The last trading session for the week April 30- May 4 has economic events mainly related to the US economy, with the anticipated Non-farm payrolls and the Unemployment Rate being the main economic events for today. These is also economic data such as the Retail Sales in the Eurozone and the Ivey PMI Business Confidence in Canada, which have the potential to move the Euro and the Canadian Dollar, but moderate to high volatility and price action is mainly expected for the US Dollar. The latest economic data for the US labor market is important to monitor closely for the continuation or not of the recent US Dollar appreciation versus other currencies.

Key economic events in the forex market for today to focus on:

European Session

- France: Balance of Trade, Spain: Unemployment Change, Markit Services PMI, Italy: Markit/ADACI Services PMI, Eurozone: Retail Sales, Germany: Bundesbank Weidmann Speech, Russia: Inflation Rate

Time: 06:45 GMT, 07:00 GMT, 07:15 GMT, 07:45 GMT, 09:00 GMT, 13:00 GMT

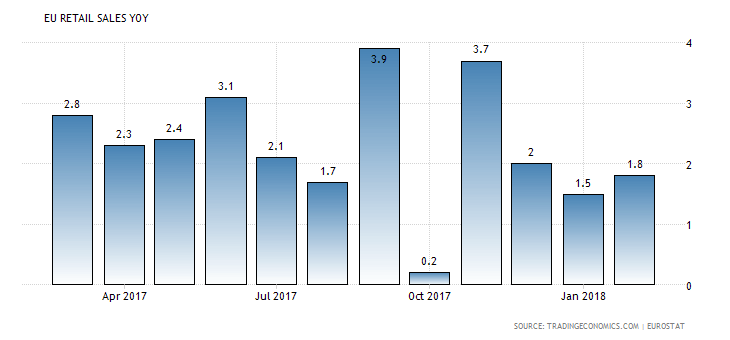

The Euro Area Retail Sales which signal the level of consumption and consumer confidence are expected to increase both on a yearly and monthly basis, which is a positive fundamental factor for the Euro. Higher Retail Sales indicate increased consumer spending and higher future economic growth and probably inflationary pressures in the economy as well. The trend for the past 12-months for the Retail Sales in the Euro Area is hard to define, with significant increased and declines.

Supportive economic data for the Euro will also be a lower value for the Unemployment Change in Spain, reflecting a strong labor market, a higher than expected value for the Services PMI Index in Italy and a narrower than expected trade deficit for the Balance of Trade in France. The forecast is indeed for all the mentioned economic data projections to occur, which should provide support for the Euro, which has been weakening against other currencies lately.

American Session

- Canada: Ivey PMI, US: Non-farm Payrolls, Unemployment Rate, Average Hourly Earnings, Fed Dudley Speech, Fed Williams Speech, Fed Quarles Speech

Time: 12:30 GMT, 14:00 GMT, 16:00 GMT, 19:00 GMT, 21:30 GMT

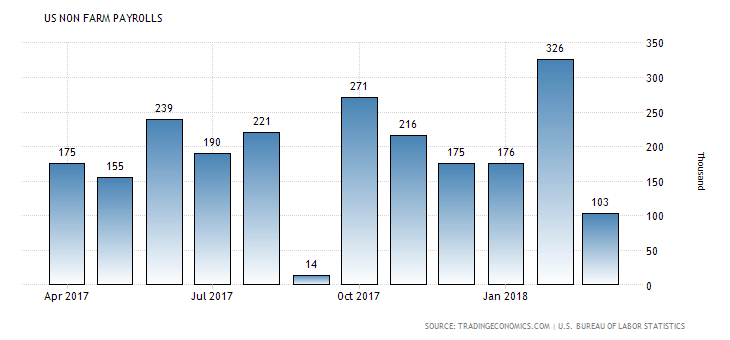

The main economic event for today in the forex market is the release of the US Non-farm payrolls and the Unemployment Rate. “Non farm payrolls in the United States increased by 103 thousand in March of 2018, following an upwardly revised 326 thousand in February. It is the lowest reading since September and well below market expectations of 193 thousand.”, Source: trading Economics.

The forex market will monitor closely the US Non-farm payrolls, as any economic surprise negative or positive has the potential to move significantly the US Dollar.

Again, we notice an undefined trend, due to the seasonality that occurs in various months in the labor market. A strong reading should be supportive for the US Dollar, with the forecast being a figure of 195K, higher than the previous figure of 103K. Still the US Unemployment Rate is expected to remain unchanged at 4.1%, a level at which seems hard to fall below at current economic conditions. The US Average Hourly Earnings are expected to decline monthly at 0.2%, lower than the previous figure of 0.3%. Increased figures for the Average Hourly Earnings are positive for the US Dollar, as they contribute positively to future consumer spending power and to higher economic growth.

The Ivey PMI in Canada, which measures the activity level of purchasing managers in Canada and business confidence is expected to increase marginally, having a figure of 59.9, higher than the previous figure of 59.8. Readings above the 50.0 level indicate expansion and increased business confidence, being supportive and positive for the Canadian Dollar.

Pacific Session

- RBA Monetary Policy Statement

Time: 01:30 GMT

The Reserve Bank of Australia Monetary Policy Statement will provide important insights on current economic conditions, employment, inflation, housing market, interest rates, and though it may not move the Australian Dollar, it should be monitored for any updates in the broader economy.