A G7 meeting in Canada on June 8-9, 2018 where finance ministers from the group of seven industrialized nations such as United States, Japan, Germany, France, United Kingdom, Italy and Canada will discuss economic policy with special mention on tariffs and potential trade wars is among the key economic events for today.

Other important economic data to place attention to is the Unemployment Rate and Change in Employment in Canada, the Industrial Production and Trade of Balance in Germany, and the Eco Watchers Survey for Japan. Overall moderate to high volatility is expected today in the forex market, mainly for the Canadian Dollar and the Euro.

These are the main economic events which can move the forex market today:

European Session

- Germany: Industrial Production MoM, Balance of Trade, France: Industrial Production MoM, Eurozone: ECB Mersch Speech

Time: 06:00 GMT, 06:45 GMT, 07:15 GMT

The Industrial Production released measures the output of the German factories and mines, with industrial production considered as a major indicator of strength in the manufacturing sector. Higher than expected or rising figures are considered positive and supportive for the Euro, indicating a strong industrial sector in Germany. The forecast is for a decline of the monthly German Industrial Production with a figure of 0.3% expected, lower than the previous figure of 1%.

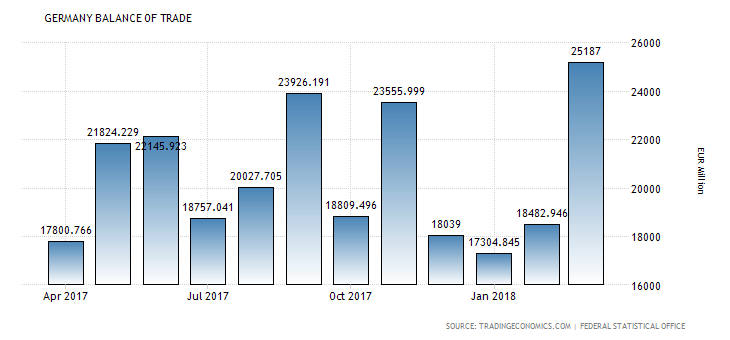

“The German trade surplus came in at EUR 25.2 billion in March of 2018, little-changed from the previous year’s EUR 25.1 billion, as exports fell 1.8 percent to EUR 116.1 billion and imports declined at a faster 2.3 percent to EUR 90.9 billion.”, Source: Trading Economics.

The German trade surplus has been rising for 2 consecutive months. Any economic surprise positive or negative may add additional volatility for the Euro. High or rising figures for the trade surplus are considered supportive and positive for the Euro, reflecting capital inflows in Germany and increased demand for goods and services denominated in Euros.

In contrast with Germany, the monthly Industrial production in France is expected to increase at 0.3%, higher than the previous figure of -0.4%. Overall some mixed data is expected for the Euro. There is also the ECB Mersch Speech, which can move the Euro with any statements on the ECB plans to later its asset purchasing program or QE later in June.

American Session

- Canada: Housing Starts, Unemployment Rate, Employment Change

Time: 12:30 GMT

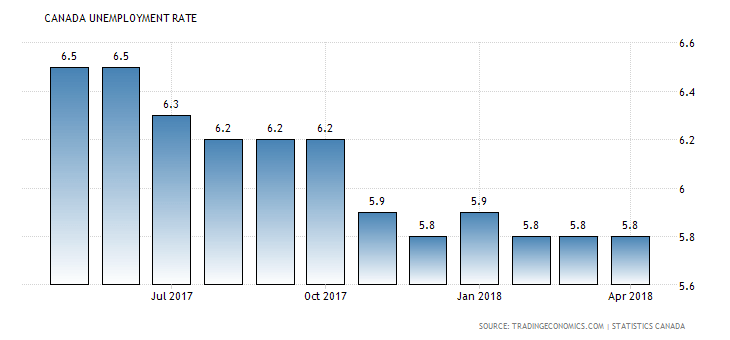

The Housing Starts measures the strength of the Canadian housing market, with higher than expected figures considered positive for the Canadian Dollar, reflecting a robust housing market having a high correlation with the state of the broader economy. The forecast is for an increase with a figure of 218K expected, higher than the previous figure of 214K. The important economic release of the Unemployment Rate and Employment Change can also move the Canadian Dollar. Lower than expected figures for the Unemployment Rate and higher than expected for the Employment Change are considered positive for the Canadian Dollar, indicating a strong labor market, with positive implications for consumer spending and stimulating the economic growth.

As seen from the below chart the Unemployment Rate in Canada has been steadily declining as of summer of 2017 and the high value of 6.5%, reaching the low value of 5.8% for the past three consecutive months. The forecast is for an unchanged Unemployment Rate of 5.8%, but a large increase in the Employment Change is expected with a figure of 17.5K, higher than the previous figure of -1.1K.

Asian Session

- Japan: Eco Watchers Survey (Current and Outlook)

Time: 05:00 GMT

The Eco Watchers Survey monitors regional short-term economic trends. Higher than expected or rising figures are considered positive for the Japanese Yen. The forecast is for an unchanged reading of 50.1 for Eco Watchers Survey Outlook, and an increase for the Eco Watchers Survey Current at 49.4, higher than the previous reading of 49.0.