The last trading session in the forex market today for summer 2018 has important economic data to be released, such as the Unemployment Rate and the Inflation Rate in the Eurozone, the German Retail Sales, the Chicago PMI and Michigan Consumer Sentiment and the Housing Starts in Japan.

The month of August 2018 has been a very volatile month in the forex market unusual for the summer period and there are always other important topics to consider such as latest Brexit developments and the potential Canada agreement with US and Mexico to replace the NAFTA deal which can move as external factors the financial markets. The market mood and preference for risk-on or risk-off sentiment other than the fundamental data can influence the short-term trends for major currencies. Today moderate to high volatility should be expected mainly for the Euro.

These are the key economic events for today in the forex market, time is GMT:

European Session

Germany: Retail Sales (YoY, MoM), UK: Nationwide Housing Prices (YoY, MoM), France: Inflation Rate YoY Prel, Italy: Unemployment Rate, Inflation Rate (YoY Prel, MoM Prel), GDP Growth (YoY Final, QoQ Final), Eurozone: Unemployment Rate, Inflation Rate YoY Flash, Core Inflation Rate YoY Flash

Time: 06:00, 06:45, 09:00, 10:00

The Euro Area economic data released today is very important and can move the Euro. Higher than expected figures for the German Retail Sales, Inflation Rate in France, Italy and in the Eurozone, GDP Growth Rate in Italy and lower than expected for the Unemployment Rate in Italy and in the eurozone are considered positive for the Euro. The forex market participants will focus on the Core Inflation Rate in the Eurozone which excludes the volatile prices of food and energy, a key economic indicator to measure inflation being a more conservative indicator, and on the Unemployment Rate in the Euro Area, a leading indicator of the European Economy. A low Unemployment Rate signals a robust labor market which can stimulate economic expansion and growth.

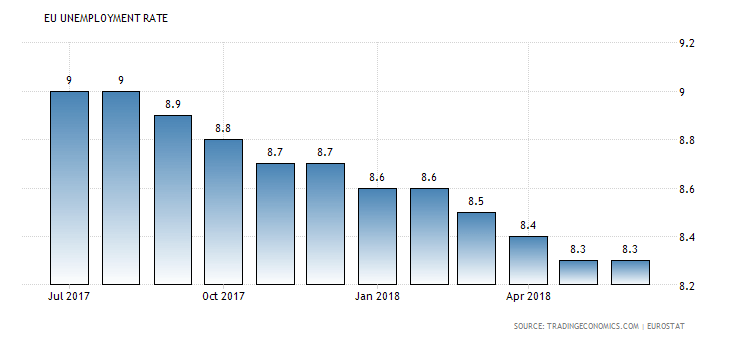

“The unemployment rate in the Euro Area was unchanged at 8.3 percent in June of 2018, the same as the previous month’s revised figure and in line with market expectations. It remains the lowest jobless rate since December of 2008.”, Source: Trading Economics.

We note from the above chart that the Euro Area Unemployment Rate has been steadily declining over the past 12-months and is at historical low levels. The forecasts are for a decrease of the Eurozone’s Unemployment Rate to 8.2% from 8.3%, an unchanged yearly figure of 1.1% for the Core Inflation Rate in the Euro Area, and an unchanged figure of 2.1% for the Euro Area Inflation Rate. These figures can be interpreted as neutral to slightly positive, but they will indicate a lack of inflationary pressures in the Eurozone, as stable prices most probably will not weigh on the ECB to shift its monetary policy decision soon.

The German monthly Retail Sales are expected to decrease to -0.2% from 1.2%, showing a weak performance of the retail sector in the short term, while the economic data for the economy of Italy is expected to decrease both for the Inflation Rate and the GDP Growth Rate. Specifically, the Italian yearly GDP Growth Rate and the yearly Inflation Rate are expected to decrease to 1.1% and 1.4% from 1.4% and 1.5% respectively. Except for the decrease for the Unemployment Rate in the Euro Are all other economic data can be considered negative which may weigh on the Euro.

The Nationwide Housing Prices provide important economic data about the trend of houses prices in UK and indicate current movements in the housing market, a sensitive factor to the UK’s economy. Higher than expected figures reflect a robust housing market and inflationary pressures in the broader economy and are considered positive for the British Pound. There are some mixed economic data expected, with a decrease for the monthly Nationwide Housing Prices figure to 0.1% from 0.6% and an increase for the yearly figure to 2.6% from 2.5%. The British Pound is also sensitive to any Brexit news coming out in the market which can add increased volatility and price action as on Wednesday, August 29, 2018.

American Session

US: Chicago PMI, Michigan Consumer Sentiment Final

Time: 13:45, 14:00

The Chicago Purchasing Managers Index captures business conditions across Illinois, Indiana and Michigan. This index is an indicator of business trends and is used to indicate the overall economic condition in US. Higher than expected readings for the Chicago Purchasing Managers Index and the Michigan Consumer Sentiment are considered positive for the US economy and US Dollar reflecting strong business conditions and high personal consumer confidence in economic activity, both of which can stimulate the economic growth.

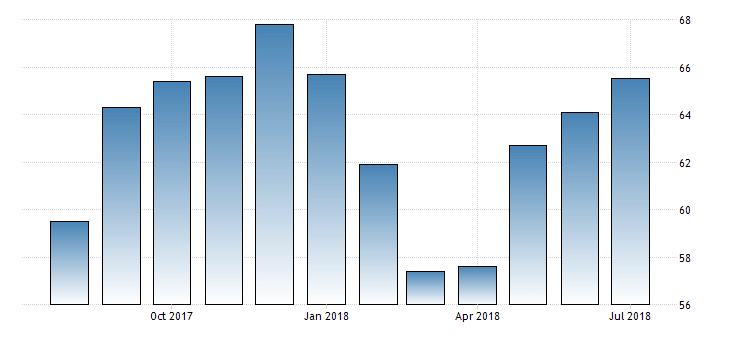

“The Chicago Business Barometer for the US rose 1.4 points to 65.5 in July of 2018, beating market expectations of 62 and reaching a new high since January. New orders and production also recorded six-month highs in July, traditionally a busy month for firms coinciding with the summer holiday season. Also, backlogs of orders capped a third straight rise by hitting a nine-month high; employment rose for the third month and price pressures were the highest since September of 2008 with multiple firms attributing it to recently implemented tariffs on imported goods.”, Source: Trading Economics.

As seen from the chart the Chicago Purchasing Managers Index after strong readings in early 2018 and a decline until April 2018 has ever since been in a steady uptrend, having increased for the past three consecutive months. However, the forecasts are for a decrease for the Chicago Purchasing Managers Index to 63 from 655.5 and a decrease also for the Michigan Consumer Sentiment Index to 95.5 from 97.9 which may influence negatively the US Dollar.

Pacific Session

Australia: AiG Performance of Manufacturing Index

Time: 22:30

The AiG Performance of the Manufacturing presents the business conditions in the Australian manufacturing sector, taking into consideration economic indicators related to business situation such as employment, production, orders, prices. Higher than expected readings and above the 50 level are considered positive for the Australian Dollar.

Asian Session

Japan: Housing Starts YoY

Time: 05:00

The Housing Starts shows the strength of the Japanese housing market, which is a leading indicator of the can be considered as the economy as the housing market exhibits increased sensitivity to changes in the business and economic cycles. A higher than expected reading is considered positive reflecting a robust housing market. The forecast is for a reading of -3.8%, which is higher than the previous reading of -7.1%.