After two central banks monetary policy decisions this week, one from the Fed and one from the ECB yesterday, today there are two more monetary policy decisions from the Bank of Japan, and the Bank of Russia. There is important economic data related to the economy of Eurozone with the release of the Inflation Rate and the Balance of Trade, and the US Economy with the release of the Industrial Production and the Michigan Consumer Sentiment Index. Moderate to high volatility is expected in the forex market, mainly for the Japanese Yen, the Euro and the US Dollar.

These are the key economic events for today in the forex market to focus on:

European Session

- Germany: Bundesbank Semi-Annual Forecasts, Eurozone: Inflation Rate (MoM, YoY Final), Core Inflation Rate YoY Final, Balance of Trade, ECB Coeure Speech, Russia: Interest Rate Decision, Monetary Policy Report.

Time: 06:30 GMT, 09:00 GMT, 09:45 GMT, 10:30 GMT, 12:00 GMT

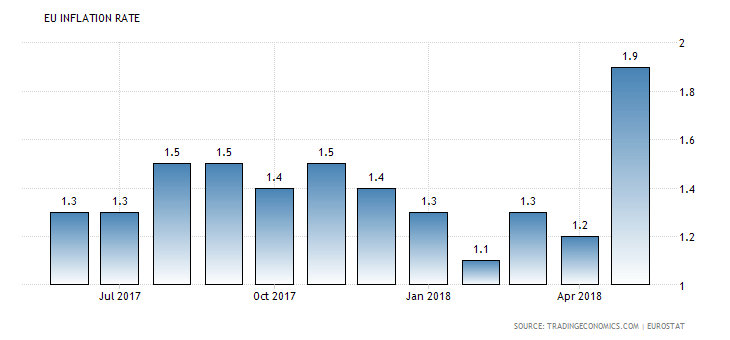

The Euro after the ECB monetary policy decision yesterday may witness additional volatility today with the anticipated release of the Inflation Rate readings.

“Annual inflation rate in the Euro Area is expected to rise to 1.9 percent in May of 2018 from 1.2 percent in April and market expectations of 1.6 percent. It is the highest rate since April of 2017, mainly boosted by rising oil prices, preliminary estimates showed.”, Source: Trading Economics.

Higher than expected readings for the Inflation Rate are considered positive for the Euro increasing the odds of a tighter monetary and a future interest rate hike by the ECB. The monthly Inflation Rate is expected to increase at the rate of 0.5%, higher than the previous rate of 0.3%, and the yearly Core Inflation Rate, a more conservative way of measuring the Inflation Rate which excludes the prices of food and energy is expected to increase at the rate of 1.1%, higher than the previous rate of 0.7%.

The Balance of Trade in the Eurozone, a balance between exports and imports of total goods and services, is expected to show a narrower trade surplus of 14.2B Euros, lower than the previous figure of 26.9B Euros. In general, a trade surplus is considered positive reflecting increased demand for goods and services denominated in Euros, and capital inflows in the Eurozone. A speech by the ECB Coeure official may influence the Euro in the event of any updated information on current economic conditions in the Eurozone, although most of these statements will probably have already been made public after the recent ECB Press Conference.

The first monetary policy decision today will be from the Bank of Russia with the forecast of leaving unchanged the key intertest rate at 7.25%. A Monetary Policy Report will follow and can influence the Russian Ruble both in the event of any economic surprise and if any hawkish or dovish language is used by the central bank about the economic conditions and projections for Russia.

American Session

- US: Industrial Production (YoY, MoM), NY Empire State Manufacturing Index, Michigan Consumer Sentiment Preliminary, Michigan Consumer Expectations Preliminary, Michigan 5 Year Inflation Expectations Preliminary, Michigan Inflation Expectations Preliminary, Michigan Current Conditions Preliminary, Net Long-Term Tic Flows, Foreign Bond Investment, Overall Net Capital Flows

Time: 12:30 GMT, 13:15 GMT, 14:00 GMT, 20:00 GMT

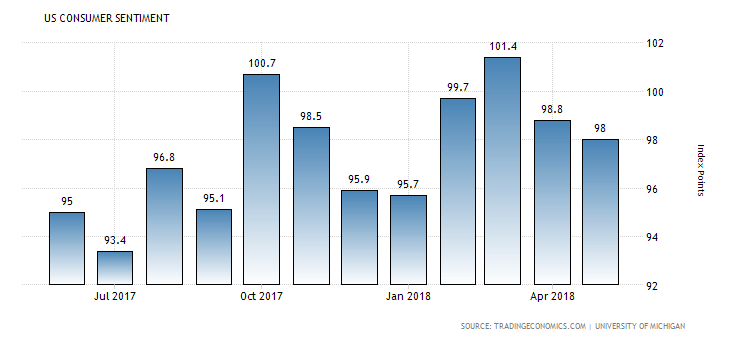

Important economic data about the US economy is expected today. The Michigan Consumer Sentiment Index is a survey of personal consumer confidence in economic activity. It provides information about optimism in the economy and future consumer spending, with increased readings considered positive for the US Dollar, as they should lead to higher economic growth. The forecast is for an increase of the Michigan Consumer Sentiment Index having a reading of 98.5, higher than the previous reading of 98.0.

The Michigan Consumer Sentiment Index as of January 2018 is in an uptrend. Higher readings for the Industrial Production and all the Michigan related figures are considered supportive and positive for the US Dollar, reflecting a strong Industrial Sector, optimism for the economy, and higher Inflation Rate expected. The total Net TIC Flows show information about inflows and outflows of financial resources in the United States. High positive readings are considered positive for the US Dollar, reflecting inflows in the country, which can offset the current trade deficit. The forecast is for a decline of the Net Long-Term Tic Flows with a figure of 58.5B US Dollars expected, lower than the previous reading of 61.8B US Dollars.

Pacific Session

- Australia: RBA Ellis Speech

Time: 03:30 GMT

Any speech by senior central bank officials is important to monitor for statements that can influence the local currency based on economic conditions and projections.

Asian Session

- Japan: BoJ Interest Rate Decision

Time: 03:00 GMT

Generally, if the BoJ is hawkish about the inflationary outlook of the economy and rises the interest rates it is considered positive for the Japanese Yen. The forecast is for an unchanged key interest rate at -0.1%. Any economic surprise most probably will add further volatility for the Japanese Yen.