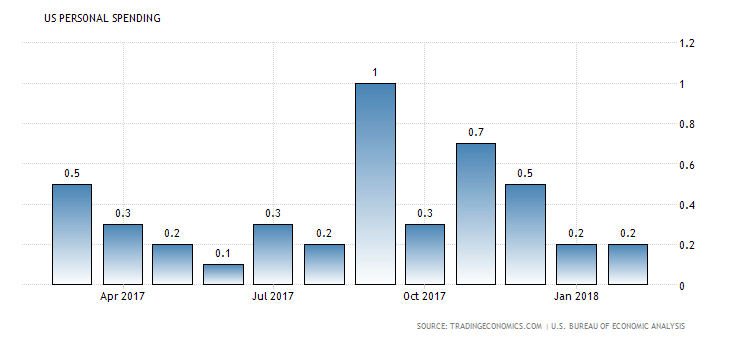

As seen for the chart the US Personal Spending has been volatile with a trend hard to define for the past 12-months. For 2018 there is no increase for the monthly figures so far and the forecast is for a reading of 0.3%, higher than the previous two-time consecutive reading of 0.2%. Personal Income is expected to remain unchanged with a monthly figure of 0.4%. Increased figures for Personal Income and Spending in the US are correlated with higher economic growth measured by the GDP level.

Also, higher readings for the Chicago PMI, Pending Homes Sales, and Dallas Fed Manufacturing Index are considered supportive and positive for the US Dollar, reflecting increased business conditions and expansion in Chicago and the Manufacturing Sector in Dallas, plus a robust housing market. The forecast is for a decline for all previous three mentioned economic data, which may weigh negatively on the US Dollar.

Pacific Session

- Australia: HIA New Home Sales, AIG Manufacturing Index

Time: 01:00 GMT, 23:30 GMT

Increased figures for both the New Home Sales and the AIG Manufacturing Index are considered positive for the Australian Dollar, indicating a robust housing market, a leading indicator of the overall economy, and expansion in the Manufacturing Sector. The forecast is for a decline for the AIG Manufacturing Index, with a figure of 59.8, lower than the previous figure of 63.1, which may influence negatively the Australian Dollar.