The US economic data on Balance of Trade, labor market, unemployment business conditions in the services and non-manufacturing sector dominate today in the forex market economic calendar. After the recent Fed monetary policy decision and the statement implying further tightening of the monetary policy with another interest rate hike most probably in September the forex market participants will weigh on the US Non-farm payrolls and establish a short-term trend for the US Dollar, expected to witness moderate to high volatility. There are also important economic events related to the Eurozone, the economies of Canada, UK, Spain, Italy, Switzerland and Australia, which should move the forex market before the American Session.

These are the key economic events which can move the forex market today, time is GMT:

European Session

- Spain: Markit Services PMI, Consumer Confidence, Switzerland: Inflation Rate YoY, Italy: Markit/ADACI Services PMI, Industrial Production MoM, Retail Sales MoM, UK: Markit/CIPS Services PMI, Eurozone: Retail Sales (YoY, MoM)

Time: 07:15, 07:45, 08:00, 08:30, 09:00

Important economic data which can move the Euro are the releases of the Retail Sales in the Eurozone, for Italy the Markit/ADACI Services PMI, Industrial Production MoM, and Retail Sales, and for Spain the Markit Services PMI, and Consumer Confidence. Higher than expected readings for all this economic data are considered positive and supportive for the Euro reflecting strong economic conditions in the services and industrial sector and increased consumer confidence which can have a positive impact on higher economic growth.

The Retail Sales measure changes in sales of the Euro zone retail sector. It shows the performance of the retail sector in the short term. The changes are widely followed as an indicator of consumer spending.

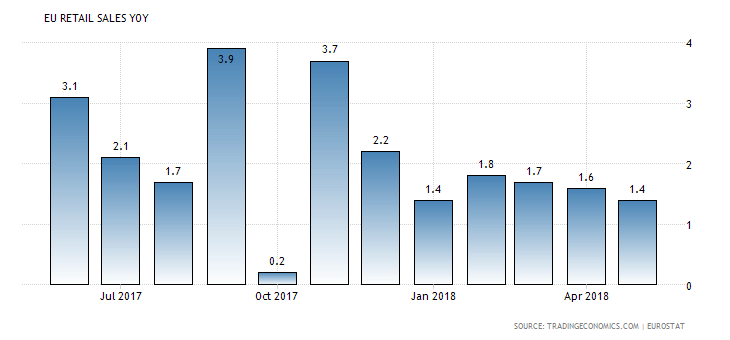

“The Eurozone’s retail trade rose 1.4 percent from a month earlier in June 2018, following a downwardly revised 1.6 percent growth in April and missing market expectations of 1.5 percent.”, Source: Trading Economics.

In 2018 the Retail Sales in the Euro area have been in general weaker compared to year 2017. The forecasts are for an unchanged yearly figure for the Retail Sales of 1.4% for the Eurozone and an increase of the monthly Retail Sales at 0.4%, compared to the previous figure of 0.0%. Other important economic data expected for the Euro are the Markit/ADACI Services PMI, monthly Industrial Production and monthly Retail Sales for Italy which are all expected to decline, and the Markit Services PMI for Spain also expected to decline. This economic data should be considered negative, indicating a slowdown for the services sector.

A slowdown for the services sector is expected for the economy of UK, with the Markit/CIPS Services PMI expected to decline at 54.7, lower than the previous reading of 55.1. The yearly Inflation Rate in Switzerland is expected to increase marginally at 1.2%, higher than the previous reading of 1.1%. This higher reading is considered positive for the Swiss Franc, indicating the presence of inflationary pressures in the economy, which if sustainable may weigh on the decision of the Swiss National Bank to increase the key interest rate to fight inflation.

American Session

- Canada: Balance of Trade, US: Balance of Trade, Non-Farm Payrolls, Unemployment Rate, Average Hourly Earnings MoM, Markit Services PMI Final, Markit Composite PMI Final, ISM Non-Manufacturing Employment, ISM Non-Manufacturing PMI

Time: 12:30, 13:45, 14:00

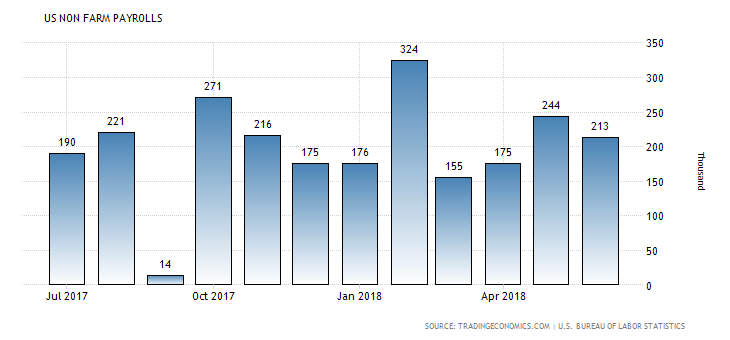

The key economic event for today which has the potential to move significantly the US Dollar is the announcement of the monthly Non-Farm Payrolls, showing the number of new jobs created during the previous month, in all non-agricultural business. The monthly changes in payrolls can be extremely volatile, due to its high relation with economic policy decisions made by the Fed.

At its latest monetary policy decision on Wednesday, August 1, 2018 the Fed noted that job gains and economic activity have been “strong.” “The FOMC expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the committee’s symmetric 2% objective over the medium term,”. “The FOMC expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the committee’s symmetric 2% objective over the medium term,”.

Higher than expected readings for the Non-Farm Payrolls, the Average Hourly Earnings MoM, Markit Services PMI Final, Markit Composite PMI Final, ISM Non-Manufacturing Employment, and ISM Non-Manufacturing PMI are considered positive and supportive for the US Dollar, indicating a robust labor market, and strong economic conditions in the services and non-manufacturing sectors. Also, a lower than expected reading for the Unemployment Rate and a trade surplus for the Balance of Trade are considered positive for the US economy. The forecasts are for mixed economic data related to the US economy. The Balance of Trade is expected to show a wider trade deficit of -46.5B US Dollars, compared to the previous trade deficit of -43.1B US Dollars, a decline for the Unemployment Rate at 3.9%, lower than the previous reading of 4.0%, an increase for the monthly Average Hourly Earnings at 0.3%, a marginal increase compared to the previous reading of 0.2% and a decline for the figure of Markit Services PMI Final at 56.2, lower than the previous reading of 56.5.

For the Non-Farm Payrolls the expectation is for a lower figure of 190K, compared to the previous reading of 213K. Any economic surprise positive or negative may add increased volatility for the US Dollar.

“Non farm payrolls in the United States increased by 213 thousand in June of 2018, following an upwardly revised 244 thousand in May and well above market expectations of 195 thousand. Job gains occurred in professional and business services, manufacturing, and health care, while employment in retail trade declined.”, Source: Trading Economics.

For Canada a trade surplus is considered positive, reflecting capital inflows, and increased demand for goods and services denominated in local currency, which over time this increased demand may lead to the appreciation of the currency versus other currencies. The forecast is for a narrower trade deficit of -2.3B Canadian Dollars, compared to the previous reading of -2.77B Canadian Dollars.

Pacific Session

- Australia: Retail Sales MoM

Time: 01:30

The Retail Sales are considered as an indicator of the strength of the Australian economy, showing the performance of the retail sector. High Retail Sales are a result of increased consumer spending, a key economic driver of higher economic growth measured by the GDP level and are considered positive for the Australian Dollar. The forecast is for a lower figure of 0.3%, compared to the previous figure of 0.4%.