The weekly trading session from 5-9 March 2018 starts today with a focus on the Purchasing Managers’ Index (PMI) Indicator of various countries. The Purchasing Managers’ Index (PMI) is an indicator of financial activity reflecting purchasing managers’ acquisition of goods and services. There are also the Retail Sales in Eurozone and the Building Permits in Australia.

These are the main economic events for today:

European Session

- Spain Markit Services PMI, Italy Markit/ADACI Services PMI, Spain Consumer Confidence, UK Markit/CIPS Services PMI

Time: 08:15 GMT, 08:45 GMT, 09:00 GMT, 09:30 GMT

Higher than expected or rising figures for the PMI Indicator will be positive and supportive for the Euro and the British Pound, indicating increased financial activity. The forecasts are for declines in the PMI figures of Spain and Italy and an increase in the PMI Indicator figure for the UK. Also higher than expected or rising figures for Consumer Confidence in Spain will be positive for the local economy and the Euro. A survey passed onto consumers having them rate and ask their opinion regarding the future of economic conditions for the next 6 months. A leading indicator reflecting on consumer spending that could drive the future of the economy if the statistic is at optimistic values.

- Eurozone Retail Sales

Time: 10:00 GMT

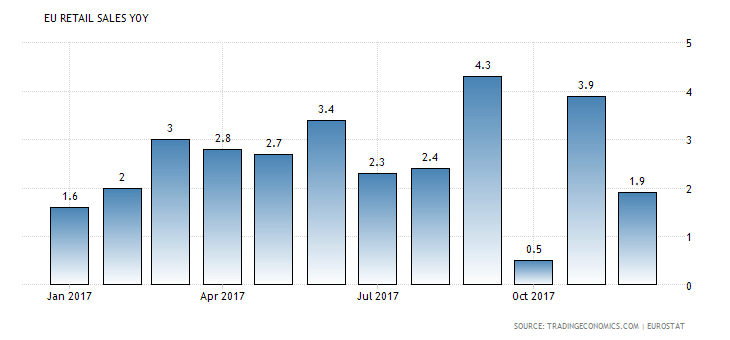

As seen from the chart the Retail Sales in the Euro Area increased 1.90 percent in December of 2017 over the same month in the previous year. The trend of the Retail Sales is a volatile one with increases and declines, so it is hard to define it.

Rising Retail Sales are positive for the Eurozone and the Euro, reflecting increased consumer spending which is correlated with higher economic growth measured by the GDP level. The forecast is for an increase of the Retail Sales in the Eurozone both on a yearly and monthly basis.

American Session

- US Markit Composite PMI Final, Markit Services PMI Final, ISM Non-Manufacturing Employment, ISM Non-Manufacturing PMI, Fed Quarles Speech

Time: 14:45 GMT, 15:00 GMT, 18:15 GMT

Higher than expected or rising figures for the PMI Indicator are positive for the US economy and the US Dollar signaling increased financial activity.

As seen from the chart the PMI Indicator in the US is above the 50.0 level which measures expansion, but there are both increases and declines in the readings, according to seasonality factors. The statistic shows the monthly trend of the Purchasing Managers’ Index (PMI) in the United States from December 2016 to December 2017. An indicator of the economic health of the manufacturing sector, the Purchasing Managers’ Index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. An index value above 50 percent indicates a positive development in the industrial sector, whereas a value below 50 percent indicates a negative situation. In December 2017, the value of the Purchasing Managers’ Index in the United States stood at 59.7.

The Composite PMI reading is expected to increase at 55.9, higher than the previous reading of 53.8, the Services PMI reading is also expected to increase at 55.9, higher than the previous level of 53.3, but the ISM Non-Manufacturing PMI is expected to decline at 58.9, less than the previous reading of 59.9. A mixed economic data for the US economy.

Pacific Session

- Australia Building Permits

Time: 00:30 GMT

Building Permits indicate the state of the housing sector and market, a leading indicator of the broader economy. A contraction in the housing sector may serve as an early indicator of an imminent broader economic slowdown. After a large decline in the previous month the expectation is for an increase for the Building Permits and a reading of 5.7%, higher than the previous reading of -20%, which should be positive for the Australian Dollar.