The US Non-farm Payrolls, US and Canadian Trade Balance and the economic data about the labor market in US and Canada are the dominant key economic news today, with high volatility expected for the USD/CAD currency pair, the US Dollar and the Canadian Dollar. There is also the release of the German Industrial Production and some Economic Indexes for Japan.

These are the key economic events in the forex market for today to focus on:

European Session

- Germany: Industrial production MoM, France: Balance of Trade, Italy: Retail Sales MoM, Eurozone: ECB Nouy Speech, Russia: Inflation Rate YoY, Foreign Exchange Reserves

Time: 06:00 GMT, 06:45 GMT, 08:00 GMT, 11:00 GMT, 13:00 GMT

The Industrial Production in Germany is a major indicator of strength in the manufacturing sector. High readings are considered positive for the Euro. Positive and supportive data for the Euro are also considered a Trade Surplus for the economy of France and higher Retail Sales in Italy. A trade surplus indicates increased demand for goods and services denominated in Euros, which could lead to the natural appreciation of Euro versus other currencies. The Retail Sales show the performance of the retail sector in the short term, an indicator of consumer spending. Consumer spending is correlated positively with higher economic growth measured by the GDP level. The forecasts are for a higher monthly German Industrial Production at 0.3%, higher than the previous figure of -1.0%, a wider trade deficit for France and higher monthly Retail Sales in Italy, a figure of 0.3% is expected, higher than the previous reading of -0.7%.

For the economy of Russia, a higher than expected Inflation Rate is expected positive for the Russian Ruble, indicating inflationary pressures in the economy with increased probabilities of future interest rate hikes by the central bank of Russia, while the Foreign Exchange Reserves act as a stabilization monetary tool for the currency fluctuation. The forecast is for a lower yearly Inflation Rate of 2.2%, compared to the previous rate of 2.4%.

American Session

- US: Average Hourly Earnings (YoY, MoM), Nonfarm Payrolls, Unemployment Rate, Trade Balance, Canada: Balance of Trade, Unemployment Rate, Net Change in Employment, Ivey Purchasing Managers Index

Time: 12:30 GMT, 14:00 GMT

The key economic data which can move the US Dollar significantly is the release today of the Nonfarm Payrolls, and the Unemployment Rate, indicating the number of new jobs created during the previous month, in all non-agricultural business, and the percentage of people actively seeking employment. A growing economy has its unemployment rate decreasing. Therefore, higher readings for the Nonfarm Payrolls and lower readings for the Unemployment Rate are considered positive for the US Dollar, reflecting a strong labor market which can stimulate positive economic growth.

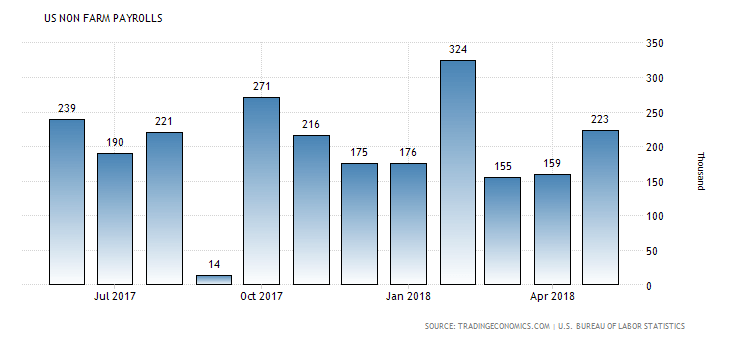

“Non-farm payrolls in the United States increased by 223 thousand in May of 2018, following a downwardly revised 159 thousand in April. It is the highest reading in 3 months, beating market expectations of 189 thousand. Employment continued to trend up in several industries, including retail trade, health care, and construction.”, Source: Trading Economics.

As seen from the below chart the US Nonfarm Payrolls are highly volatile and can be hard to predict.

The forecasts are for a figure of 190K for the US Nonfarm Payrolls, lower than the previous figure of 223K, an unchanged Unemployment Rate at 3.8%, an unchanged Average Hourly Earnings YoY at 2.7% and a wider trade deficit at -47.0B US Dollars, compared to the previous figure of -46.2B US Dollars. A trade surplus is considered positive for the US Dollar.

For the Economy of Canada, a lower Unemployment Rate, higher Employment Change and higher, Ivey Purchasing Managers Index, plus a trade surplus are considered positive for the Canadian Dollar.

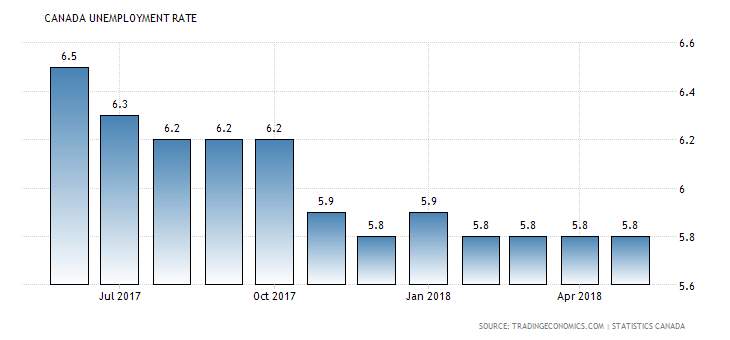

“The unemployment rate in Canada stood at 5.8 percent in May of 2018, the same as in the previous month and matching market expectations. The jobless rate remained at its lowest level since 1976 for the fourth consecutive month. Employment unexpectedly decreased by 7.5 thousand, against market expectations of a 17.5 thousand recovery. A decline in full-time work was only partially offset by an increase in part-time jobs, with main job losses being registered in health care and social assistance, manufacturing and construction.”, Source: Trading Economics.

The forecasts are for an unchanged Unemployment Rate of 5.8%, an increase of the net Change in Employment at 17.5K, higher than the previous figure of -7.5K, a wider trade deficit of -3.6B Canadian Dollars, compared to the previous figure of -1.9B Canadian Dollars and a higher Ivey Purchasing Mangers Index at 64.8, compared to the previous reading of 62.5. The Ivey Purchasing Managers Index reflects the business conditions in Canada, with higher readings reflecting improved conditions.

Asian Session

- Japan: Coincident Index Prel, Leading Economic Index Prel

Time: 05:00 GMT

The Leading Economic Index shows the performance of the Japanese economy soon, while the Coincident Index shows the current state of the economy. Higher figures are indicative of economic growth and expansion and are considered positive for the Japanese Yen. The forecasts are for lower readings for both Economic Indexes, the Leading Economic Index is expected to decline at 106.0, and the Coincident Index at 116.4. The previous figures for the Economic Indexes were 117.5 and 106.2 respectively.