Today the last trading session in the forex market for June 2018 the economic calendar is full of important economic events, with the potential to add increased volatility and price action. Some of the key events for today are the Consumer Confidence in Japan, the Unemployment Rate in Germany, the GDP Growth Rate for UK, the Inflation Rate in the Eurozone, the Personal Income and Spending for the US economy. Moderate to high volatility is expected for the Euro, the British Pound, Japanese Yen and the US Dollar.

These are they key economic events to focus on today:

European Session

- Germany: Retail Sales (YoY, MoM), Unemployment Rate Harmonised, Unemployment Rate, Unemployment Change, France: Inflation Rate YoY Prel, Switzerland: KOF Leading Indicators, Eurozone: Euro Summit, Inflation Rate YoY Flash, Core Inflation Rate YoY Flash, UK: Current Account, GDP Growth Rate (YoY Final, QoQ Final), BoE Consumer Credit, BoE Mortgage Approvals, Business Investment (YoY Final, QoQ Final), Mortgage Lending

Time: 06:00 GMT, 06:45 GMT, 07:00 GMT, 07:55 GMT, 08:00 GMT, 08:30 GMT, 09:00 GMT

The German Retail Sales and Unemployment Rate early in the European Session and later the release of the Inflation Rate in the Eurozone will most probably move the Euro, as higher than expected figures for the German Retail Sales and the Inflation Rate in the Eurozone and lower than expected figures for the German Unemployment Rate are considered positive for the Euro.

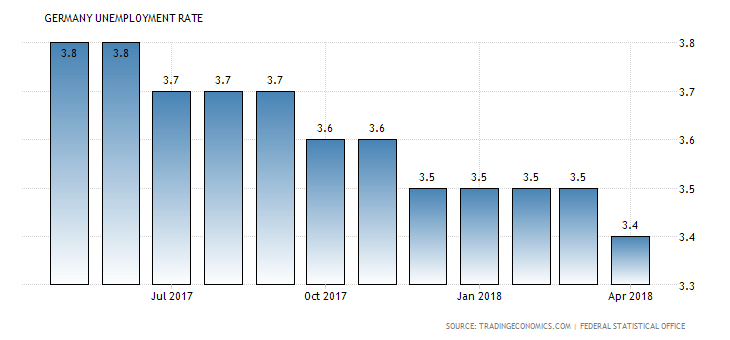

As seen from the chart “Germany’s seasonally adjusted harmonised unemployment rate fell to 3.4 percent in April 2018 from an upwardly revised 3.5 percent in the previous month. It was the lowest jobless rate since July 1980, as the number of unemployed declined further while employment was unchanged.”, Source: Trading Economics.

The German Unemployment Rate for the past 12 months has been steadily trending lower. The forecasts are for an unchanged German Unemployment Rate at 5.2%, a decline for the monthly German Retail Sales but an increase for the yearly German Retail Sales, an increase for the yearly Inflation Rate in the Eurozone at 2.0%, higher than the previous rate of 1.9%, and a decline for the yearly Core Inflation Rate in the Eurozone at 1.0%, lower than the previous rate of 1.1%. The Unemployment Change in Germany is expected to decline at -8K, lower than the previous reading of -11K, a positive effect for the consumer spending and economic growth for Germany.

The KOF Leading indicators measure the future trends of the overall economic activity in Switzerland with higher than expected readings considered positive for the Swiss Franc. The forecast is for an increase of the figure at 101.0, higher than the previous reading of 100.0.

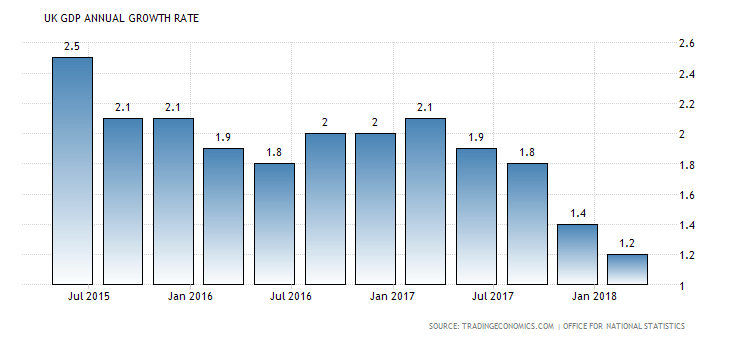

For UK the release of the GDP Growth Rate is important any may define the trend for the British Pound versus other currencies. The GDP is considered as a broad measure of the UK economic activity, and higher than expected figures are considered positive for the British Pound. As seen from the chart “The British economy advanced 1.2 percent year-on-year in the first three months of 2018, slowing from a 1.4 percent rise in the previous quarter and matching the preliminary estimate. It is the lowest annual growth rate since the second quarter of 2012 amid a slowdown in household spending, business investment and exports, the second estimate showed.”, Source: Trading Economics.

As of January 2017, the UK Annual GDP Growth Rate has been in a downtrend. The forecasts are for a decline for both the quarterly and yearly GDP Growth Rate in UK, with expected figures of 0.1% and 1.2% accordingly, lower than the previous figures of 0.4% and 1.4% respectively. Increased readings for the Mortgage Approvals and Business Investment are also considered positive for the British Pound, reflecting a robust housing market, higher capital expenditure with positive effects on growth of the UK economy. The forecasts are for lower readings for the Mortgage Approvals and the Business Investment, a negative fundamental factor.

American Session

- US: PCE Price Index (YoY, MoM), Personal Income MoM, Personal Spending MoM, Chicago PMI, Michigan Consumer Sentiment Fina

Time: 12:30 GMT, 13:45 GMT, 14:00 GMT

The Core Personal Consumption Expenditure figure is a significant indicator of inflation, the Chicago PMI reflects the business conditions and trends in Chicago, while Personal Income and Spending are indicative of consumer spending which can stimulate the economic growth. Higher readings for all these economic indicators and the Michigan Consumer Sentiment Index are considered positive for the US Dollar. The forecasts are for some mixed economic data overall.

Pacific Session

- Australia: HIA New Home Sales MoM

Time: 01:00 GMT

New Home Sales are an indicator of the housing market conditions, with higher than expected readings considered positive for the Australian Dollar stimulating the demand for goods and services, and the economic growth.

Asian Session

- Japan: Consumer Confidence, Housing Starts YoY

Time: 05:00 GMT

A high level of consumer confidence can stimulate economic expansion, while high figures of Housing Starts show strength in the Japanese housing market, which is considered an important indicator of the economy. The forecasts are for a decline for the Housing Starts and a marginal increase for the Consumer Confidence Index.