The last trading session for the week 16-20 July 2018 has a strong focus on economic data about the economy of Canada, with the announcement of the Retail Sales and the Inflation Rate. In the European Session there is the Producer Price Index in Germany and the Public-Sector Net Borrowing in UK to be announced. Other economic news expected are an OPEC meeting with any decisions on the supply of oil able to move the oil prices and the USD/CAD currency pair, and in the Asian Session the release of the All Industry Activity for Japan. Moderate to high volatility is mostly expected for the Canadian Dollar.

These are the key economic events which can move the forex market today:

European Session

- Germany: Producer Price Index (YoY, MoM), UK: Public Sector Net Borrowing

Time: 06:00 GMT, 08:30 GMT

The Producer Price Index measures the average changes in prices in the German primary markets. The changes in the PPI are considered as an indicator of commodity inflation, with higher than expected readings considered positive for the Euro, indicating inflationary pressures. The Net Borrowing measures the amount of new debt held by the U.K. governments. In general, if the Net Borrowing is negative, it is considered unfavorable and negative for the British Pound, although it can stimulate the economy due to higher public spending. The forecasts are for a decline of the German monthly PPI at 0.2%, compared to the previous reading of 0.5%, but for an increase of the yearly PPI at 2.9%, higher than the previous reading of 2.7%. The UK Public Sector Net Borrowing is expected to decline significantly at 0.277B British Pounds, compared to the previous figure of 3.356B British Pounds.

American Session

- Canada: Core Inflation Rate YoY, Inflation Rate (YoY, MoM), Retail Sales MoM

Time: 12:30 GMT

Recently the Bank of Canada made an interest rate hike of 25 basis points, setting the key interest rate at 1.50%. A sustained Inflation Rate with increasing figures may further lead to future interest rate hikes, while stronger than expected readings for Retail Sales are considered as an indicator of consumer confidence., indicating the performance of the retail sector in the short term and stimulating the economic growth. Higher than expected figured for both the Inflation Rate and the Retail Sales are considered supportive and positive for the Canadian Dollar.

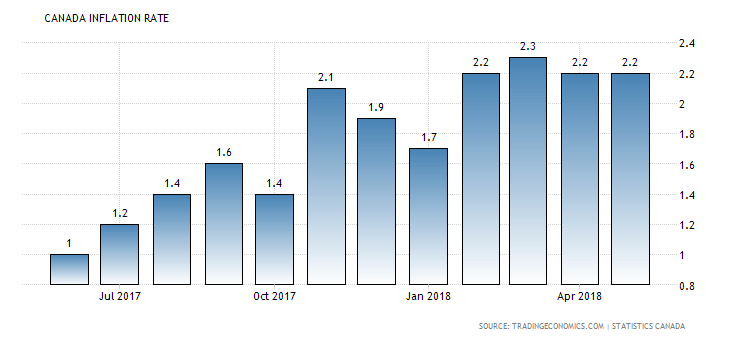

“The annual inflation rate in Canada stood at 2.2 percent in May of 2018, the same as in the previous month, missing market expectations of 2.5 percent. Higher prices for shelter and transportation were offset by slowing cost of food, household equipment, clothing & footwear. “, Source: Trading Economics

The annual inflation rate in Canada in 2018 is in an uptrend, having stabilized over the important key level of 2.0%. Any economic surprise may add further volatility for the Canadian Dollar with a beat or miss on the market expectations.

The forecasts are for an increase of the yearly Inflation Rate in Canada at 2.5%, higher than the previous rate of 2.2%, and most importantly an increase for the more conservative and representative measurement of inflationary pressures the Core Inflation Rate at 1.4%, higher than the previous reading of 1.3%. The monthly Retail Sales are expected to show a figure of 0.0%, no growth at all but still better than the previous figure of -1.2%. Overall mixed economic data is expected for the economy of Canada.

Asian Session

- Japan: All Industry Activity Index MoM

Time: 04:30 GMT

The All Industry Activity Index measures the monthly change in overall production by all industries of the Japanese economy, providing important information about the Japanese GDP and insights into current levels of Japanese economic expansion. Higher than expected readings are considered positive and supportive for the Japanese Yen indicating both economic expansion and optimism about the current economic conditions, as if the economic outlook was less optimistic then probably there would lower levels of production due to lower level of demand for goods and services in a contracting economy. The forecast is for a figure of 0%, lower than the previous figure of 1%, which may weigh negatively on the Japanese Yen.