Important fundamental data is expected to be released today for the economies of Canada, US, Eurozone, Germany and Japan, with moderate to high volatility expected mainly for the Canadian Dollar with the announcement of the Inflation Rate and the Retail Sales in Canada.

These are the key economic events in the forex market today to focus on, time is GMT:

European Session

France: GDP Growth Rate QoQ Final, Markit Manufacturing PMI Flash, Markit Services PMI Flash, Germany: Markit Manufacturing PMI Flash, Markit Services PMI Flash, Eurozone: Markit Manufacturing PMI Flash, Markit Services PMI Flash, Spain: Balance of Trade, UK: BoE Quarterly Bulletin

Time: 06:45, 07:15, 07:30, 08:00, 11:00

A plethora of economic data related to the economies of France, Spain, Germany and the Eurozone are to released today which may affect the Euro. The Manufacturing Purchasing Managers Index (PMI), and Markit Services PMI released by the Markit economics measure the business conditions in the manufacturing sector and services sector. For the economy of Germany, the manufacturing sector dominates a large part of total GDP, and the manufacturing PMI is an important indicator of business conditions and the overall economic condition in Germany. Normally, a result above 50 for the Markit readings signals expansion for the sector, and higher than expected figures are positive for the Euro, indicating strong business conditions.

“The IHS Markit/BME Germany Manufacturing PMI was revised lower to 55.9 in August of 2018 from a preliminary reading of 56.1 and below 56.9 in July. New export orders rose the least in over two years which partly reflected the slowdown in export sales growth to the weakest since May of 2016. On the other hand, production growth remained robust and employment rose the most in four months.

On the price front, input price inflation slowed to the weakest since April but remained sharp overall. Steel and oil were some of the main drivers of the increase in costs and there were also reports of pressure in supply chains leading to higher input prices. The rate in output charge inflation was the highest in three months. Finally, business confidence softened from July and was among the lowest in three years amid geopolitical concerns, namely the imposition of tariffs. Manufacturing PMI in Germany is reported by Markit Economics.”, Source: Trading Economics.

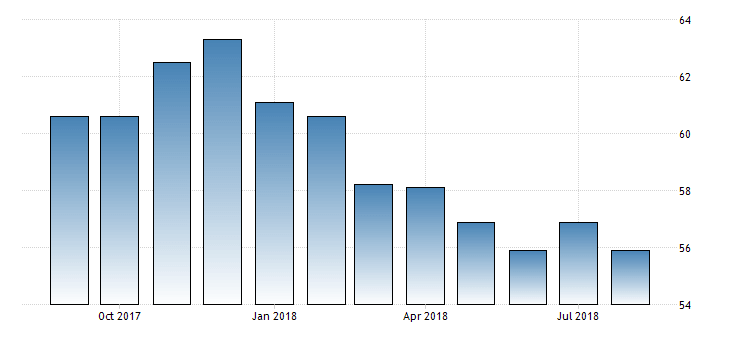

From the above chart we see a downtrend for the IHS Markit/BME Germany Manufacturing PMI as of January 2018, and the Index is near its lowest level for the past 12-months indicating weakness in the manufacturing sector in Germany, the largest economy in the Eurozone. A decrease to 55.7 from 55.9 is expected for the Markit Manufacturing PMI Flash in Germany.

Some mixed economic data is expected for the Markit readings and the business conditions in other European countries and in the Eurozone. The Markit Manufacturing PMI Flash for France is expected to decrease to 53.5 from 53.5, the Markit Manufacturing PMI Flash for the eurozone is expected to decrease to 54.4 from 54.6, while the Markit Services PMI Flash figures for France, Germany and the Eurozone are expected to be 55.2, 55.0, 54.4 respectively compared to 55.4, 55.0 and 54.4 accordingly. Except for the French economy the services sector in the Eurozone is expected to show steady business conditions.

Another market-moving factor for the Euro will be the release of the Balance of Trade for Spain. In general, a trade surplus is positive for the Euro, indicating capital inflows in Spain, and higher exports than imports. However, the latest reading for the Balance of Trade in Spain was a trade deficit of -2.45B Euros.

For the British Pound the Quarterly Bulletin, released by Bank of England, provides regular commentary on market developments and information on a wide range of topical economic and financial issues, both domestic and international. The British Pound lately exhibits increased volatility and price action both due to economic reports and latest Brexit developments and news.

American Session

Canada: Inflation Rate (YoY, Mom), Core Inflation Rate YoY, Retail Sales MoM, US: Markit Composite PMI Flash, Markit Manufacturing PMI Flash, Markit Services PMI Flash

Time: 12:30, 13:45

Higher than expected readings for the Inflation Rate and the Retail Sales in Canada are considered positive for the Canadian Dollar, indicating inflationary pressures in the economy and a high level of consumer confidence showing the performance of the retail sector in the short term. Increased consumer spending is a key driver for higher economic growth, while a high reading for the Inflation Rate may weigh on the BoC to increase further its key interest rate. The Bank of Canada aims at an inflation range (1%-3%). A decrease to 2.8% from 3% is expected for the yearly Inflation Rate in Canada, a decrease to -0.1% from 0.5% for the monthly Inflation Rate figure and mostly a decrease for the yearly Core Inflation Rate to 1.4% from 1.6%. The Core Inflation Rate is a more conservative measure of the real inflationary pressures in the broader economy excluding the volatile prices of several goods and services such as fruits, vegetables, gasoline, fuel oil, natural gas, and tobacco products.

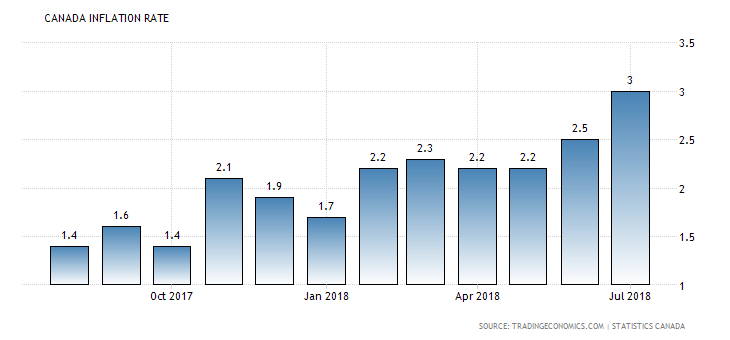

“The inflation rate in Canada increased to 3 percent in July of 2018 from 2.5 percent in June, above market expectations of 2.5 percent. It is the highest inflation rate since September of 2011, boosted by rising prices for gasoline, fuel, air transportation and travel tours.”, Source: Trading Economics.

From the above chart a clear uptrend for the Inflation Rate in Canada in 2018 is evident, with a recent jump in July of 2018.

The monthly Retail Sales in Canada are expected to increase to 0.4% from -0.2%. Overall some mixed economic data is expected for the economy of Canada with a decrease in the Inflation Rate and an increase in the Retail Sales.

The Markit readings show the business conditions for the services, manufacturing and composite sectors with a level above 50.0 signaling an increase and expansion in business conditions, considered positive for the US Dollar. All three US Markit figures are expected to increase, which should influence positive the US Dollar. Any economic surprises either positive or negative may add further volatility to the US Dollar versus other currencies.

Asian Session

Japan: Nikkei Manufacturing PMI Flash

Time: 00:30

The Nikkei Manufacturing PMI provides important information about the health of manufacturing sector in Japan, being a significant indicator of business conditions in Japan. A result above 50 signals expansion and strong business conditions and is positive for the Japanese Yen. An increase to 53.1 from 52.5 is expected.