The key economic event for today is the monthly release of the US Non-farm Payrolls which can move the US Dollar amid worries about global trade, weak emerging markets and the NAFTA talks between the US and Canada which are still uncertain. The economic calendar today is very rich as there is also economic data related to the Eurozone, Japan, Canada, Germany, and Australia. Moderate to high volatility should be expected today in the forex market with the US Non-farm Payrolls and Unemployment Rate being a strong catalyst to set a trend for the US Dollar during September with the Fed monetary policy decision at the end of this month.

These are the key economic events for today in the forex market to focus on, time is GMT:

European Session

Switzerland: Unemployment Rate, Germany: Balance of Trade, Industrial Production MoM, France: Industrial Production MoM, Balance of Trade, Italy: Retail Sales (YoY, MoM), Eurozone: Eurogroup Meeting, GDP Growth Rate (YoY 3rd Est, QoQ 3rd Est), UK: Consumer Inflation Expectations

Time: 05:45, 06:00, 06:45, 08:00, 08:30, 09:00

Plenty of important economic data can move the Euro today, with the release of the German Trade Balance, French Trade Balance, the Retail Sales in Italy and mainly the GDP Growth Rate in the Eurozone. The Trade Balance between exports and imports of total goods and services. A positive value shows a trade surplus, while a negative value shows a trade deficit. For Germany and France, a trade surplus is positive for the Euro, reflecting capital inflows in these countries and increased demand for goods and services denominated in Euros, which over time this demand may lead to the appreciation of the Euro versus other currencies. The forecast is for a narrower trade deficit for France to -5.7B Euros from -6.2B Euros.

Other economic indicators which are positive and supportive for the Euro are higher than expected figures for the Retail Sales in Italy, the Industrial Production in Germany and France and the GDP Growth in the Eurozone. The Industrial Production measures volume of production of industries such as factories and manufacturing. An increase is regarded as inflationary which may lead to a rise in interest rates, and changes in industrial production are a major indicator of strength in the manufacturing sector. The Retail Sales in Italy is an economic indicator about the performance of the retail sector in the short term, with changes considered also an indicator of consumer spending, a key driver to economic growth. The forecasts are for an increase for the German monthly Industrial Production to 0.2% from -0.9%, a decrease for the French monthly Industrial Production to 0.2% from 0.6% and an increase for the Italian monthly Retail Sales to 0.2% from -0.2%.

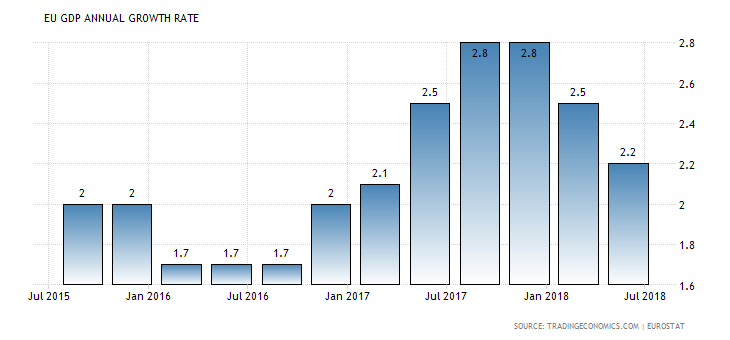

The key economic event for the Euro is probably the release of the GDP Growth Rate in the Eurozone, with higher than expected figures considered to be positive for the Euro, as GDP is considered as a broad measure of the Eurozone economic activity and health. Higher readings reflect economic expansion and a robust economy.

“The Euro Area economy grew 2.2 percent year-on-year in the second quarter of 2018, above a preliminary reading of 2.1 percent and following a 2.5 percent expansion in the previous period, the second estimate showed.”, Source: Trading Economics.

The forecasts for the Eurozone are for a decrease of the yearly GDP Growth Rate (3rd estimate) to 2.2% from 2.5% and an unchanged reading of quarterly GDP Growth Rate (3rd estimate) of 0.4%. These readings will reflect a slower economic expansion for the Eurozone compared to the first half of 2018 which may weigh on its value versus other currencies. Any economic surprise either positive of negative may add increased volatility for the Euro.

For the Swiss Franc and the British Pound lower than expected readings for the Unemployment Rate in Switzerland and higher than expected readings for the Consumer Inflation Expectations in UK are positive, reflecting an expansion in the labor market and expectations for increased inflationary pressures in the economy which may lead to further interest rate hikes by the Bank of England. An unchanged Swiss Unemployment Rate of 2.4% is expected which can be taken as neutral for the Swiss Franc.

American Session

Canada: Employment Change, Participation Rate, Unemployment Rate, Ivey PMI, US: Fed Rosengren Speech, Non-farm Payrolls, Unemployment Rate, Average Hourly Earnings MoM, Fed Mester Speech

Time: 12:30, 13:00, 14:00

A plethora of very important macroeconomic data will be released today simultaneously for the economies of Canada and US adding most probably increased volatility for the USD/CAD currency pair and for other currencies versus the Canadian and US Dollar. For Canada higher than expected readings for the Employment Change, Participation Rate and Ivey PMI and lower than expected for the Unemployment Rate are considered positive for the Canadian Dollar reflecting a strong labor market with positive implications for consumer spending stimulating economic growth and strong business conditions. The forecasts are for a decrease for the Employment Change to 5K from 54.1K, an unchanged Participation Rate of 65.4%, an increase for the Unemployment Rate to 5.9% from 5.8% and a small decrease for the Ivey PMI to 61.4 from 61.8.

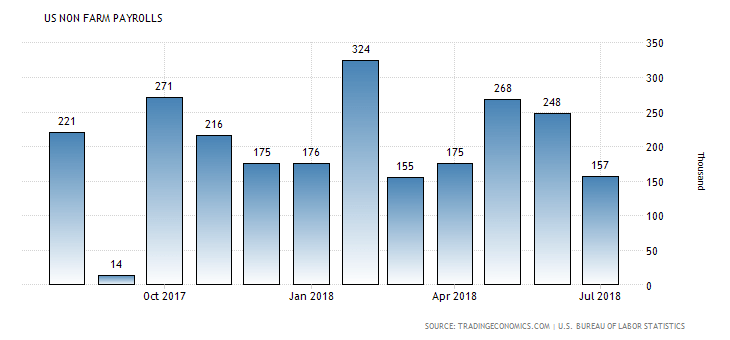

For the US economy the monthly announcement of the Non-farm Payrolls can be as mentioned before a catalyst for the trend of US Dollar during this month.

“Non-farm payrolls in the United States increased by 157 thousand in July of 2018, following an upwardly revised 248 thousand in June and below market expectations of 190 thousand. Job gains occurred in professional and business services, in manufacturing, and in health care and social assistance.”, Source: Trading Economics.

The US Non-farm Payrolls are highly volatile and any beat or miss of the expectations can add increased volatility for the US Dollar. For the US Dollar higher than expected readings for the Non-farm Payrolls and Average Hourly Earnings and lower than expected readings for the Unemployment Rate are considered positive, indicating a strong labor market and a growing economy which sees its Unemployment Rate decreasing.

The figures of the Unemployment Rate and Non-farm Payrolls will be monitored by the forex market participants as they could predict an almost certain interest rate hike by the Fed later during September. An increase for the Non-farm Payrolls to 191K from 157K, a decrease for the Unemployment Rate to 3.8% from 3.9% and a decrease for the monthly Average Earnings to 0.2% from 0.3% are expected.

Pacific Session

Australia: Home Loans MoM, Investing Lending for Homes

Time: 01:30

For the economy of Australia higher than expected readings for the Home Loans and the Investment Lending for Homes are positive for the Australian Dollar reflecting the current housing market trend and the level of consumer confidence with high readings anticipating growth in the Australian economy.

Asian Session

Japan: Coincident Index, Leading Economic Index

Time: 05:00

The Leading Economic Index is an economic indicator that consists of 12 indexes such as machinery orders, stock prices and other leading economic indicators, showing the performance of the Japanese Economy over the short and mid-term, while the Coincident Index measures the current economic conditions in the Japanese economy. An increase in the index indicates an expansion of economic activity. Higher values for both Indexes are positive for the Japanese Yen. Some mixed economic data is expected with an increase for the Coincident Index to 116.9 from 116.4 and a decrease for the Leading Economic Index to 103.5 from 104.7.